Published: Monday July 10 2017Increasing concerns about potential cyber attacks on satellites, energy installations and defence systems call for more creative threat responses, according to an expert in international security at a leading UK think-tank.The enormous growth in the processing power of computers has put great connectivity in the hands of users, but it has also offered great opportunities for cyber criminals to exploit their vulnerabilities. This has raised concerns over the...

Read More »Monthly Investment Strategy Highlights, July 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationAs central bank support starts to be withdrawn, volatility could well rise.We are still slightly long equities, since fundamentals are supportive, but have bought put options on the S&P 500 to guard against downside risks. A rise in volatility will create opportunities for tactical trading and especially hedge funds.CommoditiesOil prices fell again in June, but now appear close to what we assess as the...

Read More »US job market remains strong, but wage growth still disappoints

The latest non-farm payroll report is unlikely to make the Fed deviate from plans for policy normalisation.All in all, today’s employment report was healthy. In the end, job creation was actually quite robust overall in Q2, ‘aggregate weekly payrolls’ rose strongly q-o-q, and if unemployment rebounded a little in June, it was only because of higher participation, not a lack of employment growth. However, once again, wage data brought some disappointment, with average hourly earnings...

Read More »Equity markets set for a pause

[embedded content] Published: Thursday July 06 2017Economic cycles have resynchronised, but this looks to be only a temporary phenomenon. Christophe Donay, Head of Asset Allocation and Macro Research at Pictet Wealth Management, discusses the implications for equity markets.

Read More »Pictet Perspectives – Equity markets set for a pause

Economic cycles have resynchronised, but this looks to be only a temporary phenomenon. Christophe Donay, Head of Asset Allocation and Macro Research at Pictet Wealth Management, discusses the implications for equity markets.

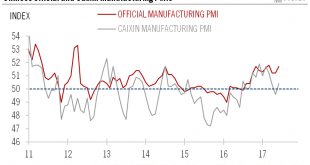

Read More »Upbeat PMIs in China point to solid growth momentum in Q2

June PMI surveys suggest that economic activity moderated only slightly in the last quarter, but we maintain our view the deceleration in Chinese growth will be more notable in the second half.China’s official manufacturing PMI rose to 51.7 in June, the second highest reading in 2017. The Markit manufacturing PMI also rebounded to 50.4 in June after having dropped below the 50 threshold in the previous month. The rise in both indices in June suggests that China’s growth momentum in the...

Read More »Strong earnings growth from an industry which is expanding fast

Published: Monday July 03 2017Stocks in businesses that provide security solutions in a wide variety of market sectors are proving to be an attractive investment theme with growth fuelled by innovation, urbanisation and regulation.When Pictet Asset Management launched the Security Fund ten years ago, the security market was not seen as a strong or growing one. But today the security industry is growing very fast, and expanding to cover many different market sectors.Security permeates our...

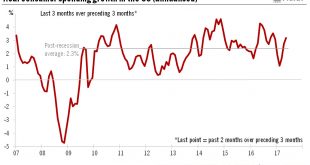

Read More »U.S. consumer spending picks up, but inflation is still soft

Just-released figures lead us to revise our forecasts for US spending and inflation.Real consumer spending increased by just 0.1% month-on-month in May. However, Q1 and April consumption figures were revised higher. The overall result was that between Q1 and April-May, US personal consumption grew by a strong 3.2% annualised. The strong bounce back in consumption growth expected has been confirmed, so that our forecast of 2.7% growth in consumer spending for Q2 overall now looks too low. We...

Read More »Rebound in euro area core inflation

While core inflation was slightly stronger than expected in June, we believe it will rise only slowly for the rest of this year.Euro area ‘flash’ HICP inflation eased to 1.3% y-o-y in June (down from 1.4% in May) while core inflation increased to 1.1% (up from 0.9% in May). Both figures were slightly above consensus expectations, but our overall assessment is unchanged. The bottom line from the June inflation report is that the broad picture remains unchanged – we continue to expect euro...

Read More »怎樣買Bitcoin:四個工具投資比特幣,分析它的前景(國語)

******我要離開了,新頻道請訂閱!****** https://youtube.com/channel/UC666Z4JMa7hrwpINpRKkj6w?sub_confirmation=1 Bitcoin大家都知道很火,因為漲價厲害的升了將近十倍。那麼到底Bitcoin值得投資嗎,它的未來還是一樣向好,能為你賺錢嗎?不過,最重要還是要知道怎樣去投資,坊間雖然很多關於Bitcoin的新聞,卻沒有教大家如何投資,於是我想到拍這影片跟大家分享。如你喜歡今集關於電子貨幣的內容,記得按個Like,也分享出去給朋友,當然也要subscribe我的YouTube Channel!你簡單的一個回應,是我最大的動力 :) ============================= 茶敘32 - 澳門、台灣、馬來西亞、新加坡站 (LIVE): https://www.facebook.com/permalink.php?story_fbid=1719498478066201&id=203349819681082 加拿大、澳洲站 (LIVE):...

Read More » Perspectives Pictet

Perspectives Pictet