In 2016, we could see upward revisions in earnings expectations as the year progresses. But while earnings may be improving, we believe equity markets hold limited upside potential Read full report here The first quarter results season is almost over, and has been marked by positive surprises from Europe and, less so, the US, while Japanese earnings appear to have suffered from the strength of the yen. US and European net earnings came out 1.4% and 11.2% ahead of expectations, respectively, according to Bloomberg data. By contrast, Japanese earnings were the worst since 2013, with net profits 37.5% below expectations. Every year since 2013, earnings expectations have been revised lower as the year progressed, and this trend accelerated after 2014, with energy and commodity sectors accounting for the bulk of negative revisions. This year could develop differently, as the trough in metals and oil prices and positive earnings revisions in the relevant sectors started only recently. Hence, according to Datastream figures, the recent earnings upgrades are lagging the 83% recovery in oil prices since January. The positive contribution to the overall earnings picture from the energy sector should therefore continue. This factor will improve the picture mostly for US and European earnings, but much less so in Japan, as the energy sector only represents 0.5% of the Topix index.

Topics:

Alexandre Tavazzi and Jacques Henry considers the following as important: corporate earnings, earnings revisions, earnings surprises, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

In 2016, we could see upward revisions in earnings expectations as the year progresses. But while earnings may be improving, we believe equity markets hold limited upside potential

The first quarter results season is almost over, and has been marked by positive surprises from Europe and, less so, the US, while Japanese earnings appear to have suffered from the strength of the yen. US and European net earnings came out 1.4% and 11.2% ahead of expectations, respectively, according to Bloomberg data. By contrast, Japanese earnings were the worst since 2013, with net profits 37.5% below expectations.

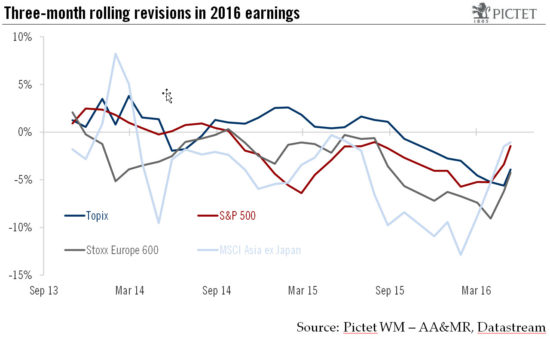

Every year since 2013, earnings expectations have been revised lower as the year progressed, and this trend accelerated after 2014, with energy and commodity sectors accounting for the bulk of negative revisions. This year could develop differently, as the trough in metals and oil prices and positive earnings revisions in the relevant sectors started only recently. Hence, according to Datastream figures, the recent earnings upgrades are lagging the 83% recovery in oil prices since January. The positive contribution to the overall earnings picture from the energy sector should therefore continue. This factor will improve the picture mostly for US and European earnings, but much less so in Japan, as the energy sector only represents 0.5% of the Topix index.

While earnings growth in energy and commodities is finally starting to rise, a key question now is whether financials will follow. Compared to last year, the monetary landscape has changed for financials in general and banks in particular. Negative central banks rates combined with flat yield slopes have led to reduced profitability expectations for banking stocks. The positive earnings revisions seen in oil and energy in the first quarter were partly offset by negative revisions in financials. This could change if sovereign yield slopes start to steepen, as that would improve the profitability of lending and reverse the current negative momentum in financials earnings.

While there have been modest improvements in projected earnings growth overall, valuations are stretched again as a result of the rebound in equity prices. As the rise in these prices since their February low point has been much quicker than the improvement in earnings, valuations are close to the peaks recorded one year ago. According to Bloomberg data, by mid May the US price-earnings ratio (PER) stood at 17.6x, the European at 15.3x and the Japanese at 13.1x. Thus, the price/earnings-to-growth (PEG) ratio for developed markets is quite high on a historical basis. As valuations are high and growth prospects remain constrained, big gains from current levels will be difficult to achieve and will most likely progress in line with earnings improvements.

Overall, despite the welcome improvements in earnings, we therefore stick to our scenario of limited upside in equity markets, as the global environment is characterised by growth constraints that limit multiples expansion. As the performance potential of equity markets remains limited, we believe a nimble and opportunistic equity strategy remains the most suitable.