High yield bonds are vulnerable to a rise in spreads from their current low levels. Default levels could also rise for US high yield.US and euro high yield have performed strongly between Donald Trump’s election as US president and the end of June. However, our analysis of fair value suggests there is potential for a widening of spreads and a rise in default rates ahead.Our multi-factor model of high-yield corporate spreads enables us to forecast US and euro high-yield spread levels based on...

Read More »The dollar should rebound in the coming months

The euro rose sharply against the US dollar after a speech by Mario Draghi today. We still expect the US dollar to strengthen in the coming months.The euro appreciated significantly against the US dollar (by as much as 1.4% at one stage) on 27 June, reaching a 10-month high. The main reaon was a speech by ECB President Mario Draghi at the ECB forum on central banking at Sintra. To a lesser extent, the ongoing struggle to find legislative consensus among the US Republican Party, highlighted...

Read More »EA: Bank credit flows rose again in May

Euro area M3 and credit flows for May were pretty strong overall. Our GDP growth forecast remains unchanged for the euro area.Euro area credit flows to non-financial corporations increased again in May, by EUR10 bn in adjusted terms, following a gain of EUR11 bn in April.Broad money growth (M3) rose marginally from 4.9% to 5.0% y-o-y. Bank lending growth to the private sector was broadly unchanged at 2.6% y-o-y, in line with leading indicators.Overall, we are keeping unchanged our GDP growth...

Read More »Chinese infrastructure companies will benefit from sustained high investment

While ambitious initiatives like the One Belt One Road plan will continue to support companies and while valuations appear reasonable, careful stock-picking is required.A high level of investment in infrastructure in China is set to continue into the medium term. Under the latest Five Year Plan (FYP), for 2016-20, the transportation sector is to see CNY15 trillion (USD2.2trn) of capital expenditure, much of which will go into roads and railways. Another major domestic project, the Xiongan...

Read More »The evolving threats from cyber terrorists

Published: Monday June 26 2017Terrorist organisations intent on destroying their enemies are using increasingly sophisticated cyber attacks to damage critical infrastructure and kill large numbers of people, according to a former Israeli security chief.Governments and large organisations trying to protect themselves from large-scale cyber attacks face two primary challenges in the modern era, according to Doron Bergerbest-Eilon, the former Head of the Protection and Security Division of the...

Read More »逼車搶劫遭網友肉搜 搶匪竟在臉書喊冤

南投市最近發生飛車搶劫,婦人被搶匪逼車後,從置物籃搶走包包,損失三千多元,警方調閱監視器追查,當地居民也在網路群組肉搜,找到搶匪臉書,發現搶匪犯案時穿的衣服,跟臉書大頭照一樣,沒想到這名搶匪卻在臉書喊冤,說他被誣賴,真的很倒楣!警方也留言喊話,要他出面說明,他卻嚇的不敢回應,警方下午在台中逮到他,他才坦承他就是搶匪。

Read More »6/24 760-N8計程車 惡意逼車 危險駕駛

760-N8 計程車 危險超車 刷卡後惡意煞車減速 1:00後鏡頭 當下已請警方前往協調 警方請我事後檢舉

Read More »米糕店生意好! 車擋巷口 住戶反映挨揍│中視新聞 20170625

打人糾紛!來看到雲林科大附近,有一間米糕店,因為生意不錯,客人的車子都會停到巷子口,影響附近住戶出入,有住戶去提醒店家,但米糕店老闆卻突然暴衝,先騎車繞了好幾圈,接著拿安全帽衝過來打人,把住戶逼到角落,拳打腳踢, 家屬嚇得趕緊報警。 ⊕熱 門 節 目⊕ 《了解與互信 兩岸一定旺》完整版►http://bit.ly/2nZbisF 從台灣出發,了解世界脈動 從大陸視角,建立兩岸互信 兩岸關係剖析 國際角力探討 請鎖定每週一到週四晚間22點 中視頻道 《放眼天下》深度國際時事評論節目 完整版►http://bit.ly/2mJxczR 郝廣才在中視►http://bit.ly/28MTDMe 改變的起點►http://bit.ly/28SQfO7 60分鐘►http://bit.ly/28O1r34 健康總動員►http://bit.ly/1swAMLT ⊕新 聞 焦 點⊕ 政治最前線►http://bit.ly/2gn6x8f 今日十大發燒新聞► http://bit.ly/1WHwRHn...

Read More »接駁車司機行車糾紛 理論還亮"電擊棒"│中視新聞 20170625

百貨接駁車司機,疑似行車糾紛與人下車理論,遭民眾投訴竟亮"電擊棒"作勢傷人!有民眾在路上,遇到接駁車示意亮燈超車,後來對方竟在等紅燈時,兩度打了倒車燈疑似想逼車,雙方下車理論,接駁車司機疑似還亮出電擊棒作勢攻擊。 ⊕熱 門 節 目⊕ 《了解與互信 兩岸一定旺》完整版►http://bit.ly/2nZbisF 從台灣出發,了解世界脈動 從大陸視角,建立兩岸互信 兩岸關係剖析 國際角力探討 請鎖定每週一到週四晚間22點 中視頻道 《放眼天下》深度國際時事評論節目 完整版►http://bit.ly/2mJxczR 郝廣才在中視►http://bit.ly/28MTDMe 改變的起點►http://bit.ly/28SQfO7 60分鐘►http://bit.ly/28O1r34 健康總動員►http://bit.ly/1swAMLT ⊕新 聞 焦 點⊕ 政治最前線►http://bit.ly/2gn6x8f 今日十大發燒新聞► http://bit.ly/1WHwRHn...

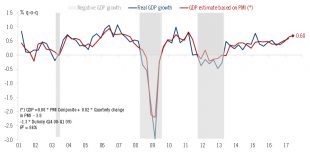

Read More »Euro PMIs show business activity remains solid

Euro area PMI indices showed some signs of moderation in June, but suggest that there is still plenty of growth momentum.PMI indices showed some signs of moderation in June. The composite PMI decreased from 56.8 in May to 55.7 in June, below consensus expectations (56.6).The PMI’s forward-looking components remained pretty strong in June, with some bright spots in new orders and employment.On average, composite PMI in Q2 was the highest in six years and points to GDP growth of 0.68% q-o-q,...

Read More » Perspectives Pictet

Perspectives Pictet