Relatively robust growth in the US and an active Fed suggest markets are too bearish on the USD versus the euro, but the greenback’s potential is limited.The euro has significantly appreciated against the US dollar since the start of the year (roughly 7% by 8 June). The single currency has benefited from strong activity in Q1, higher inflation and reduced political uncertainties in the euro area, especially after the French presidential election. Meanwhile, the US dollar has been damped by weak activity in Q1, falling inflation and higher political uncertainties in the US.Although the improvements in the euro area point to a more supportive outlook for the single currency in the next 12 months, we expect the euro to decline against the US dollar from current elevated levels of around

Topics:

Luc Luyet considers the following as important: Dollar euro exchange rate, euro currency forecast, Macroview, USD currency forecast, USD/EUR rate

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Relatively robust growth in the US and an active Fed suggest markets are too bearish on the USD versus the euro, but the greenback’s potential is limited.

The euro has significantly appreciated against the US dollar since the start of the year (roughly 7% by 8 June). The single currency has benefited from strong activity in Q1, higher inflation and reduced political uncertainties in the euro area, especially after the French presidential election. Meanwhile, the US dollar has been damped by weak activity in Q1, falling inflation and higher political uncertainties in the US.

Although the improvements in the euro area point to a more supportive outlook for the single currency in the next 12 months, we expect the euro to decline against the US dollar from current elevated levels of around USD1.12 towards USD1.06 per EUR by the end of the year.

Overall, and in contrast with the pessimism surrounding the US dollar, the outlook for growth and monetary policy means that its prospects look relatively bright in the months ahead, in our view. As regards the euro, the muted underlying inflation outlook, the slight slowdown in activity we expect in the second half of the year, and the upsurge in optimism surrounding it (as highlighted by a sharp increase in net EUR non-commercial futures positions) mean the European currency could show some vulnerability in the months ahead.

More precisely, strengthening US activity (we expect 2% GDP growth this year) and ongoing Fed tightening cycle (we expect two more rate hikes this year after that of March) should lead to a rise in US long-term yields to around 2.8-3.0% by the end of 2017, according to our central scenario, hence boosting the attractiveness of the USD because of the real rate differential.

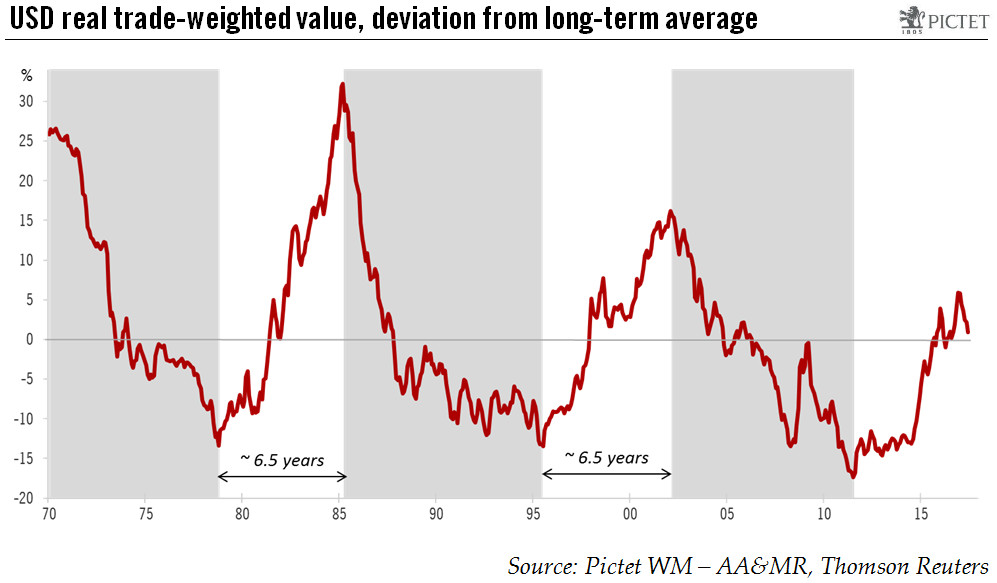

That being said, the possibility of a one-off hike of the deposit rate by the ECB in 2018 (most likely in June) and the reduced probability of a strong boost to the US growth outlook (either through fiscal policies or an innovation-led shock) coupled with an overvalued USD mean downside potential for the EUR/USD rate is limited. Consequently, we expect a move back towards the low end of the USD1.05-1.15 per EUR range it has been in. We have adjusted our end-of-year forecast to USD1.06 per EUR (compared with a previous level of 1.03). We expect this level would mark a low point for 2018.