Japan presents the paradox of a tight labour market, yet little wage pressure. While there are a number of reasons for this, we still believe wage growth will feed into Japanese inflation figures.The unemployment rate dropped to 2.8% in April 2017, the lowest in more than two decades, with 148 jobs for every 100 job seekers, a level that has not been seen since the early 1970s. What’s puzzling, however, is that the tightness in the labour market appears to have put very little pressure on wage growth.Although the average nominal wage stopped declining in 2013, growth has been very modest since then with little sign that wage growth is accelerating. In April 2017, for example, the average nominal cash earnings of Japanese workers were still growing by just 0.5% year-over-year. If inflation

Topics:

Dong Chen considers the following as important: Japan inflation, Japan wage growth, Japanese growth, Japanese labour market, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Japan presents the paradox of a tight labour market, yet little wage pressure. While there are a number of reasons for this, we still believe wage growth will feed into Japanese inflation figures.

The unemployment rate dropped to 2.8% in April 2017, the lowest in more than two decades, with 148 jobs for every 100 job seekers, a level that has not been seen since the early 1970s. What’s puzzling, however, is that the tightness in the labour market appears to have put very little pressure on wage growth.

Although the average nominal wage stopped declining in 2013, growth has been very modest since then with little sign that wage growth is accelerating. In April 2017, for example, the average nominal cash earnings of Japanese workers were still growing by just 0.5% year-over-year. If inflation is taken into account, real earnings growth was actually zero.

In our view, cyclical factors such as concerns about Japan’s economic outlook and the sustainability of global demand are still preventing Japanese corporations from raising wages significantly. We also believe the apparent paradox of a tight labour market and slow average wage growth is also the result of some structural factors. These include the growth in part-time employment, which now accounts for over 30% of total employment, and the high concentration of new jobs in certain sectors. For example, about one third of jobs created in Japan this year have been in the healthcare sector, where government efforts to contain healthcare costs have prevented wages from rising.

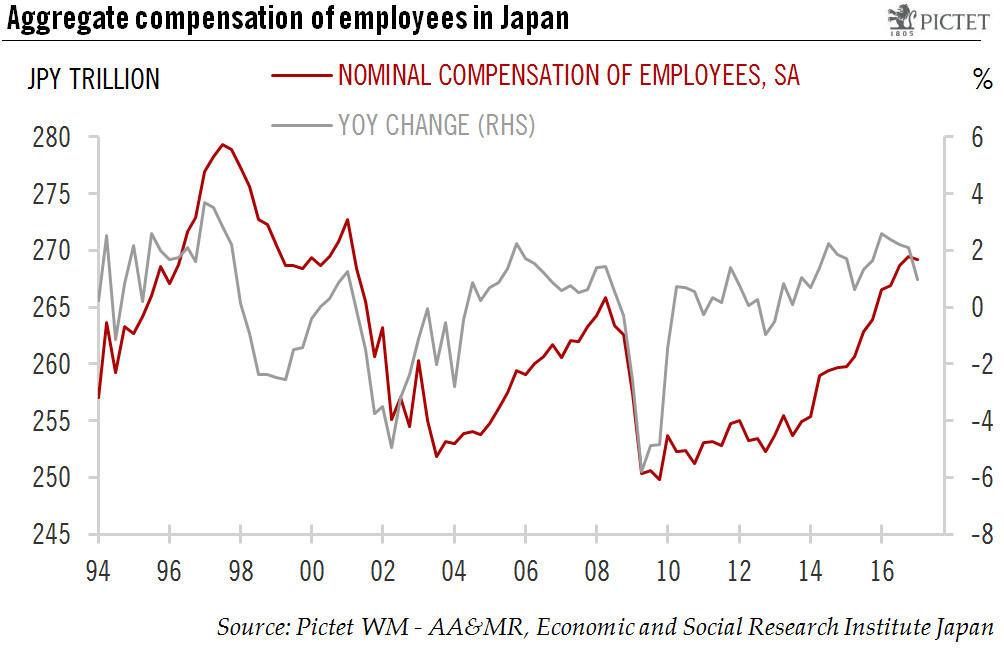

But if we look at aggregate wages instead of average wages, then we form a different picture of the Japanese economy. From 2012 to Q1 2017, the total nominal compensation of employees in Japan cumulatively rose by 5.9%.

In our view, divergence between the two measures of income growth implies that the underlying inflationary pressure from Japan’s tightening labour market might be stronger than the sluggish average wage growth suggests. After all, inflation ultimately is determined by aggregate demand and supply. While many new workers may have starting salaries lower than those of their predecessors, their purchasing power is still higher than when they were outside the workforce. Hence, the growing tightness of the labour market in Japan will likely show up more visibly in inflation figures going forward.