BA course at the University of Bern.

Time: Monday, 10:15–12:00. Location: H4, 106. Uni Bern’s official course page.

This course is aimed at students interested in macro finance who have completed their mandatory training in microeconomics, macroeconomics, and mathematics. Macro finance focuses on the pricing of securities and other assets. Using the Euler equation as a basis, we derive the fundamental pricing relationships. The course then explores a range of applications, including bubbles, government debt, money, the interaction between fiscal and monetary policy, CBDCs, and crypto assets. Grades may be based on class participation, group work and presentations, and/or a written exam.

Articles by Dirk Niepelt

“Fiscal and Monetary Policies,” Bern, Spring 2025

February 12, 2025MA course at the University of Bern.

Lecture: Monday, 12.15 – 14.00, UniS A027.Session: Tuesday, 12.15 – 14.00, UniS A017, on 4 Mar, 18 Mar, 25 Mar, 15 Apr, 29 Apr, 20 May. Some lecture and session dates may be swapped.

Uni Bern’s official course page. Problem sets and solutions can be found here.

The course covers macroeconomic theories of fiscal policy (including tax and debt policy) and the interaction between fiscal and monetary policy. Participants should be familiar with the material covered in the course Macroeconomics II. The course grade reflects the final exam grade. The classes follow selected chapters in the textbook Macroeconomic Analysis (MIT Press, 2019) and build on the material covered in the Macroeconomics II course, which follows the same text.

Main contents:

Does the US Administration Prohibit the Use of Reserves?

February 2, 2025An executive order issued on January 23, 2025, aims at protecting “Americans from the risks of Central Bank Digital Currencies (CBDCs), which threaten the stability of the financial system, individual privacy, and the sovereignty of the United States, including by prohibiting the establishment, issuance, circulation, and use of a CBDC within the jurisdiction of the United States.”

The executive order defines CBDC as “a form of digital money or monetary value, denominated in the national unit of account, that is a direct liability of the central bank.”

As (a reader of) Matt Levine’s newsletter points out, the two statements combined have wide ranging implications. Reserves, which are issued by the Fed and which banks use to pay each other, are a form of digital money; they are

“Pricing Liquidity Support: A PLB for Switzerland” (with Cyril Monnet and Remo Taudien), UniBe DP, 2025

January 28, 2025With Cyril Monnet and Remo Taudien. University of Bern Discussion Paper 25.01, January 2025. PDF.

The proposed revision of the Swiss Banking Act introduces a public liquidity backstop (PLB) for distressed systemically important banks (SIBs), in part to facilitate resolution. We examine the impact of the PLB on fiscal balances, societal welfare, and the incentives of bank shareholders and management. A PLB, like too-big-to-fail (TBTF) status, acts as a subsidy for non-convertible bonds, which can create negative externalities. Corrective measures must be implemented before the PLB is activated to align incentives with societal interests. We conservatively estimate that Swiss SIBs’ TBTF status results in funding cost reductions far greater than the proposed ex-ante compensation,

Read More »“Report by the Parliamentary Investigation Committee on the Conduct of the Authorities in the Context of the Emergency Takeover of Credit Suisse”

December 21, 2024The report (in German). From the press release:

The Parliamentary Investigation Committee (PInC) attributes the Credit Suisse crisis to years of mismanagement at the bank. It is critical of FINMA’s relaxation of capital requirements and regrets the lack of effectiveness of its banking supervision. The PInC also criticises the hesitant development of the TBTF legislation and identifies shortcomings in the flow of information between authorities. It does not find any misconduct on the part of the authorities as a causative factor in the Credit Suisse crisis and acknowledges that the authorities prevented a global financial crisis in March 2023. In its report, however, the PInC calls for specific improvements: a more international approach to TBTF regulations, more effective rules for

“Governments are bigger than ever. They are also more useless”

September 25, 2024Says The Economist. The authors argue that falling state capacity, incompetence, corruption, and transfer/entitlement spending, which crowds out public investment and services, are to blame.

Update: Related, in VoxEU, Martin Larch and Wouter van der Wielen argue that

[g]overnments lamenting a stifling effect of fiscal rules on public investment are often those that have a poor compliance record and, as a result, high debt. They tend to deviate from rules not to increase public investment but to raise other expenditure items.

The New Keynesian Model and Reality

September 11, 2024To analyze the transmission from interest rate policies to output and inflation, many academics and central bank economists use the basic New Keynesian (NK) ‘three-equation model’ and its various extensions. A key factor responsible for the model’s success is the seeming alignment with conventional wisdom—some of the model features can be framed in the language of familiar business cycle narratives, as found in newspapers, central bank communication, or introductory macroeconomics courses. But the resemblance between model and narratives is deceptive and the framing misleading. Practitioners and journalists might think that they base their reasoning on the NK model, but typically that’s not what they do.

