On 23 June, the British will decide whether to stay in the European Union or not. Using econometric models, we can attempt to measure the impact a vote to leave the EU would have on global and European growth, as well as on equities and bonds Read full report here The relatively small size of the UK economy (2.4% of world GDP) means the global impact of Brexit would be almost negligible in strictly economic terms, according to global-VAR models of the kind used by central banks to assess the effect of specific events on the global economy. Unsurprisingly, the most exposed countries would be the UK’s European neighbours, whereas countries outside Europe are all largely uncorrelated from events in the UK. According to the proprietary Pictet Global Impact Macro-Financial (P-GIM) model, 20 basis points (bps) could be knocked from euro area GDP growth in both 2016 and 2017 should the UK vote to leave the EU. According to this model, while household consumption would be almost unaffected by Brexit, investment would bear the brunt of the shock, with 60 bps knocked from the projected growth in investment spending in 2016 and 80 bps in 2017. So the impact of Brexit on the euro area economy would essentially be propagated through the investment channel.

Topics:

Jean-Pierre Durante considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

On 23 June, the British will decide whether to stay in the European Union or not. Using econometric models, we can attempt to measure the impact a vote to leave the EU would have on global and European growth, as well as on equities and bonds

The relatively small size of the UK economy (2.4% of world GDP) means the global impact of Brexit would be almost negligible in strictly economic terms, according to global-VAR models of the kind used by central banks to assess the effect of specific events on the global economy. Unsurprisingly, the most exposed countries would be the UK’s European neighbours, whereas countries outside Europe are all largely uncorrelated from events in the UK.

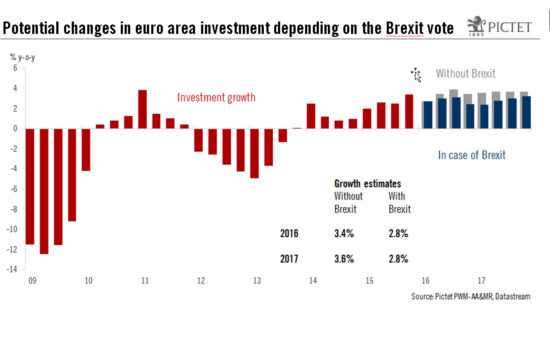

According to the proprietary Pictet Global Impact Macro-Financial (P-GIM) model, 20 basis points (bps) could be knocked from euro area GDP growth in both 2016 and 2017 should the UK vote to leave the EU. According to this model, while household consumption would be almost unaffected by Brexit, investment would bear the brunt of the shock, with 60 bps knocked from the projected growth in investment spending in 2016 and 80 bps in 2017. So the impact of Brexit on the euro area economy would essentially be propagated through the investment channel.

The adverse outcome on investment would require additional monetary policy relaxation, the P-GIM model suggesting that some 20 bps of rate cuts would be needed. This might appear modest, but could be problematic as benchmark refi rates already stand at 0% in the euro area. So Brexit would probably force the ECB to find new measures to support the banking sector in order to favour monetary transmission.

Spill-over effects from a UK stock market correction are likely to be more harmful to the world economy than the direct macroeconomic effects. The econometric models show that an 8% fall of the FTSE 100 would cause a 2% correction in global equity markets. Again, neighbouring countries are the most exposed while the US, Canadian, Indian and Japanese stock markets appear to be the least correlated to a potential UK correction. So the models suggest that overweighting North America and Japan could offer equity investors some protection against Brexit.

The P-GIM model suggests that term premiums would increase in the event of Brexit, with 10-year bond yields likely to rise by 20 bps. As a result, the whole yield curve is likely to steepen. Higher average interest rates would probably hide big differences among euro area members. As during the sovereign debt crisis of 2010-2012, the yield on German Bunds would likely fall whereas the risk premium would increase for government bonds in the euro area periphery.

A similar impact is to be expected on corporate bonds, with Brexit likely to lead to additional risk premiums being demanded. On average, corporate spreads would widen by close to 30 bps, according to the model.