The market leadership of US ’Value' has strengthened considerably in the aftermath of the US elections.The US Value equity strategy’s outperformance has accelerated since the US elections on November 8. Over the 15 trading days following the elections, our Value index returned 9.8% (in US dollars), compared with 8.2% during the preceding six months.Current economic and equity market dynamics reveal an opportunity to arbitrage between two distinct equity investment strategies: US ‘Low Vol’ (low price volatility equities) and US ‘Value’ (stocks that have lower relative valuations and more sensitivity to economic shocks).Among macro factors, inflation expectations are among the most relevant for explaining the regime shift toward US Value since July 2016. As inflation expectations rise, Value gains traction. Since July 2016, Value equities have not only significantly outperformed Low Vol, but also the S&P 500 benchmark. The regime shift also coincided with recovery in sentiment in the aftermath of the UK’s Brexit vote and better-than-expected US employment data.An investor can further dissect the US equity market according to Value and the Low Vol risk, which also suggests an early July 2016 shift in market dynamics. Investors are now clearly eschewing US Low Vol equities in favour of US Value.

Topics:

Wilhelm Sissener and Jacques Henry considers the following as important: equity investment strategies, investment strategy, Macroview, tactical risk factors, US value equity style

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The market leadership of US ’Value' has strengthened considerably in the aftermath of the US elections.

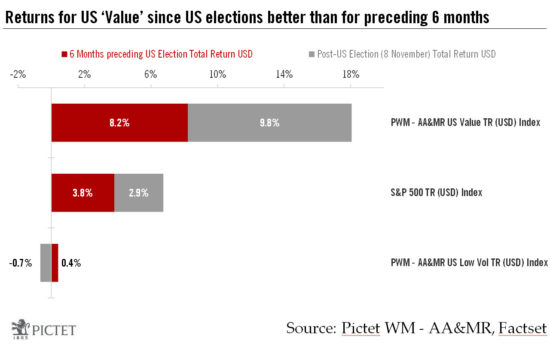

The US Value equity strategy’s outperformance has accelerated since the US elections on November 8. Over the 15 trading days following the elections, our Value index returned 9.8% (in US dollars), compared with 8.2% during the preceding six months.

Current economic and equity market dynamics reveal an opportunity to arbitrage between two distinct equity investment strategies: US ‘Low Vol’ (low price volatility equities) and US ‘Value’ (stocks that have lower relative valuations and more sensitivity to economic shocks).

Among macro factors, inflation expectations are among the most relevant for explaining the regime shift toward US Value since July 2016. As inflation expectations rise, Value gains traction. Since July 2016, Value equities have not only significantly outperformed Low Vol, but also the S&P 500 benchmark. The regime shift also coincided with recovery in sentiment in the aftermath of the UK’s Brexit vote and better-than-expected US employment data.

An investor can further dissect the US equity market according to Value and the Low Vol risk, which also suggests an early July 2016 shift in market dynamics. Investors are now clearly eschewing US Low Vol equities in favour of US Value. Such an analysis shows that:

- The least volatile stocks have been underperforming the more volatile ones;

- The least expensive shares have been outperforming higher priced ones; and

- Value has been outperforming Low Vol.

Under certain conditions, an investment strategy built around US Value could continue to outperform US Low Vol. But in order to do this, long-term inflationary pressures have to be sustained, but without getting out of control. And it is worth remembering that Value stocks exhibit more than twice the volatility of Low Vol equities. All in all, an extension of an arbitrage trade that favours Value over Low Vol depends on investors’ conviction regarding the underlying macro risk factors driving these respective investment strategies.