Published: 21st June 2017Download issue:English /FrançaisWe live in a digital world where security threats are proliferating and becoming more sophisticated. The Summer 2017 issue of Pictet Report, examines the nature of these threats and various aspects of online security.On a personal level, people find hackers trying to access their personal information online for criminal purposes. Commercial organisations and public bodies face similar attacks, while terrorists and hostile governments...

Read More »Japan’s tight jobs market may still show up in inflation

Japan presents the paradox of a tight labour market, yet little wage pressure. While there are a number of reasons for this, we still believe wage growth will feed into Japanese inflation figures.The unemployment rate dropped to 2.8% in April 2017, the lowest in more than two decades, with 148 jobs for every 100 job seekers, a level that has not been seen since the early 1970s. What’s puzzling, however, is that the tightness in the labour market appears to have put very little pressure on...

Read More »Swiss National Bank in wait-and-see mode

The SNB is unlikely to pre-empt the European Central Bank in hiking rates. Currency intervention will remain the SNB’s policy tool of choice in the case of renewed strengthening of the Swiss franc.At its June meeting, the Swiss National Bank (SNB) left its accommodative monetary policy unchanged. The interest rate on sight deposits was maintained at a record low of -0.75% and the SNB reiterated its willingness to intervene in the foreign exchange market if needed. Our baseline scenario...

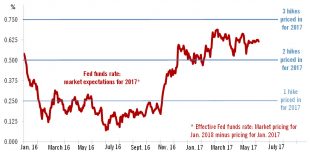

Read More »Fed on the road to normalisation, People’s Bank of China stands pat

The Fed is on track to hike rates once more in 2017, with balance-sheet reduction later this year set to tighten policy further. China’s PBoC is taking a relaxed view of the Fed’s policy changes.As was widely expected, the Federal Reserve decided at latest policy meeting on June 14 to raise the Fed funds rate target range by 25bp to 1.0%-1.25%. The Fed appeared relatively upbeat on the economy, downplayed the recent weakness in inflation numbers and left unchanged its median projections for...

Read More »Monthly Investment Strategy Highlights, June 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationMarkets have continued to rally on strong fundamentals. It has been important to stay invested, and we continue to favour DM equities. However, markets appear unduly complacent, and we have taken advantage of current low volatility to scale back our risk exposure.We reduced our equity overweight in June by selling part of our Global Defensives equities, and also cut most of our US high yield position. We...

Read More »Dealing with complacency

[embedded content] Published: Tuesday June 13 2017Cesar Perez Ruiz, Chief Investment Officer at Pictet Wealth Management, discusses the synchronised global recovery, political and geopolitical risks, and the need to protect portfolios against market complacency.

Read More »Pictet Perspectives – Dealing with complacency

Cesar Perez Ruiz, Chief Investment Officer at Pictet Wealth Management, discusses the synchronised global recovery, political and geopolitical risks, and the need to protect portfolios against market complacency.

Read More »Too much pessimism surrounding the US dollar

Relatively robust growth in the US and an active Fed suggest markets are too bearish on the USD versus the euro, but the greenback’s potential is limited.The euro has significantly appreciated against the US dollar since the start of the year (roughly 7% by 8 June). The single currency has benefited from strong activity in Q1, higher inflation and reduced political uncertainties in the euro area, especially after the French presidential election. Meanwhile, the US dollar has been damped by...

Read More »ECB: first (hawkish) move since 2011

The ECB took its first step towards a very slow normalisation of its monetary stance – a very small one, but symbolically important nonetheless.As we expected, the ECB moved to a more neutral stance today by describing the risks to economic activity as “broadly balanced” and by removing its bias to even “lower” policy rates. The symbolic significance of the move should not be underestimated. It is the first time that the balance of risks to growth has been upgraded since August 2011, just...

Read More »Rise in our growth forecast for the euro area

We are upgrading our GDP growth forecast for the euro area to 1.9% this year, although we expect a modest decline in momentum in the second half.Euro area Q1 GDP growth was today revised up to 0.6% quarter on quarter, from 0.5% in the previous estimate. This revision reflects large adjustments in several countries, and mechanically pushes our annual growth forecasts higher. We now expect euro area real GDP to grow by 1.9% on average this year, after 1.7% in 2016 and 1.9% in 2015. We had...

Read More » Perspectives Pictet

Perspectives Pictet