Against the backdrop of a charged political climate, greater flexibility on debt and deficit rules plus ECB largesse are helping national economies We are entering a period of heightened political risk across many countries in Europe, marked by the progress of populism, as seen in the surge of support for non-mainstream parties. Not only do we have the Brexit referendum on June 23, but three days later there will be a re-run of the Spanish general election. We still expect strong Spanish growth this year, of the order of 2.8%, but there is the possibility that the June election will be as inconclusive as it was in December. Meanwhile, the Catalan question rumbles on, while Spain has failed to meet its deficit reduction targets. Elsewhere, even though the political situation has settled somewhat in Portugal, that country’s growth prospects remain modest and its access to European Central Bank (ECB) funding hangs on maintaining its last remaining investment-grade rating. Greek debt relief is again in the spotlight. We believe Greece will receive the next tranche of its latest bailout at the end of negotiations with its creditors in late May. We also believe there could be some movement on debt relief, in spite of dissension about the details. However, we expect that Greece will again record negative growth this year, just as it did in 2015.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: accommodative policies, European policy mix, European political risk, European populism, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Against the backdrop of a charged political climate, greater flexibility on debt and deficit rules plus ECB largesse are helping national economies

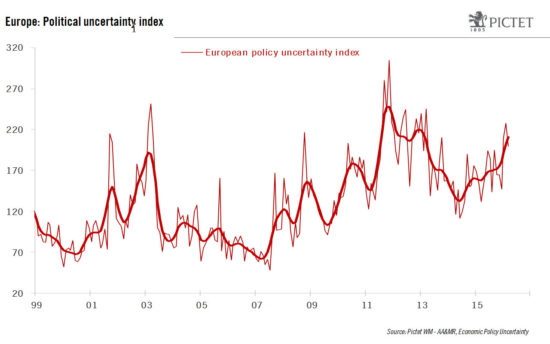

We are entering a period of heightened political risk across many countries in Europe, marked by the progress of populism, as seen in the surge of support for non-mainstream parties.

Not only do we have the Brexit referendum on June 23, but three days later there will be a re-run of the Spanish general election. We still expect strong Spanish growth this year, of the order of 2.8%, but there is the possibility that the June election will be as inconclusive as it was in December. Meanwhile, the Catalan question rumbles on, while Spain has failed to meet its deficit reduction targets.

Elsewhere, even though the political situation has settled somewhat in Portugal, that country’s growth prospects remain modest and its access to European Central Bank (ECB) funding hangs on maintaining its last remaining investment-grade rating. Greek debt relief is again in the spotlight. We believe Greece will receive the next tranche of its latest bailout at the end of negotiations with its creditors in late May. We also believe there could be some movement on debt relief, in spite of dissension about the details. However, we expect that Greece will again record negative growth this year, just as it did in 2015. Finally, while legislative elections are not planned to take place in Italy until 2018, a referendum on constitutional reform in October is highly delicate, being seen as a plebiscite on the government of prime minister Matteo Renzi. Meanwhile, growth in Italy remains disappointing (little over 1%), while efforts to establish a bad bank fund and to reform banking law are fraught with complexity.

There are a number of channels by which political risk might be transmitted to economic activity—for example, through declines in business and consumer confidence, lower spending and hiring levels, and higher funding costs for businesses.

But a number of factors are also serving to mitigate the impact of political risk, so that European financial markets have so far proved resilient to the increasingly charged climate in some countries. Of particular note is the change in the fiscal stance in euro area countries. Whereas the financial and sovereign-debt crises ushered in a period of fiscal austerity, the currency zone’s fiscal stance is about to ease this year for the first time since 2009. When measured by changes in the structural primary balance, all the main euro area countries are now loosening fiscal policy. This has been accompanied by signs of greater flexibility with regard to deficit and debt rules, with the European Commission giving both Portugal and Spain an extra year to meet their deficit targets. Italy has also been granted greater flexibility (to the tune of EUR 14bn, 0.85% of GDP) in meeting its debt reduction target for this year. Greater budgetary flexibility, coupled with a significant expansion of the ECB’s balance sheet, has produced a highly accommodative policy mix that is helping both to sustain the European economy and, arguably, to offset the current political strains.

Yet the long-term issue of debt sustainability remains. Past efforts to control spending have helped reduce or at least stabilize public deficits as a percentage of GDP. But legacy debt is still high (public debt stands at around 133% of GDP in the case of Italy), and another recession would see debt levels climb even higher. The issue is being dealt with today by a mixture of some easing of fiscal policy and the very low interest rates introduced by the ECB. Together with our baseline case that Brexit will not happen, that a stable coalition government will be formed in Spain, and that there will be a positive conclusion to Greek bailout negotiations, this enables us to remain cautiously optimistic and to maintain our above-consensus estimate for euro area GDP growth this year (1.8%), in spite of the short-term political risks.

At the same time, it may take a “quantum leap” in the form of closer integration (including partial debt mutualisation) to put the euro area on a surer footing over the longer term.