We believe that y-o-y core CPI inflation will remain relatively stable over the coming 6-9 months. Year-on-year headline inflation fell back to zero in September, but core inflation inched up from +1.8% in August to +1.9% in September. The slack in the labour market is diminishing rapidly, and deflation is not really posing a risk in the US. However, with a higher dollar and inflation low worldwide, we believe core inflation will remain relatively stable over the coming months. The headline consumer price index (CPI) declined by 0.2% m-o-m in September, in line with consensus estimates. As suggested by weekly data on gasoline prices, energy prices fell markedly back further in September (-4.7% m-o-m). Meanwhile, food prices increased by 0.4% m-o-m. The end-result was that, on a year-on-year basis, headline inflation fell back to zero in September, against +0.2% in August. However, headline inflation should bounce back soon (see end of this post). Core CPI rose by 0.2% m-o-m, slightly more than expected The core CPI index (which excludes food and energy prices) rose by 0.2% m-o-m in September (+0.21% before rounding), a reading above consensus expectations (+0.1%). However, this higher monthly reading followed two consecutive months of soft increases. As a result, over the past three months, the core CPI has increased at a still moderate annualised pace of 1.

Topics:

Bernard Lambert considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

We believe that y-o-y core CPI inflation will remain relatively stable over the coming 6-9 months.

Year-on-year headline inflation fell back to zero in September, but core inflation inched up from +1.8% in August to +1.9% in September. The slack in the labour market is diminishing rapidly, and deflation is not really posing a risk in the US. However, with a higher dollar and inflation low worldwide, we believe core inflation will remain relatively stable over the coming months.

The headline consumer price index (CPI) declined by 0.2% m-o-m in September, in line with consensus estimates. As suggested by weekly data on gasoline prices, energy prices fell markedly back further in September (-4.7% m-o-m). Meanwhile, food prices increased by 0.4% m-o-m. The end-result was that, on a year-on-year basis, headline inflation fell back to zero in September, against +0.2% in August. However, headline inflation should bounce back soon (see end of this post).

Core CPI rose by 0.2% m-o-m, slightly more than expected

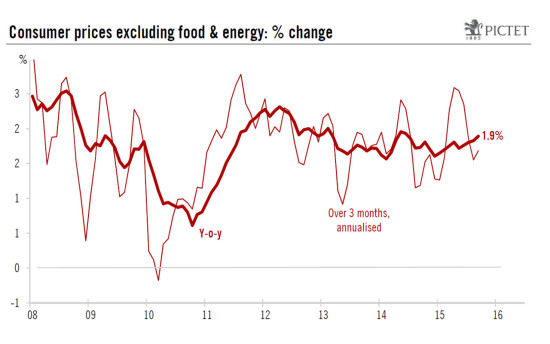

The core CPI index (which excludes food and energy prices) rose by 0.2% m-o-m in September (+0.21% before rounding), a reading above consensus expectations (+0.1%). However, this higher monthly reading followed two consecutive months of soft increases. As a result, over the past three months, the core CPI has increased at a still moderate annualised pace of 1.7%, against a faster 2.3% over the previous three months. On a year-on-year basis, core inflation inched up from +1.8% in August to +1.9% in September (+1.89% before rounding).

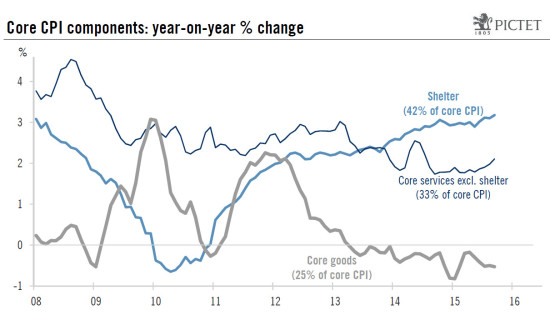

CPI core inflation is the aggregation of very different groups of prices, with very different behaviours. For our part, we tend to regroup prices into three sub-indices: goods, shelter and services excluding shelter (see chart below).

