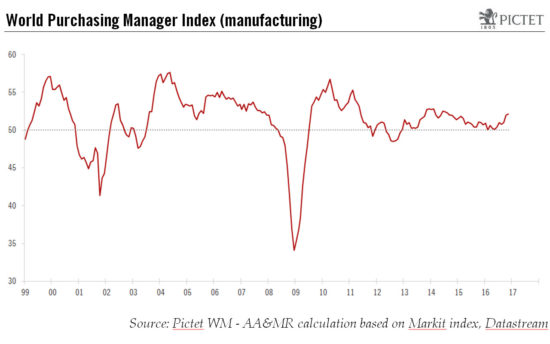

Aggregate purchasing manager indices are pointing to upticks in growth and inflation in developed markets in line with our central scenario, but emerging markets are lagging.Global sentiment improved slightly in November, to 52.1 from 52.0 in October, according to Markit’s global Purchasing Manager Index (PMI). This is the third monthly improvement in a row. One has to look back to August 2014 to find a higher level.Advanced economies are among the more upbeat. Business sentiment in November was highest in the European Union (ex euro area), closely followed by the euro area and the US where sentiment has improved markedly in the last three months, most notably after the presidential election on 8 November.Sentiment in emerging countries continues to lag sentiment in developed markets, and, according to our own aggregate of Markit figures, in November was only barely above the 50 threshold that divides expansion from contraction. In China, apart from a slight dip in November, sentiment has increased significantly since June. Russia has also recorded an impressive recovery, but other emerging-market heavyweights appear less optimistic. Sentiment in India has probably been hurt by the government’s decision to withdraw banknotes from circulation, while sentiment in South Korea has been dented by the scandal involving President Park Geun-hye.

Topics:

Jean-Pierre Durante considers the following as important: Global inflation indicator, Global sentiment, Growth indicator, Macroview, PMI survey

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Aggregate purchasing manager indices are pointing to upticks in growth and inflation in developed markets in line with our central scenario, but emerging markets are lagging.

Global sentiment improved slightly in November, to 52.1 from 52.0 in October, according to Markit’s global Purchasing Manager Index (PMI). This is the third monthly improvement in a row. One has to look back to August 2014 to find a higher level.

Advanced economies are among the more upbeat. Business sentiment in November was highest in the European Union (ex euro area), closely followed by the euro area and the US where sentiment has improved markedly in the last three months, most notably after the presidential election on 8 November.

Sentiment in emerging countries continues to lag sentiment in developed markets, and, according to our own aggregate of Markit figures, in November was only barely above the 50 threshold that divides expansion from contraction. In China, apart from a slight dip in November, sentiment has increased significantly since June. Russia has also recorded an impressive recovery, but other emerging-market heavyweights appear less optimistic. Sentiment in India has probably been hurt by the government’s decision to withdraw banknotes from circulation, while sentiment in South Korea has been dented by the scandal involving President Park Geun-hye. In Brazil, despite a slight improvement recently, sentiment continues to be impacted by a long-lasting economic and institutional crisis, while business sentiment in the Middle East also remains downbeat.

PMI surveys constitute a good leading indicator of world GDP growth. Applying our in-house model to the PMI data suggests we will see an acceleration of real GDP growth in 2017, in line with our scenario that global economic growth will accelerate to 3.3% in 2017 from 3.1% in 2016.

The PMI surveys also offer useful insight into global inflation expectations. In aggregate, the surveys point towards an acceleration of inflation in the months ahead, in line with our scenario.

Combining the forecasts for real GDP growth and inflation hint at trends in nominal GDP growth, which is essential for dynamics like debt sustainability and company earnings. The trends in economic activity and inflation that our in-house modelling is pointing to are a good omen, suggesting that after years of low growth, 2017 could finally be the year when we see a marked acceleration in nominal global GDP.