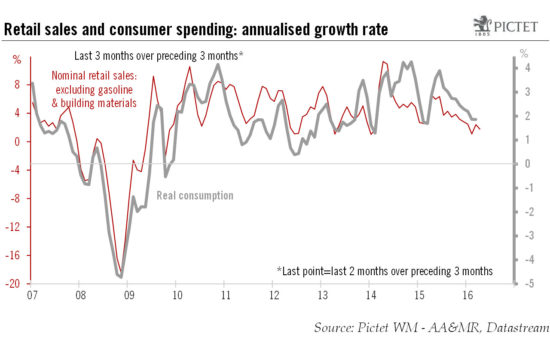

Macroview Strong April figures and revisions to March and February numbers mean sonsumer spending is on course to rise around 3% in second quarter Full report April US retail sales The US retail sales report for April was very encouraging, with core retail sales increasing strongly month on month (m-o-m) in April, while the figures for February and March figures were revised upward. Consumer spending growth should approach a strong rate of 3.0% q-o-q annualised in Q2. According to the US Department of Commerce, nominal total retail sales rose by a very strong 1.3% m-o-m in April, well above consensus expectations. Retail sales were helped by a rise in nominal fuel sales (on the back of higher gasoline prices) and a sharp rebound m-o-m in nominal auto sales. All this data suggests household consumption entered the second quarter with quite strong momentum (moreover, Q1 consumer spending growth may well be revised up) and supports our optimistic view on US consumer spending growth. Employment growth is likely to slow somewhat but should nevertheless remain healthy, while wage increases are likely to pick up gradually. A good part of the windfall from past declines in oil prices has still not been spent by US consumers, instead showing up in a relatively high savings rate. But this rate may well decline over the coming months.

Topics:

Bernard Lambert considers the following as important: Macroview, US auto sales, US consumer spending, US retail sales

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Strong April figures and revisions to March and February numbers mean sonsumer spending is on course to rise around 3% in second quarter

Full report April US retail sales

The US retail sales report for April was very encouraging, with core retail sales increasing strongly month on month (m-o-m) in April, while the figures for February and March figures were revised upward. Consumer spending growth should approach a strong rate of 3.0% q-o-q annualised in Q2.

According to the US Department of Commerce, nominal total retail sales rose by a very strong 1.3% m-o-m in April, well above consensus expectations. Retail sales were helped by a rise in nominal fuel sales (on the back of higher gasoline prices) and a sharp rebound m-o-m in nominal auto sales.

All this data suggests household consumption entered the second quarter with quite strong momentum (moreover, Q1 consumer spending growth may well be revised up) and supports our optimistic view on US consumer spending growth. Employment growth is likely to slow somewhat but should nevertheless remain healthy, while wage increases are likely to pick up gradually. A good part of the windfall from past declines in oil prices has still not been spent by US consumers, instead showing up in a relatively high savings rate. But this rate may well decline over the coming months.

All in all, we expect consumer spending growth to approach 3.0% in Q2 2016. Our forecast that US GDP will grow at a pace of 2.5% q-o-q annualised in Q2 remains unchanged.