The SNB is unlikely to pre-empt the European Central Bank in hiking rates. Currency intervention will remain the SNB’s policy tool of choice in the case of renewed strengthening of the Swiss franc.At its June meeting, the Swiss National Bank (SNB) left its accommodative monetary policy unchanged. The interest rate on sight deposits was maintained at a record low of -0.75% and the SNB reiterated its willingness to intervene in the foreign exchange market if needed. Our baseline scenario remains unchanged. We expect the interest on sight deposits at the SNB to stay at its current level of -0.75% throughout 2017.Looking ahead, we continue to believe that the SNB is unlikely to pre-empt the ECB in normalizsng monetary policy, which remains the key variable to watch. Based on our expectations

Topics:

Nadia Gharbi considers the following as important: Macroview, SNB currency intervention, Swiss growth forecast, Swiss monetary policy, Swiss policy normalisation

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The SNB is unlikely to pre-empt the European Central Bank in hiking rates. Currency intervention will remain the SNB’s policy tool of choice in the case of renewed strengthening of the Swiss franc.

At its June meeting, the Swiss National Bank (SNB) left its accommodative monetary policy unchanged. The interest rate on sight deposits was maintained at a record low of -0.75% and the SNB reiterated its willingness to intervene in the foreign exchange market if needed. Our baseline scenario remains unchanged. We expect the interest on sight deposits at the SNB to stay at its current level of -0.75% throughout 2017.

Looking ahead, we continue to believe that the SNB is unlikely to pre-empt the ECB in normalizsng monetary policy, which remains the key variable to watch. Based on our expectations of a gradual ECB exit, including a slow tapering of asset purchases starting in Q1 2018 and a first hike in the ECB’s deposit rate in June 2018, the SNB could indeed deliver a first rate hike around the middle of 2018. Until then, the SNB will likely adopt a wait-and-see approach.

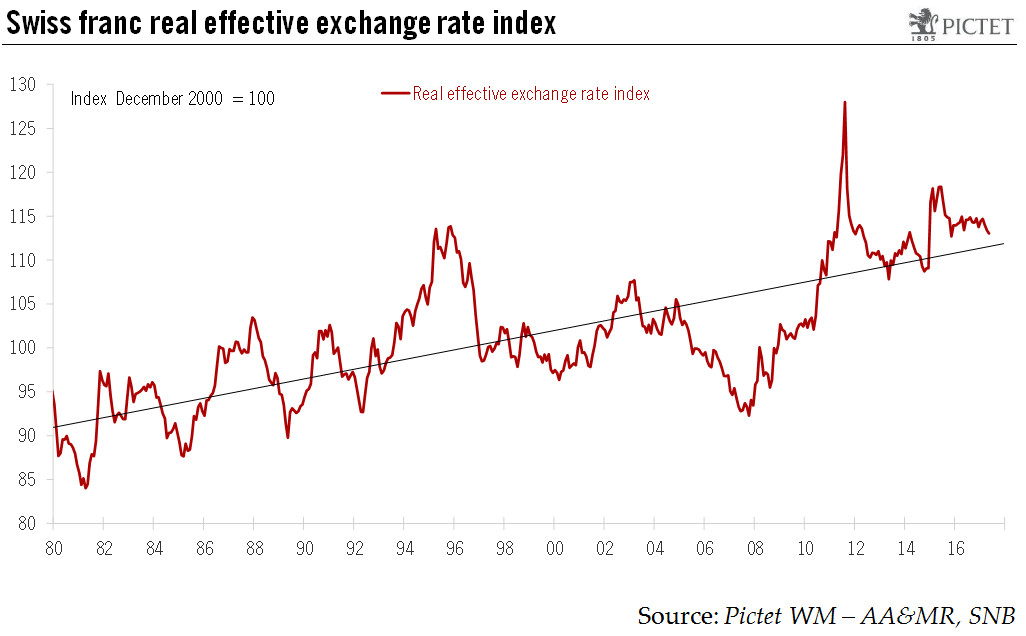

Intervention in the FX markets is likely to remain the SNB’s policy tool of choice to curb any unwarranted appreciation of the Swiss franc. The latest sight deposits data from the SNB (used as a proxy to gauge FX interventions) indicates that FX interventions slowed down considerably after the second round of the French presidential elections in May. But while political developments have eased appreciation pressure on the Swiss franc overall, the currency remains strong and the SNB is likely to remain active in the FX market.

The SNB published an update of its forecasts for inflation and GDP growth. The central bank maintained its forecast for the Swiss economy to grow by roughly 1.5% in 2017 (Pictet PWM’s forecast is for 1.4% GDP growth in 2017). The SNB kept its inflation forecast for 2017 at 0.3%. For 2018, the SNB anticipates inflation of 0.3%, down from its forecast of 0.4% in March (Pictet PWM’s own forecast is for +0.5% headline inflation in 2017, +1.0% in 2018).