The slight acceleration in y-o-y core inflation comes from the latter two subindices. Shelter prices – which represent 42% of total core CPI – rose at a solid pace: +0.3% m-o-m and +3.2% y-o-y in September (+3.1% in August). And prices for core services excluding shelter rose by 2.1% y-o-y in September, against +2.0% in August. Admittedly, this group of prices only increased by a modest 0.1% m-o-m last month, but that was nevertheless higher than the flat monthly reading recorded in September 2014. Meanwhile, prices of core goods remained unchanged m-o-m in September and were down 0.5% y-o-y, the same reading as in August (see chart below).

Core inflation likely to remain relatively stable

What should we expect for the future? With high demand for rental units and a low level of rental vacancies, shelter inflation is likely to remain relatively high. However, we do not expect any further acceleration over the coming months, mainly due to the lagged moderating impact of the slowdown in house price inflation witnessed over the past two years or so. Meanwhile, despite the recent downward correction, the dollar surge recorded in the past few months will continue to have a damping impact on import prices. And we forecast that, on a trade-weighted basis, the greenback will climb further by around 4% over the coming 12 months. Moreover, the indirect lagged impact of much lower oil and commodity prices is probably not completely behind us. These two factors should continue to weigh on core inflation, at least over the coming 6-9 months. In addition, it is important to note that the international background is not pushing towards more inflation – quite the opposite. Inflation remains pretty low worldwide, and deflationary forces are still present. This context is limiting pricing power in the US as well.

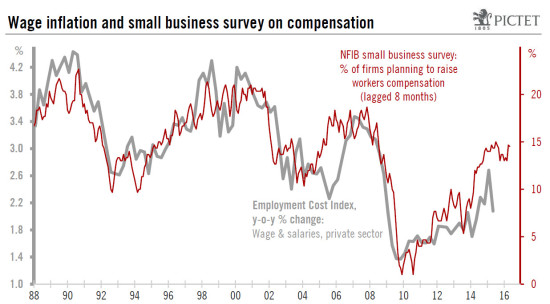

As for potential domestic wage pressure, the analysis remains quite difficult. Most measures of wages continue to rise at a very modest pace. At the same time, though, the unemployment rate is falling rapidly, and most indicators of the situation in the labour market have improved quite markedly of late.

Although there is much discussion about the extent of the slack in the labour market, there is no denying this slack is diminishing rapidly. At some stage or another, the fall in unemployment is expected to feed through and push wage inflation upwards (see chart below). We continue to expect wage increases to pick up gradually over the coming months. However, the influence of wage increases on overall core inflation should remain pretty muted, at least for the coming 12 months or so.

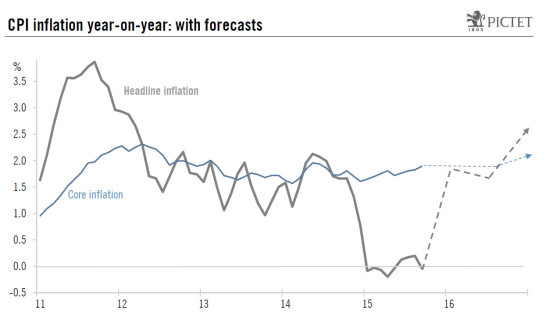

Overall, we continue to believe that y-o-y core inflation will remain relatively stable over the coming 6-9 months, before picking up modestly towards +2.1%-2.2% by the end of next year. We see the same kind of movements in core inflation with the Personal Consumption Expenditures (PCE) deflator, the Fed’s preferred measure (from +1.3% y-o-y in August to around +1.6%-1.7% by the end of next year).

As for y-o-y headline CPI inflation, the most important factor will be the disappearance of the sizeable base effect linked to the fall in gasoline prices recorded between September 2014 and January 2015, and then again the decline witnessed between July and September this year. Headline inflation should, therefore, bounce back sharply in the near future (see chart above), before stabilising for a few months. Working on the hypothesis that oil prices recover gradually in 2016, headline inflation should then rise again and move above core inflation sometime in H2 2016.