The ECB’s October Bank Lending Survey reveals a sixtieth consecutive quarter of net easing of credit conditions and a further increase in credit demand. The ECB’s October Bank Lending Survey (BLS), conducted between 15 and 30 September 2015 and released today, revealed a sixtieth consecutive quarter of net easing of credit conditions as well as a further increase in demand for loans to non-financial corporations. Moreover, forward-looking BLS indicators pointed towards banks expecting to ease their credit conditions further for enterprises alongside a further “considerable” increase in credit demand in Q4. Most other survey findings were very encouraging as well (see main features below), with the exception of households for which credit conditions tightened somewhat and demand for loans for house purchases slowed, although this did come after several quarters of easing in loan terms and conditions. Meanwhile, credit transmission to small and medium-sized enterprises (SMEs) improved further while euro area banks are increasingly planning on using extra liquidity to grant new loans and purchase assets. As a result, the ECB can easily justify a QE expansion, if and when conditions warrant it, as more liquidity finds its way into the real economy.

Topics:

Perspectives Pictet considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

The ECB’s October Bank Lending Survey reveals a sixtieth consecutive quarter of net easing of credit conditions and a further increase in credit demand.

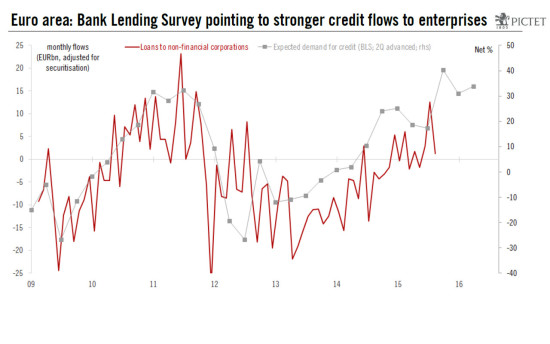

The ECB’s October Bank Lending Survey (BLS), conducted between 15 and 30 September 2015 and released today, revealed a sixtieth consecutive quarter of net easing of credit conditions as well as a further increase in demand for loans to non-financial corporations. Moreover, forward-looking BLS indicators pointed towards banks expecting to ease their credit conditions further for enterprises alongside a further “considerable” increase in credit demand in Q4.

Most other survey findings were very encouraging as well (see main features below), with the exception of households for which credit conditions tightened somewhat and demand for loans for house purchases slowed, although this did come after several quarters of easing in loan terms and conditions.

Meanwhile, credit transmission to small and medium-sized enterprises (SMEs) improved further while euro area banks are increasingly planning on using extra liquidity to grant new loans and purchase assets. As a result, the ECB can easily justify a QE expansion, if and when conditions warrant it, as more liquidity finds its way into the real economy. This remains our central case as we expect an expansion in the ECB’s QE to be announced in December, most likely through a 6-month extension to the programme until “at least March 2017”.

In all, the latest credit surveys bode well for the euro area credit cycle and the broader economic outlook, including private investment spending, with upside risks building around our 1.7% GDP growth forecast for next year.

Further easing in credit conditions for enterprises

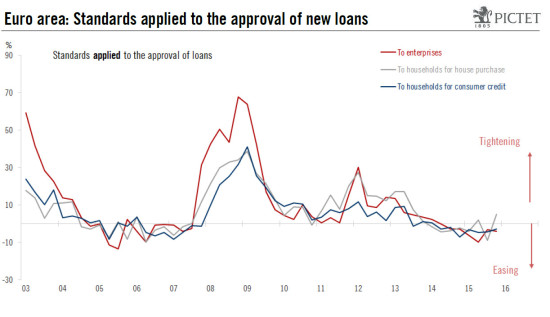

The BLS showed that banks reported a further net easing of credit standards on loans to non-financial corporations in Q3, stronger than had been expected in the previous survey round. Across firm size, credit standards were eased mainly on loans to SMEs, but were broadly unchanged for large firms.

At country level, credit standards tightened in France, whereas they improved in Italy and were broadly unchanged in net terms in Germany and Spain.

The only disappointment came on the household front. The number of banks reporting tightening credit standards for loans to buy houses outweighed the number of banks reporting an easing of credit standards in Q3 (see the grey line in chart below). It is worth highlighting the net tightening in credit conditions on loans was driven mainly by the Netherlands where a change in regulation impacted standards.

Looking at the fourth quarter of 2015, euro area banks expect a further net easing of credit standards on loans to businesses. As for households, the number of banks expecting a net tightening of credit standards on loans for house purchases in Q4 declined.

Credit demand: further improvement for enterprises, slowdown for households

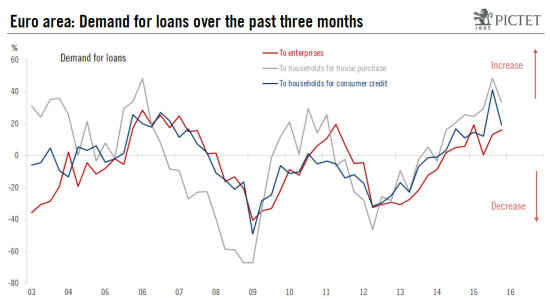

Net demand for loans to non-financial corporations improved further in Q3. The net percentage of banks reporting a rise in demand rose to 16% in Q3, from 13% in the previous quarter (see chart below). Among the factors contributing to increased demand in loans to businesses, the general level of interest contributed the most, while fixed investment, inventories, working capital and other financing needs also supported demand. In contrast, the use of alternative finance, in particular the issuance of debt securities, continued to dampen demand for loans.

On the households’ side, after reaching a record high since the survey was first compiled, the number of banks reporting an increase in present demand for loans for both house purchases (to 33%, down from 49%) and consumer credit (to 19%, down from 41%) slowed down, albeit to levels still supportive of improving credit flows.

