The Q1 figure confirms our expectations of 1.8% growth this year, despite some clouds on the horizon Read the full report here Euro area GDP rose by 0.6% quarter on quarter (q-o-q) in Q1, in line with our above-consensus forecast. Evidence from high-frequency data suggests that domestic demand was the main engine of growth once again, supported by a strong rebound in both household consumption and corporate investment spending. We believe that momentum from this source still has legs:...

Read More »US Q1 growth disappoints, but improvement likely

Macroview Growth continued to be dampened by a strong dollar, a collapse in oil sector investment and falling inventories, but prospects still relatively healthy Read the full report here US real GDP, buffeted by numerous headwinds and lacking momentum, grew by a feeble 0.5% in Q1 2016. Seasonality factors mean the first-quarter GDP growth rate can be very volatile, but Q1 growth was a clear disappointment overall, particularly as growth in Q4 2015 was already soft (+1.4% q-o-q...

Read More »Euro area credit growth slowed in March, but Q1 very strong overall

Macroview Bank lending grew at a record pace in Q1, in spite of challenging environment for banks Read the full report here The expansion of bank credit to euro area non-financial corporations slowed in March, to EUR 1bn compared with a rise of EUR 24bn in January and EUR 19bn in February. By contrast, credit to households continued to increase at a decent pace in March and was slightly stronger than in previous months. Although credit flows eased in March, the three-month moving...

Read More »What prospects for gold prices?

Macroview After hitting a low point at the end of 2015, fundamentals point to a rise in gold prices--but market conditions suggest the upside potential remains limited Read the full report here After the hefty gains made by gold this year, the attached Flash Note examines what might lie ahead for the precious metal by analysing the five key underlying drivers of gold prices: financial stress, inflation, real interest rates, the US dollar and supply and demand. Our conclusions are as...

Read More »Deflationary pressures slacken in the euro area

We continue to forecast a gradual pick-up in the pace of economic expansion from 1.5% in 2015 to 1.8% in 2016, largely led by domestic demand. Read the full report here According to Markit’s preliminary estimates, the euro area composite PMI decreased slightly from 53.1 in March to 53.0 in April. Nevertheless, the employment component improved in both the manufacturing and services sectors. Looking at forward-looking components, the manufacturing new export orders and new business...

Read More »The ECB focuses on policy implementation and reaffirms its independence

Takeaways from the press conference following the ECB's policy meeting of 21 April 2016 Read the full report here The 10 March ECB meeting was all about bold action and strong signals. The main message from the 21 April meeting was one of continuity, consistency and cohesion. The ECB’s assessment of economic conditions has not changed materially in the past few weeks, with the view that existing and upcoming policy measures will help to push inflation higher over the medium-term. In the...

Read More »Brexit risks

[unable to retrieve full-text content]Brexit risks Christophe Donay, Chief Strategist, explains how markets are pricing in the risk of Brexit, and what the economic impact would be.

Read More »Pictet Perspectives – Brexit risks

Christophe Donay, Chief Strategist, explains how markets are pricing in the risk of Brexit, and what the economic impact would be.

Read More »Navigating through rollercoaster markets

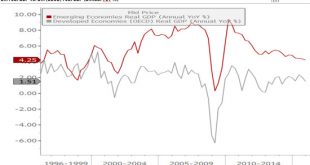

Macroview As growth fails to attain a stronger trajectory and deflation remains a threat, the credibility of central banks has begun to suffer. Yet we remain relatively upbeat on prospects for world growth although we expect continued volatility in some asset classes. April insights from Pictet Wealth Management's Asset Allocation & Macro Research team The current decline in US profit margins would usually herald a recession. The continued decline in earnings expectations is a concern,...

Read More »Banking crisis? What banking crisis?

In spite of the various pressures facing banks, the ECB's latest Bank Lending Survey points to continued improvement in loan conditions. The hope must be that ECB policies will continue to facilitate bank lending in the months ahead Read the full report here The ECB’s April Bank Lending Survey (BLS), conducted among 141 banks between 11 and 30 March 2016 and released today, revealed a net easing of credit conditions for companies for the eighth consecutive quarter. The demand for loans...

Read More » Perspectives Pictet

Perspectives Pictet