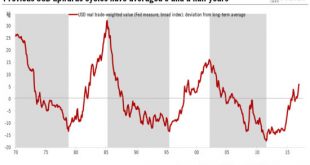

But the potential for fiscal stimulus and ongoing Fed tightening are factors that support USD appreciation in 2017 at least.Our core scenario foresees risk appetite remaining robust as President Trump adopts a more moderate stance on protectionism than his past rhetoric would suggest. The USD should appreciate most against low-yielding currencies. But while we acknowledge that fundamental drivers also justify further USD strength, we believe that the long-term trend of USD appreciation is...

Read More »Credit impulse remains weak in euro area

Relatively strong credit data for October were not enough to prevent the credit impulse from continuing to soften.Euro area bank credit flows to non-financial corporations rebounded strongly in October, by EUR11 bn in adjusted terms. Bank loans to households continued to expand at a healthy pace (+EUR10 bn). The slowdown in annual growth of the broad monetary aggregate M3, from 5.1% to 4.4% year on year in October, was largely due to base effects.The rebound in credit flows to the private...

Read More »Signs of higher growth and inflation in the euro area

Surveys that show activity remains buoyant in the euro area mean growth and inflation could be higher than forecast, thus complicating the ECB’s task.Flash purchasing managers’ indices (PMI) for November, compiled by Markit, delivered upside surprises across most countries and sectors in the euro area.Business confidence remained very strong in Germany, and improved markedly in France and peripheral countries. The euro area composite PMI rose to 54.1, pointing to real quarter-over-quarter...

Read More »European populists unlikely to replicate Trump win

Political risks never completely disappear from the European landscape, but we are not convinced that the US elections have materially increased the odds of another populist ‘accident’ in the euro area.While the Italian referendum is the most obvious near-term risk, we see extremely low chances of a nationalist, anti-European party winning a major election next year or holding a legally-binding referendum on EU/EMU membership. Apart from any other consideration, electoral processes are too...

Read More »2017 growth forecast for U.S. remains unchanged for now

Recent data shows that consumer spending remains on track, but we see prospects dimming for economic growth in H1 2017, before rising again in H2 thanks to fiscal stimulus.Figures released on November 15 show that core retail sales in the US rose by a strong 0.8% month over month in October, well above consensus expectations. Moreover, figures for the previous months were revised up. We believe consumer spending will grow by around 2.5% q-o-q annualised in Q4 (2.1% in Q3) and that it should...

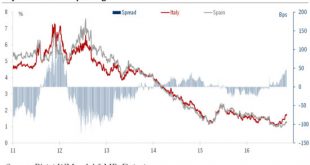

Read More »Referendum at heart of Italian uncertainties

A ‘No’ vote in the 4 December referendum would be seen as a negative by investors in Italy, adding to the challenges the country must face.The 4 December referendum on senate reform is the next big event on the European political calendar, coming just ahead of the next ECB and Fed policy meetings on 8 December and 14 December, respectively.We believe a ‘Yes’ vote would boost government confidence and marginally help Italian securities, but is unlikely to represent a significant game changer...

Read More »Into the Unknown

[embedded content] Published: Friday November 11 2016The switch from monetary to fiscal stimulus, and a rise in earnings growth for the first time in two years looked like being two of the big themes for 2017. To these must now be added a third one: the unpredictability of a president Trump. Cesar Perez Ruiz, Pictet’s Chief Investment Officer, discusses the road ahead.

Read More »Pictet Perspectives – Into the Unknown

The switch from monetary to fiscal stimulus, and a rise in earnings growth for the first time in two years looked like being two of the big themes for 2017. To these must now be added a third one: the unpredictability of a president Trump. Cesar Perez Ruiz, Pictet’s Chief Investment Officer, discusses the road ahead.

Read More »Implications of Trump’s election win

We are cautious about the impact of a Trump presidency and are not changing our economic forecasts at this time. Uncertainty about how Trump will govern make near-term volatility spikes likely.A Trump presidency could see major changes in policy on many themes such as fiscal policy, trade policy, immigration, the environment, financial regulation, healthcare, social security, and supervision of the Fed. However, it remains highly uncertain whether Trump will in fact pursue the policies he...

Read More »Time is ripe for change in monetary policy style

Published: 7th November 2016Download issue:In spite of large doses of policy easing, inflation and global growth remain tepid. With the effectiveness of existing monetary policy styles therefore being increasingly questioned, the November 2016 issue of Perspectives looks at three of the most plausible alternatives.One is asset-price targeting. Could central banks assume responsibility for ensuring the stability of asset prices as well as price stability? Christophe Donay, head asset of asset...

Read More » Perspectives Pictet

Perspectives Pictet