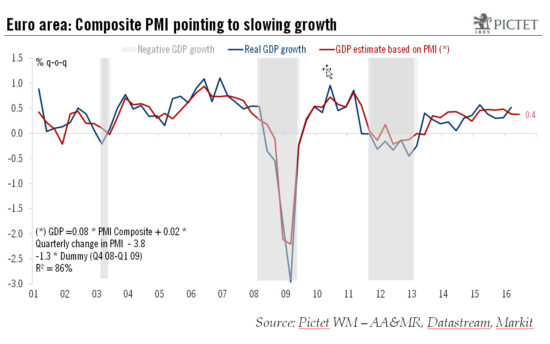

Flash estimates for euro area composite PMI eased slightly in May, pointing to a slowdown in economic growth after a strong first quarter Read full report here Following a strong performance in Q1, when real GDP expanded by 0.5% q-o-q (2.1% in annualised terms), the euro area economy was expected to slow down a gear to more sustainable levels of growth. The flash purchasing manager indices (PMI) released on May 23 may signal just that, although mixed news at the national level—with renewed strength in core countries offset by weakness in the periphery—make near-term GDP projections uncertain. Crucially, in our view, May PMI indices remain consistent with strong momentum in domestic demand, the key driver of economic expansion in the euro area, helping to partially compensate for any weakness from abroad or reversal in the temporary factors that helped push Q1 growth higher. The euro area composite PMI fell marginally from 53.0 in April to 52.9 in May, a 16-month low, despite stronger readings in France and Germany. In fairness, the composite PMI has been hovering around the 53-54 region for one and a half years and we would not put too much emphasis on a one-month print. More worryingly though, forward-looking indicators have failed to recover since the start of the year, possibly pointing to downside risks for H2 relative to our forecasts.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: euro area growth, Euro area PMI, Flash estimate PMI, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Flash estimates for euro area composite PMI eased slightly in May, pointing to a slowdown in economic growth after a strong first quarter

Following a strong performance in Q1, when real GDP expanded by 0.5% q-o-q (2.1% in annualised terms), the euro area economy was expected to slow down a gear to more sustainable levels of growth. The flash purchasing manager indices (PMI) released on May 23 may signal just that, although mixed news at the national level—with renewed strength in core countries offset by weakness in the periphery—make near-term GDP projections uncertain. Crucially, in our view, May PMI indices remain consistent with strong momentum in domestic demand, the key driver of economic expansion in the euro area, helping to partially compensate for any weakness from abroad or reversal in the temporary factors that helped push Q1 growth higher.

The euro area composite PMI fell marginally from 53.0 in April to 52.9 in May, a 16-month low, despite stronger readings in France and Germany. In fairness, the composite PMI has been hovering around the 53-54 region for one and a half years and we would not put too much emphasis on a one-month print. More worryingly though, forward-looking indicators have failed to recover since the start of the year, possibly pointing to downside risks for H2 relative to our forecasts. The compiler of the composite PMI, Markit, mentioned a cooling in the pace of expansion to a 17-month low. This was most likely due to countries like Italy and Spain as PMI figures from the two largest core members, France and Germany, remain upbeat. Markit will provide a full breakdown (and potential revisions) of PMI figures in early June.

At this stage, Markit notes that PMI indices look consistent with quarterly GDP growth of just 0.3% q-o-q, although we do not rule out small upside risks relative to these projections assuming the stronger momentum in core countries ultimately translates into better sentiment in the periphery as well. We are maintaining our above-consensus forecast for euro area GDP growth of 1.8% this year, but our baseline scenario remains predicated on favourable political outcomes in Spain, Greece and the UK, as well as on a rebound in business surveys in the months ahead. The latter is of particular importance since hard data were generally weak at the end of Q1, including data for retail sales and industrial output, leading to an unfavourable carryover into Q2.