The ECB’s increasingly dovish tone continues to support our expectation of a 6-month QE extension to be announced at the 3 December meeting. Mario Draghi was unsurprisingly dovish at today’s policy meeting, bearing our view that more monetary easing is in the pipeline, effectively signalling a move at the 3 December meeting. By saying that “the degree of monetary policy accommodation will need to be re-examined in December” and that the ECB was not in “wait-and-see” but in “work-and-assess” mode, Draghi went as close as possible to making a pre-commitment. He added that “some members” favoured more stimulus as soon as today. Overall, we still believe that the ECB will announce, at its 3 December meeting, an extension of its QE programme of at least 6 months, until March 2017 “or beyond”. The monthly pace of asset purchases could be increased by EUR10-20bn (from EUR60bn currently) and their composition could be broadened to encompass corporate bonds or other riskier assets, in the event of the economic outlook deteriorating further. Crucially, a deposit rate cut was “discussed” at today’s meeting for the first time since it had been lowered to -0.20% in September 2014. Draghi struggled to justify this U-turn, given that the Governing Council repeatedly said that policy rates had reached their lower bound.

Topics:

Perspectives Pictet considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

The ECB’s increasingly dovish tone continues to support our expectation of a 6-month QE extension to be announced at the 3 December meeting.

Mario Draghi was unsurprisingly dovish at today’s policy meeting, bearing our view that more monetary easing is in the pipeline, effectively signalling a move at the 3 December meeting. By saying that “the degree of monetary policy accommodation will need to be re-examined in December” and that the ECB was not in “wait-and-see” but in “work-and-assess” mode, Draghi went as close as possible to making a pre-commitment. He added that “some members” favoured more stimulus as soon as today.

Overall, we still believe that the ECB will announce, at its 3 December meeting, an extension of its QE programme of at least 6 months, until March 2017 “or beyond”. The monthly pace of asset purchases could be increased by EUR10-20bn (from EUR60bn currently) and their composition could be broadened to encompass corporate bonds or other riskier assets, in the event of the economic outlook deteriorating further.

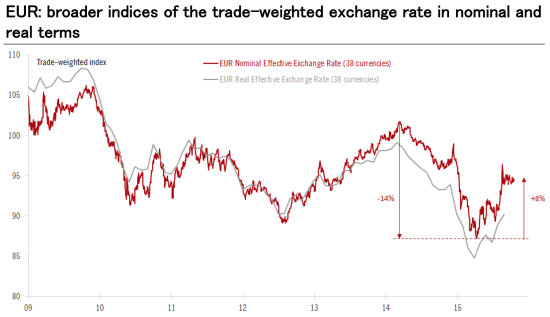

Crucially, a deposit rate cut was “discussed” at today’s meeting for the first time since it had been lowered to -0.20% in September 2014. Draghi struggled to justify this U-turn, given that the Governing Council repeatedly said that policy rates had reached their lower bound. As we suspected, this communication shift is likely aimed at weighing on the EUR. We believe a 10bp deposit rate cut would be implemented in H1 2016 if and only if the euro’s trade-weighted exchange rate appreciates more significantly from here, say by another 5% or more, for instance if there is evidence of the first Fed hike being delayed beyond March 2016. Therefore, a rate cut is still not part of our baseline scenario at this stage.

Reinforcing ECB’s dovishness and flexibility

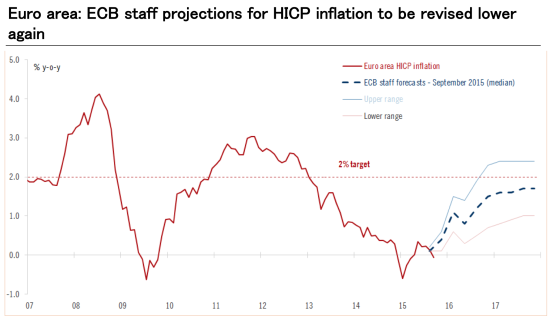

The ECB’s rationale remains essentially unchanged: downside risks to inflation have risen, largely due to external factors (weaker commodities and a stronger trade-weighted EUR) which should translate into lower inflation projections by the staff in December (currently projected at 1.7% by the end of 2017), thereby forcing the ECB to ease further.

