The least bad option for the ECB could just be to leave the threat of lower rates hanging in the air while hoping that actually delivering on the threat might not be needed. With a few exceptions, the recent history of ECB easing has been marked by episodes of lengthy bouts of verbal interventions, preparing the ground for actual decisions once a consensus has been reached. Several reasons can be found for the ECB’s slow responsiveness to changes in the macro-financial environment, including differences of views among its 25 members. Verbal interventions, of course, can still produce powerful effects on the market, at least in the short term, and Mario Draghi has long established himself as a master of communication by any standard. This time may not be different. Indeed, the market has come to price in an extension to ECB QE with even greater certainty, yet an announcement at the 22 October meeting looks “premature” according to a majority of Governing Council members.

Topics:

Perspectives Pictet considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

The least bad option for the ECB could just be to leave the threat of lower rates hanging in the air while hoping that actually delivering on the threat might not be needed.

With a few exceptions, the recent history of ECB easing has been marked by episodes of lengthy bouts of verbal interventions, preparing the ground for actual decisions once a consensus has been reached. Several reasons can be found for the ECB’s slow responsiveness to changes in the macro-financial environment, including differences of views among its 25 members. Verbal interventions, of course, can still produce powerful effects on the market, at least in the short term, and Mario Draghi has long established himself as a master of communication by any standard.

This time may not be different. Indeed, the market has come to price in an extension to ECB QE with even greater certainty, yet an announcement at the 22 October meeting looks “premature” according to a majority of Governing Council members. We believe the ECB still has options to surprise the market if needed, but our baseline remains geared towards a ‘soft’ QE boost (see “Topic of the month” on page 12 of “Perspectives”, October 2015 issue), to be announced in December, probably through a 6-month extension to the programme (until “at least March 2017”) and possibly a modest increase in the monthly pace of asset purchases (from €60bn at the moment). With this kind of option largely priced in, it is debatable how much of an impact it would have on financial conditions.

Arguably, the ECB could still surprise with the implied size of additional balance sheet expansion, or with a change in the composition of asset purchases to include corporate debt or even riskier securities. But there is another, perhaps less controversial, way for the ECB to spring a surprise, one that involves the threat of a deposit rate cut.

Assuming the exchange rate remains the most effective transmission channel for QE, both in the ECB’s theoretical framework and in practice, there is indeed another option the ECB might contemplate. Essentially, Draghi could find new ways to let the market believe that a deposit rate cut is on the cards while buying time for the actual decision to be pondered. More evidence would be needed before the Governing Council reaches any decision as it would like to better gauge the effects of the EM slowdown, the VW scandal or the Fed procrastination. If communicated properly to the market, the mere threat of a rate cut may be enough to keep the euro under downward pressure ahead of the December meeting, and with some luck even until the Fed hikes and the USD resumes its appreciation.

Trick or t(h)reat

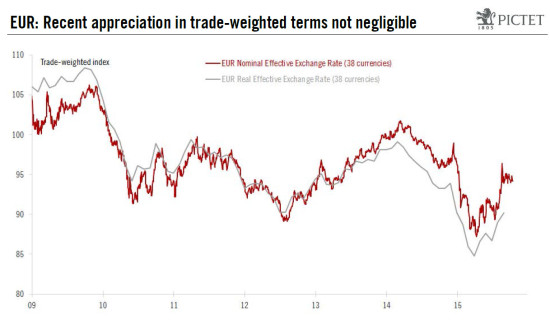

The accounts of the September meeting mentioned the need to monitor FX developments closely, especially the broader euro index of the trade-weighted currency against a basket of 38 currencies which has appreciated by around 8% from its lows in April 2015. From that perspective, the outlook for EM currencies, including the CNY accounting for 18%, could prove more important than the EUR/USD cross.

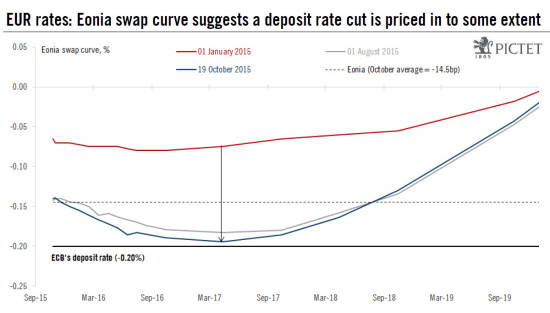

Since then, a deposit rate cut has not been hinted at explicitly, let alone endorsed by ECB speakers, but it has not been dismissed either. It has been priced in by the market to some extent*. All in all, the Governing Council likely views a deposit rate cut as the ultimate option for pushing the euro downwards if all else fails, including if the Fed does not hike.

