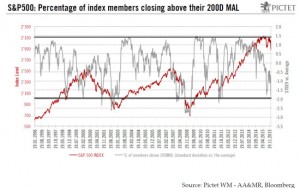

In 2016, we could see upward revisions in earnings expectations as the year progresses. But while earnings may be improving, we believe equity markets hold limited upside potential

Read full report here

The first quarter results season is almost over, and has been marked by positive surprises from Europe and, less so, the US, while Japanese earnings appear to have suffered from the strength of the yen. US and European net earnings came out 1.4% and 11.2% ahead of expectations, respectively, according to Bloomberg data. By contrast, Japanese earnings were the worst since 2013, with net profits 37.5% below expectations.

Every year since 2013, earnings expectations have been revised lower as the year progressed, and this trend accelerated after 2014, with energy and commodity sectors accounting for the bulk of negative revisions. This year could develop differently, as the trough in metals and oil prices and positive earnings revisions in the relevant sectors started only recently. Hence, according to Datastream figures, the recent earnings upgrades are lagging the 83% recovery in oil prices since January. The positive contribution to the overall earnings picture from the energy sector should therefore continue. This factor will improve the picture mostly for US and European earnings, but much less so in Japan, as the energy sector only represents 0.5% of the Topix index.

Read More »