At the same time, domestic demand is strengthening, unemployment is falling, credit transmission is improving and evidence is accumulating that investment spending – the missing link – might be about to pick up as well. Above all, the ECB is seeing mounting evidence that QE is producing the intended effects as more banks are planning to use new liquidity capacity to grant new loans or purchase assets. All this will provide the ECB with the fundamental justification for more easing, if and when needed, as QE is working its way through the real economy.

More specifically, the ECB’s introductory statement and press conference clearly conveyed the impression of an even stronger dovish bias, if not a firm commitment to act in December. Concerns over the outlook for EM growth and commodity prices were said to “continue to signal downside risks to the outlook for growth and inflation” in the euro area. On the positive side, the ECB added that domestic demand remained supported by lower commodity prices, loose financial conditions and improvement in the credit cycle. Structural reforms, while not ambitious enough in the ECB’s mind, should be helpful as well.

On inflation, Draghi did not echo Nowotny’s comments according to which “the ECB is clearly missing its inflation target”, which would have made the justification for today’s status quo more difficult. Instead, Vice-President Constancio took some time to explain how negative inflation or “low-flation” were different than deflation, adding that the ECB never changed its mandate. Draghi did, however, insist on downside risks to inflation again, hinting at likely downward revisions to upcoming staff projections in December (see chart on the front page).

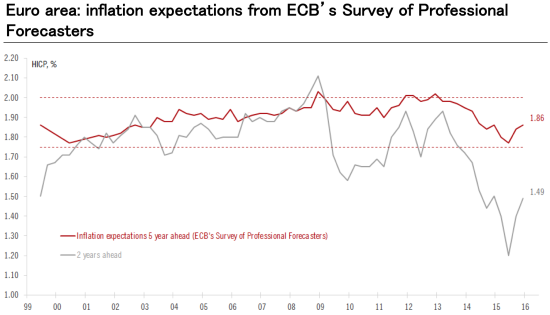

The ECB still expects inflation to bottom out in Q3 2015 before a large base effect plays out and pushes headline HICP inflation above 1% in Q1 2016, as per our projections. The main risks include the weaker outlook for external demand and commodity prices, together with the recent appreciation in the trade-weighted exchange rate. Inflation expectations should play a key role as well. The ECB’s quarterly Survey of Professional Forecasters (SPF) is due to be published tomorrow for Q4, and much of the focus will fall on longer-term inflation expectations once again. Despite a challenging environment and weaker commodity prices, the latter have actually risen in the previous two quarters, from 1.77% to 1.86% in Q3. Any relapse would provide the ECB with another justification to ease.

How to deal with more negativity?

In the end, Draghi left all his easing options open, including an expansion “in the size, composition and duration” of the QE programme as well as “other policy instruments”. Asked whether the latter could include a cut in the deposit facility rate, Draghi said that this option had been discussed at today’s meeting.

As we wrote earlier, a deposit rate cut should be specifically targeted at offsetting any further currency strength at a time when uncertainty prevails about the timing of the first Fed hike and the outlook for EM growth. This would be in line with Draghi’s important speech in Amsterdam in April 2014 when he outlined the “contingencies” for ECB action. A further cut in policy rates was then described as the appropriate tool to tackle any “unwarranted tightening of monetary policy stance”, including through the exchange rate.

Arguably, the ECB could find new ways to mitigate the collateral damage of a deposit rate cut on the money-market industry, in particular, for instance, by applying a limit to the level of excess bank reserves to which the more negative deposit rate would apply. For instance, Denmark’s central bank manages excess reserves and short-term rates based on such a system of banks’ current-account limits. Still, we see more cons than pros to a deposit rate cut, and we doubt it will be the ECB’s first port of call.

In the end, our view remains that the ECB will refrain from cutting rates provided that the Fed finally hikes rates in March 2016 as per our central case. Other factors might influence its decisions in the coming months (see timeline in the table below). If we are proven wrong and the trade-weighted EUR appreciates much further from here, say by more than 5%, with the EUR/USD crossing the 1.20 mark, then the ECB might be forced to deliver eventually. In turn, this may force central banks in Denmark, Switzerland or Sweden to ease policy further, most likely through rate cuts themselves.

Meanwhile, we stick with the view that the ECB will announce an extension of its QE programme of at least 6 months, until March 2017 or beyond, at its 3 December meeting, possibly alongside a EUR10-20bn increase in the monthly pace of asset purchases and some targeted changes in their composition.