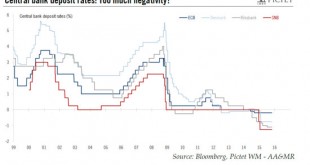

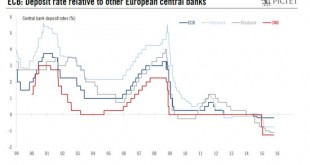

The ECB has explicitly (re-)opened the door to further cuts in the rate applied to its deposit facility, currently standing at -0.20%. The ECB is one of four major central banks to have lowered one of its policy rates into negative territory; the ECB’s rate on the deposit facility used to remunerate banks’ reserves – or the ‘depo rate’ – currently stands at ‑0.20%. The other negative experimenters, in Switzerland, Denmark and Sweden, have even lower repo and deposit rates (see chart below)....

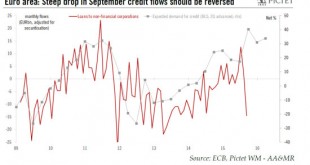

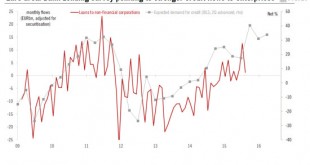

Read More »Euro area: big drop in credit flows in September to be reversed

Despite September's setback in credit flows, the credit impulse improved further in Q3, still consistent with growth in domestic demand of close to 2%. Euro area M3 and credit data surprised on the downside in September, contradicting the positive message from the ECB’s Bank Lending Survey (BLS) published last week. Overall, we believe these volatile bank credit flows are likely to rebound strongly in the months ahead, closing the gap with upbeat leading indicators like the BLS (see chart...

Read More »Equity markets: is it time to move out of Growth stocks and into Value ones?

Growth investing has been very profitable in the US equity market since 2009, outperforming Value investing by 55% since April 2009. A great period for Growth investing Since equity markets bottomed out in March 2009, the Growth style (as measured, for the purposes of this Flash Note, by the MSCI US Growth index ) has handsomely outperformed the Value style (MSCI US Value Index). Price-wise, the performance gap worked out at 55% for the period from April 2009 to end-September 2015, its...

Read More »ECB: expect QE expansion in December, but no rate cut for now

The ECB’s increasingly dovish tone continues to support our expectation of a 6-month QE extension to be announced at the 3 December meeting. Mario Draghi was unsurprisingly dovish at today’s policy meeting, bearing our view that more monetary easing is in the pipeline, effectively signalling a move at the 3 December meeting. By saying that “the degree of monetary policy accommodation will need to be re-examined in December” and that the ECB was not in “wait-and-see” but in “work-and-assess”...

Read More »Financial markets likely to rebound further

Macroview Economic cycles are desynchronised; monetary policies are also desynchronised and noncooperative; corporate earnings have been downgraded; and uncertainty has compressed valuation ratios. Concerns about China’s slowdown and the Fed’s impending interest rate rise have loomed especially large. The result has been volatile and shaky markets. However, the recent market correction has been driven by perceptions rather than reality. Economic fundamentals have not deteriorated and,...

Read More »Euro area: banking on stronger credit flows to boost investment

The ECB’s October Bank Lending Survey reveals a sixtieth consecutive quarter of net easing of credit conditions and a further increase in credit demand. The ECB’s October Bank Lending Survey (BLS), conducted between 15 and 30 September 2015 and released today, revealed a sixtieth consecutive quarter of net easing of credit conditions as well as a further increase in demand for loans to non-financial corporations. Moreover, forward-looking BLS indicators pointed towards banks expecting to...

Read More »The ECB still has options to weigh on the currency

The least bad option for the ECB could just be to leave the threat of lower rates hanging in the air while hoping that actually delivering on the threat might not be needed. With a few exceptions, the recent history of ECB easing has been marked by episodes of lengthy bouts of verbal interventions, preparing the ground for actual decisions once a consensus has been reached. Several reasons can be found for the ECB’s slow responsiveness to changes in the macro-financial environment,...

Read More »United States: core inflation likely to remain relatively stable

We believe that y-o-y core CPI inflation will remain relatively stable over the coming 6-9 months. Year-on-year headline inflation fell back to zero in September, but core inflation inched up from +1.8% in August to +1.9% in September. The slack in the labour market is diminishing rapidly, and deflation is not really posing a risk in the US. However, with a higher dollar and inflation low worldwide, we believe core inflation will remain relatively stable over the coming months. The...

Read More »Higher market volatility should not preclude a rebound in DM equities

Published: 15th October 2015 Download issue: The Vix, a widely used measure of equity-market volatility, was in a systemic risk regime for 15 days this year, compared with just two days in 2014 and none at all in 2013, as shown by the chart below. This year’s experience of volatility is still not extensive in a historical comparison, but it still represents a marked change from very subdued conditions in the previous two years. What explains the change? Higher market volatility at present...

Read More »United States: soft retail sales report, but robust consumption overall in Q3

Today’s retail sales report was disappointing. Nevertheless, overall consumption growth is likely to have topped 3.0% q-o-q annualised in Q3, and we remain optimistic about future consumption growth. Nominal total retail sales increased by a modest 0.1% m-o-m in September, slightly below consensus expectations (+0.2%). Moreover, August’s number was revised down from +0.2% to 0.0%. As widely expected, total sales were dented by a massive (-3.2%) m-o-m fall in nominal sales at gasoline...

Read More » Perspectives Pictet

Perspectives Pictet