So, what does the NK model really say? Few writers have identified the model’s

Urban Roadway in America: Land Value

September 5, 2024In a CEPR discussion paper, Erick Guerra, Gilles Duranton, and Xinyu Ma estimate the cost of land use for roads in the U.S.

Read More »“Macroeconomics II,” Bern, Fall 2024

August 6, 2024MA course at the University of Bern.

Time: Monday 10:15-12:00. Location: A-126 UniS. Uni Bern’s official course page. Course assistant: Stefano Corbellini.

The course introduces Master students to modern macroeconomic theory. Building on the analysis of the consumption-saving tradeoff and on concepts from general equilibrium theory, the course covers workhorse general equilibrium models of modern macroeconomics, including the representative agent framework, the overlapping generations model, and the Lucas tree model.

Lectures follow chapters 1–4 (possibly 5) in this book.

“Makroökonomie I (Macroeconomics I),” Bern, Fall 2024

August 6, 2024BA course at the University of Bern, taught in German.

Time: Monday 14:15-16:00. Location: Audimax. Uni Bern’s official course page. Course assistant: Sally Dubach.

Course description:

Die Vorlesung vermittelt einen ersten Einblick in die moderne Makroökonomie. Sie baut auf der Veranstaltung „Einführung in die Makroökonomie“ des Einführungsstudiums auf und betont sowohl die Mikrofundierung als auch dynamische Aspekte. Das heisst, sie interpretiert makroökonomische Entwicklungen als das Ergebnis zielgerichteten individuellen (mikroökonomischen) Handelns, und sie wird der Tatsache gerecht, dass wirtschaftliche Entscheidungen Erwartungen widerspiegeln und Konsequenzen in der Zukunft haben. Der klassische Modellrahmen, der in der Vorlesung entwickelt wird, bietet die Grundlage für die

“Money and Banking with Reserves and CBDC,” JF, 2024

June 7, 2024Journal of Finance. HTML (local copy).

Abstract:

We analyze the role of retail central bank digital currency (CBDC) and reserves when banks exert deposit market power and liquidity transformation entails externalities. Optimal monetary architecture minimizes the social costs of liquidity provision and optimal monetary policy follows modified Friedman rules. Interest rates on reserves and CBDC should differ. Calibrations robustly suggest that CBDC provides liquidity more efficiently than deposits unless the central bank must refinance banks and this is very costly. Accordingly, the optimal share of CBDC in payments tends to exceed that of deposits.

A Financial System Built on Bail-Outs?

May 15, 2024In a Wall Street Journal opinion piece and an accompanying paper and blog post, John Cochrane and Amit Seru argue that vested interests prevent change towards a simpler, better-working financial system. They describe various “bail-outs” since 2020, in the U.S. financial sector and elsewhere. They point out that in Switzerland, too, the government orchestrated takeover of Credit Suisse by UBS relied on taxpayer support. And they conclude that regulatory measures after the great financial crisis including the implementation of the Dodd-Frank act failed. Instead, Cochrane and Seru favor narrow banking (they prefer to call it “equity-financed banking and narrow deposit-taking”):

Our basic financial regulatory architecture allows a fragile and highly leveraged financial system but counts on

Budgetary Effects of Ageing and Climate Policies in Switzerland

April 29, 2024A report by the Federal Finance Administration anticipates lower net revenues for all levels of government.

… demographic-related expenditure will increase from 17.2% of gross domestic product (GDP) to 19.8% of GDP by 2060. If no reforms are made, public debt would rise from the current 27% to 48% of GDP. The need for reform is particularly pronounced at federal (including social security) and cantonal level. While AHV expenditure in particular poses a challenge for the Confederation, especially after the adoption of the popular initiative for a 13th AHV pension payment, cantonal finances are coming under greater pressure, particularly in terms of healthcare expenditure.

… the path to net zero will primarily place a financial burden on the federal government and the social security

SNB Annual Report

March 20, 2024The SNB has published its annual report. Some highlights from the summary:

Climate risks and adjustments to climate policy can trigger or amplify market fluctuations and influence the attractiveness of investments. From an investment perspective, such risks are essentially no different from other financial risks. The SNB manages the risks to its investments by means of its diversification strategy. …

A prerequisite for illiquid assets to be used as collateral in obtaining liquidity assistance is that a valid and enforceable security interest in favour of the SNB can be established on these assets. Otherwise, should the loan not be repaid, the SNB would be unable to realise the collateral. A decisive factor for the usability of assets is that the banks have made the necessary

Banks and Privacy, U.S. vs Canada

February 3, 2024JP Koning writes:

An interesting side point here is that Canadians don’t forfeit their privacy rights by giving up their personal information to third-parties, like banks. We have a reasonable expectation of privacy with respect to the information we give to our bank, and thus our bank account information is afforded a degree of protection under Section 8 of the Charter.