We believe that this was already in the back of the ECB’s mind when it intentionally removed the reference to the lower bound in its September statement. The question will no doubt be asked of Draghi during this week’s Q&A session. Last month, he only remarked that a rate cut “was not discussed” while refraining from commenting on the lower bound. One option could be just to repeat the strategy on Thursday by not answering the question about whether policy rates have indeed reached their lower bound.

An alternative, relatively cheap, way for Draghi to engineer renewed euro weakness could be to allude to Governing Council discussions on the lower bound, and a potential rate cut, as a policy option to be considered under some specific contingency. He could do that while hinting at the fact the decision has not been unanimous, saying that some members wanted to ease policy earlier and/or more aggressively. Although it looks premature for the ECB to make any decision at this stage given the conceptual and practical difficulties coming with a rate cut (see below), it could be enough for markets to believe that this option can no longer be ruled out completely.

What if the ECB needs to deliver a deposit rate cut?

Difficulties coming with a deposit rate cut are not insurmountable, yet nor are they negligible either. First, the ECB’s credibility could be at stake, having stated (twice!) since summer 2014 that policy rates have reached their lower bound. A turnround could be difficult to articulate even if justified by the ECB’s assessment of economic and financial conditions. In other words, one would need to see much more downside in the ECB’s macroeconomic scenario and more upside in their projections for the currency, probably above 1.20 for EUR/USD.

Second, implementation risks for the money market industry and the broader financial system should not be underestimated. At just above -15bp, the Eonia benchmark may still be manageable for the banking sector as a whole, but lending volumes would likely be at risk with short-term rates falling to much lower levels. Excess liquidity looks set to rise more or less steadily from the current level of €500bn+, and the bigger those excess reserves held on current account holdings at the ECB, the larger the ‘tax’ for cash-rich banks. Meanwhile, we believe it highly unlikely the ECB would decide to cut its main refinancing rate, currently at 0.05%, to push it into negative territory so that the rates corridor would have to be widened. Other disruptions could prove hard to manage, including in the all-important repo markets, at a time when financial regulation remains a constraint on balance sheet expansion.

If the ECB needs to deliver a rate cut nonetheless, it could find new ways to mitigate collateral damage on the financial system. In particular, it could decide only to apply the lower deposit rate to a certain proportion of (excess) bank reserves, contrary to what was decided when negative rates were initially introduced**. For instance, Denmark’s central bank manages excess reserves and short-term rates based on such a system of banks’ current account limits.

The problem with this solution is that it would be likely to reduce the intended effect of the rate cut, which brings us to a third limitation. A deposit rate cut has already been priced in at least to some extent in the rates and FX markets, hence the net effect could end up smaller than with previous cuts. Put differently, the counterfactual would probably be a higher euro today, adding to pressure on the ECB to deliver… in order to push the euro down, in a vicious circular fashion.

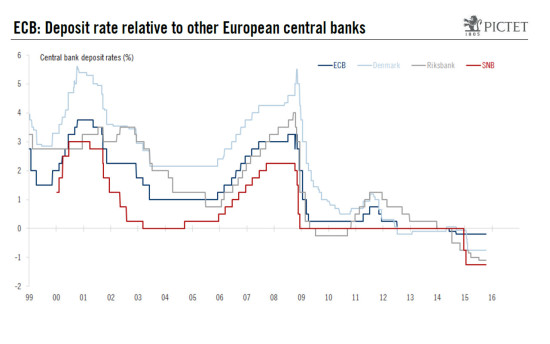

Last, and perhaps more important, a rate cut would risk reigniting the ‘currency war’ theme. In the short term, it may force central banks in Denmark, Switzerland or Sweden to ease policy further, most likely through rate cuts themselves.

There are also arguments in favour of a deposit rate cut that could look more sensible today, including the reduced financial fragmentation boosting the transmission of lower rates to the real economy. Still, over the longer term, and barring some sort of policy co-ordination, an ECB rate cut could add to the current financial volatility and further damp global growth prospects. If the medicine proves to be counter-productive, then it may be better not to press too hard for it. Again, the least bad option for the ECB could just be to leave the threat of lower rates hanging in the air while hoping that actually delivering on the threat might not be needed.

* The probability of a deposit rate cut as priced in by the market, still below 50%, depends on the assumptions made in terms of excess liquidity and the relationship with the Eonia-Depo spread.

** See ECB press release on 5 June 2014 for details: https://www.ecb.europa.eu/press/pr/date/2014/html/pr140605_3.en.html