Looking ahead, euro area banks expect a further significant increase in demand for lending to non-financial corporations in Q4. The number of banks expecting an increase in loan demand from non-financial corporations rose from 31% to 34%. As for households, demand for house-purchase loans is expected to continue expanding, but at a slower pace, although the number of banks reporting a rise in demand has declined (to 23% from 33%)

Looser standards + higher demand = stronger credit impulse

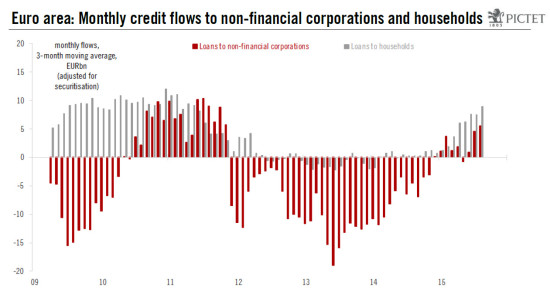

Improvement in both credit standards and demand, as reflected in the BLS, continues to bode well for credit flows in the coming months. Unsurprisingly, the latter have rebounded since the Asset Quality Review was completed in October 2014, also helped by the ECB’s TLTROs (Targeted Longer-Term Refinancing Operations) which created space and incentives for banks to lend to non-financial corporations*.

In the past nine months since new loans to non-financial corporations (NFCs) first turned positive, monthly flows have averaged €2.8bn to NFCs and €5.7bn to households (both adjusted for sales and securitisation), still well below pre-crisis standards. These figures remain volatile, and August credit flows failed to accelerate materially, but the trend is nonetheless pointing upwards, as shown in the previous chart.

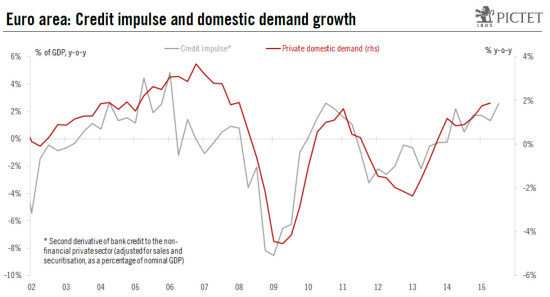

In order to quantify momentum in the credit cycle, we tend to focus on the credit impulse – the second derivative of credit, or the change in credit flows, which matters the most for domestic demand – which has improved further as bank deleveraging has slowed. The chart below shows that this metric reached a cycle-high at +2.60% y-o-y in August, consistent with domestic demand growing at around 2% y-o-y. September credit data are due to be released on 27 October, and recent evidence points to further strength in the months ahead.

In particular, today’s BLS suggests that increasing demand for loans to enterprises will translate into strong credit flows in coming months, starting from a low base, as overall terms and conditions remain favourable, rejection rates decrease, and private-sector deposits increase.

ECB’s sweet spot: better credit and QE transmission

Furthermore, while credit transmission mechanisms continue to improve to SMEs, banks are increasingly planning on using new QE-fuelled liquidity to grant new loans. The ECB thus concludes that “these results confirm that the APP [expanded Asset Purchase Programme] continues to support lending to the euro area”. In other words, the ECB can easily justify an extension to its QE programme on that basis, if and when conditions warrant it, as more liquidity finds its way into the real economy.

So far, the BLS has indicated that 39% of euro area banks have used the additional liquidity from their sales of marketable assets to grant loans to non-financial corporations (up from 32% in the previous survey), 14% for housing loans (down from 17%) and 36% for consumer credit and other lending to households (up from 18%). Looking ahead, this positive trend should even strengthen as more banks are signalling their intent to deploy the extra liquidity to grant loans in all three loan categories (business loans: 42%; housing loans: 15%; consumer credit and other lending to households: 37%). On top of that, the ECB sees mounting evidence of portfolio-rebalancing effects as 21% of banks signalled that they have used the extra liquidity to purchase new assets, up from 4% in the previous survey.

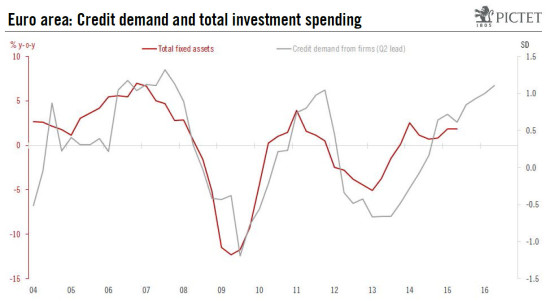

Crucially, these developments bode well for investment spending in the coming quarters – the missing link in the current recovery. At this juncture, observed and expected demand for private-sector credit looks consistent with growth in fixed investment picking up, possibly close to 5% y-o-y considering the more supportive environment compared with the previous mini-cycle in 2010-2011. Whether the improvement can be sustained at these levels will depend on other factors, including broader financial conditions and external demand.

In the end, recent credit flows and surveys support our scenario of increasing domestic demand, including investment, into 2016, with upside risks building around our GDP growth forecast of 1.7% for next year.

Despite this improving domestic outlook, inflation remains well below the ECB’s target and downside risks prevail. Weaker commodity prices and a stronger currency, in particular, should force another downward revision to the staff forecasts in December. As a result, we continue to expect a soft QE expansion to be announced by the year-end, most likely through a 6-month extension to the programme until “at least March 2017”, although the ECB can always find ways to surprise the market if needed.

* Based on actual credit flows recorded in the reference period starting in May 2014, banks could in theory borrow an additional €430bn from the ECB in upcoming TLTROs should they use their full allowances and leverage. Loans to households for house purchases are excluded from the ECB’s lending benchmarks.