My American readers may find this latter feature odd, given that U.S. law stipulates the opposite, that Americans have no reasonable expectation of privacy in the information they provide to third parties, including banks, and thus one’s personal bank account information isn’t extended the U.S. Constitution’s search and seizure protections. This is known as the third-party doctrine, and it doesn’t extend north of the

“Topics in Macroeconomics,” Bern, Spring 2024

January 31, 2024BA course at the University of Bern.

Time: Monday, 10:15–12:00. Location: H4, 115. Uni Bern’s official course page.

The course targets students who have completed their mandatory training in microeconomics, macroeconomics and mathematics and who want to make use of macroeconomic theory in order to analyze questions related to asset prices, bubbles, government debt, or the link between fiscal and monetary policy. The grade may depend on participation in class; small group projects; and/or a written exam.

“Fiscal and Monetary Policies,” Bern, Spring 2024

January 31, 2024MA course at the University of Bern.

Lecture: Monday, 12.15 – 14.00, UniS A027.Session: Tuesday, 12.15 – 14.00, UniS A017, on 5 Mar, 19 Mar, 26 Mar, 16 Apr, 30 Apr, 14 May. Some lecture and session dates may be swapped.

Uni Bern’s official course page. Problem sets and solutions can be found here.

The course covers macroeconomic theories of fiscal policy (including tax and debt policy) and the interaction between fiscal and monetary policy. Participants should be familiar with the material covered in the course Macroeconomics II. The course grade reflects the final exam grade. The classes follow selected chapters in the textbook Macroeconomic Analysis (MIT Press, 2019) and build on the material covered in the Macroeconomics II course, which follows the same text.

Main contents:

“Augenwischerei um SNB-Ausschüttungen (Misconceptions about SNB Distributions),” NZZ, 2024

January 27, 2024Neue Zürcher Zeitung, January 25, 2024. PDF. HTML.

Kritik an der Höhe der SNB-Ausschüttungen ist somit nur gerechtfertigt, wenn die Finanzverantwortlichen von Bund und Kantonen die genannten Hebel nicht in Bewegung setzen können. Einer solchen Kritik muss sich die SNB stellen. Sie hat die Kompetenz, ihre Bilanz nach geldpolitischen Erfordernissen zu gestalten, aber eine mechanische Rückstellungspolitik entspricht diesem Erfordernis kaum. Die SNB sollte daher begründen, warum eine stabilitätsorientierte Politik vor dem Hintergrund der geldpolitischen Analyse und plausibler Szenarien die gewählte Bilanzstruktur und Rückstellungspolitik erfordert.

Ebenso wichtig ist ein Perspektivenwechsel in der politischen Diskussion. Mehr Interesse als SNB-Ausschüttungen verdienen das

Bank of England CBDC Academic Advisory Group

January 2, 2024The Bank of England and HM Treasury have formed a CBDC Academic Advisory Group (AAG).

The AAG will bring together a diverse, multi-disciplinary group of experts to encourage academic research, debate and promote discussion on a range of topics, to support the Bank and HM Treasury’s work during the design phase of a digital pound.

Members:

Alexander Edmund Voorhoeve

Professor of Philosophy

London School of Economics

Alistair Milne

Professor of Financial Economics

Loughborough University

Andrew Theo Levin

Professor of Economics

Dartmouth College

Anna Omarini

Tenured Researcher and an Adjunct Professor in Financial Markets and Institutions

Bocconi University

Bill Buchanan

Professor of Computing

Edinburgh Napier University

Burcu Yüksel Ripley

Senior Lecturer of Law

University of Aberdeen

Panel on “Will the digital euro take off?,” CEPR, 2023

December 8, 2023Katrin Assenmacher (ECB), Peter Bofinger (U of Wurzburg), Rod Garratt (UCSB, BIS), Alexandre Stervinou (Banque de France). Chair: Dirk Niepelt. One of the opening events at CEPR’s Paris Symposium 2023.

Organizer: Tessa Ogden, Dirk Niepelt.

Conference on “The Macroeconomic Implications of Central Bank Digital Currencies,” CEPR/ECB, 2023

November 26, 2023Conference jointly organized by CEPR’s RPN FinTech & Digital Currencies and the European Central Bank. Welcome speech by Piero Cippolone, keynote by Fabio Panetta.

