Despite the lack of wage growth, yen weakening and higher commodity prices mean inflation in Japan may start to move higher.The labour survey for October shows that wage growth remains sluggish in Japan, despite increasing signs of tightness in the labour market. Nonetheless, inflation in Japan may start to move higher on account of external factors such as the exchange rate and commodity prices.Japanese workers’ cash earnings rose by just 0.1% year-over-year in October. Earnings have been largely stagnant since 2009, after having collapsed during the global financial crisis (see chart above). As a matter of fact, the cash earnings of Japanese workers in the first 10 months of 2016 were 0.5% less than that for the same period in 2010.There is little sign of wages picking up in the near future despite the efforts of the Abe government and the Bank of Japan (BoJ) to boost inflation expectations. The anaemic wage growth seems all the more puzzling as Japan’s labour market continues to tighten. The job-to-applicant ratio in October hit 1.4 (meaning for every job applicant there are 1.4 job openings), close to the highest level since 1980. Meanwhile, the unemployment rate in October came in at 3.0%, which was the lowest since late-1994.

Topics:

Dong Chen considers the following as important: Bank of Japan, Japan inflation, Japan wage growth, Japanese labour market, Macroview

This could be interesting, too:

Marc Chandler writes Trump’s Tariff Talks Wobble Forex Market, Close Neighbors Suffer Most

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes Higher Yields Help Extend the Dollar’s Gains

Marc Chandler writes Eurozone Growth Surprises, Lifts Euro, while UK Budget is Awaited

Despite the lack of wage growth, yen weakening and higher commodity prices mean inflation in Japan may start to move higher.

The labour survey for October shows that wage growth remains sluggish in Japan, despite increasing signs of tightness in the labour market. Nonetheless, inflation in Japan may start to move higher on account of external factors such as the exchange rate and commodity prices.

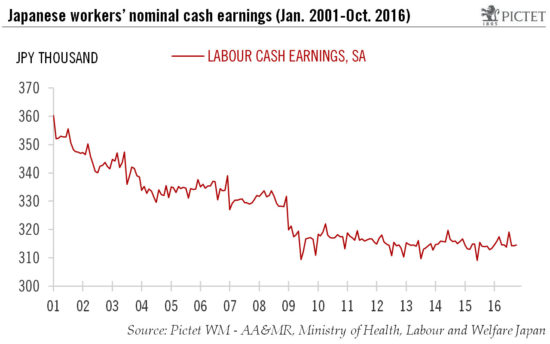

Japanese workers’ cash earnings rose by just 0.1% year-over-year in October. Earnings have been largely stagnant since 2009, after having collapsed during the global financial crisis (see chart above). As a matter of fact, the cash earnings of Japanese workers in the first 10 months of 2016 were 0.5% less than that for the same period in 2010.

There is little sign of wages picking up in the near future despite the efforts of the Abe government and the Bank of Japan (BoJ) to boost inflation expectations. The anaemic wage growth seems all the more puzzling as Japan’s labour market continues to tighten. The job-to-applicant ratio in October hit 1.4 (meaning for every job applicant there are 1.4 job openings), close to the highest level since 1980. Meanwhile, the unemployment rate in October came in at 3.0%, which was the lowest since late-1994.

The yen’s sharp appreciation since mid-2015 came to a stop in Q3 2016, and the currency has weakened quite significantly since Donald Trump won the US presidential election on 8 November. We expect the impact of a weaker currency to start to show up in Japan’s inflation figures in Q2 2017. And rising commodity prices, especially the rebound in crude oil, may have a more immediate impact on Japan’s inflation.

Data released for October is consistent with our analysis that inflation in Japan has troughed. As things stand, we expect to see Japan’s core inflation rise above zero starting Q2 of 2017 and rise by 0.3% y-o-y in 2017 as a whole, compared with an expected -0.3% change in 2016. If we are right, then this will likely take some pressure off the BoJ, which, we believe, has very limited room to further ease its monetary policy. However, wage growth is essential if the BoJ is to achieve its 2% inflation target. In addition to even further labour market tightening, structural reforms that boost inflation expectations will be crucial.