Organizers: Toni Ahnert, Katrin Assenmacher, Massimo Ferrari Minesso, Peter Hoffmann, Arnaud Mehl, Dirk Niepelt.

CEPR’s conference website. ECB’s website with videos. Website with pictures.

Panel on the Economics of CBDC, Riksbank, 2023

November 17, 2023Panel at the Bank of Canada/Riksbank Conference on the Economics of CBDC, November 16, 2023. Video.

Fed Governor Christopher Waller, UCSB professor Rod Garratt and myself assess the case for central bank digital currency and stable coins and respond to excellent questions from the audience.

“Das Große Gehege”

November 10, 2023Caspar David Friedrich: Das große Gehege, 1832.Wikipedia.

Read More »“A Macroeconomic Perspective on Retail CBDC and the Digital Euro,” EIZ, 2023

October 25, 2023In Christos V. Gortsos and Rolf Sethe, editors: Central Bank Digital Currencies, EIZ Publishing, ch. 3, Zurich, October 2023. PDF.

Read More »Mapping the History of Palestine and Israel

October 21, 2023The long view:

The current war:

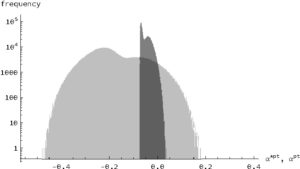

“Retail CBDC and the Social Costs of Liquidity Provision,” VoxEU, 2023

September 27, 2023VoxEU, September 27, 2023. HTML.

From the conclusions:

… it is critical to account for indirect in addition to direct social costs and benefits when ranking monetary architectures.

… the costs and benefits we consider point to an important role of central bank digital currency in an optimal monetary architecture unless pass-through funding is necessary to stabilise capital investment and very costly.

… the interest rate on CBDC should differ from zero and from the rate on reserves.

From the text:

Notes: The dark grey area represents the efficiency advantage of CBDC needed to make it less costly than a two-tier system with optimum reserve holdings. The light grey area displays the same object but based on actual US reserve holdings rather than model-implied optimal ones. These

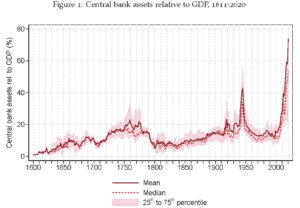

Read More »Central Bank Balance Sheets, LOLR Safety Nets, and Moral Hazard

September 23, 2023Niall Ferguson, Martin Kornejew, Paul Schmelzing and Moritz Schularick in CEPR dp 17858:

From the introduction:

… time and again, central banks deployed their power to create liquidity in a bid to insulate economies from disasters. … first began to be linked to geopolitical tail events during the 17th and 18th centuries – occurring with increasing regularity during wars and revolutions –, … the context of central bank liquidity support gradually but consistently shifted towards financial crises: … central banks’ sensitivity to financial crises has risen sharply over the 20th century and increasingly became a systematic response to financial distress after the Great Depression. …

… central bank liquidity support systematically cushioned economic effects of financial

Read More »On the Credibility of the ‘Credibility Revolution’

September 23, 2023Kevin Lang argues in NBER wp 31666:

When economists analyze a well-conducted RCT or natural experiment and find a statistically significant effect, they conclude the null of no effect is unlikely to be true. But how frequently is this conclusion warranted? The answer depends on the proportion of tested nulls that are true and the power of the tests. I model the distribution of t-statistics in leading economics journals. Using my preferred model, 65% of narrowly rejected null hypotheses and 41% of all rejected null hypotheses with |t|

Conference on “The Future of Payments and Digital Assets,” Bocconi/CEPR, 2023

September 15, 2023Conference jointly organized by Bocconi’s Algorand FinTech Lab and CEPR’s RPN FinTech & Digital Currencies. Keynotes by Hyun Song Shin and Xavier Vives. Organized by Claudio Tebaldi and Dirk Niepelt.

CEPR’s conference website with program. Bocconi’s website with videos and more.

“Macroeconomics II,” Bern, Fall 2023

September 11, 2023MA course at the University of Bern.

Time: Monday 10:15-12:00. Location: A-126 UniS. Uni Bern’s official course page. Course assistant: Stefano Corbellini.

The course introduces Master students to modern macroeconomic theory. Building on the analysis of the consumption-saving tradeoff and on concepts from general equilibrium theory, the course covers workhorse general equilibrium models of modern macroeconomics, including the representative agent framework, the overlapping generations model, and the Lucas tree model.

Lectures follow chapters 1–4 (possibly 5) in this book.