Niall Ferguson, Martin Kornejew, Paul Schmelzing and Moritz Schularick in CEPR dp 17858: From the introduction: … time and again, central banks deployed their power to create liquidity in a bid to insulate economies from disasters. … first began to be linked to geopolitical tail events during the 17th and 18th centuries – occurring with increasing regularity during wars and revolutions –, … the context of central bank liquidity support gradually but consistently shifted towards financial crises: … central banks’ sensitivity to financial crises has risen sharply over the 20th century and increasingly became a systematic response to financial distress after the Great Depression. … … central bank liquidity support systematically cushioned economic effects of financial

Topics:

Dirk Niepelt considers the following as important: Bank, Banking crisis, Central Bank, Lender of last resort, Liquidity insurance, Liquidity support, Moral Hazard, Notes, risk-taking

This could be interesting, too:

Dirk Niepelt writes Does the US Administration Prohibit the Use of Reserves?

Dirk Niepelt writes “Pricing Liquidity Support: A PLB for Switzerland” (with Cyril Monnet and Remo Taudien), UniBe DP, 2025

Dirk Niepelt writes “Report by the Parliamentary Investigation Committee on the Conduct of the Authorities in the Context of the Emergency Takeover of Credit Suisse”

Dirk Niepelt writes “Governments are bigger than ever. They are also more useless”

Niall Ferguson, Martin Kornejew, Paul Schmelzing and Moritz Schularick in CEPR dp 17858:

From the introduction:

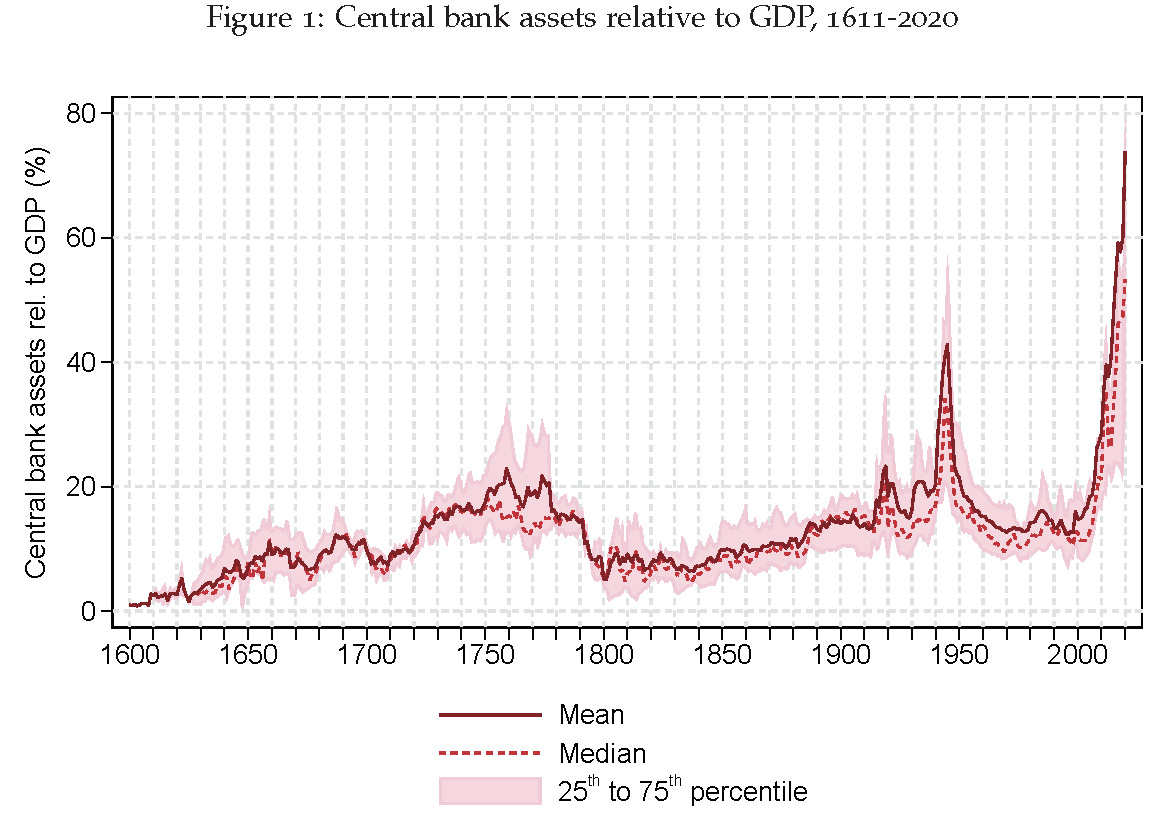

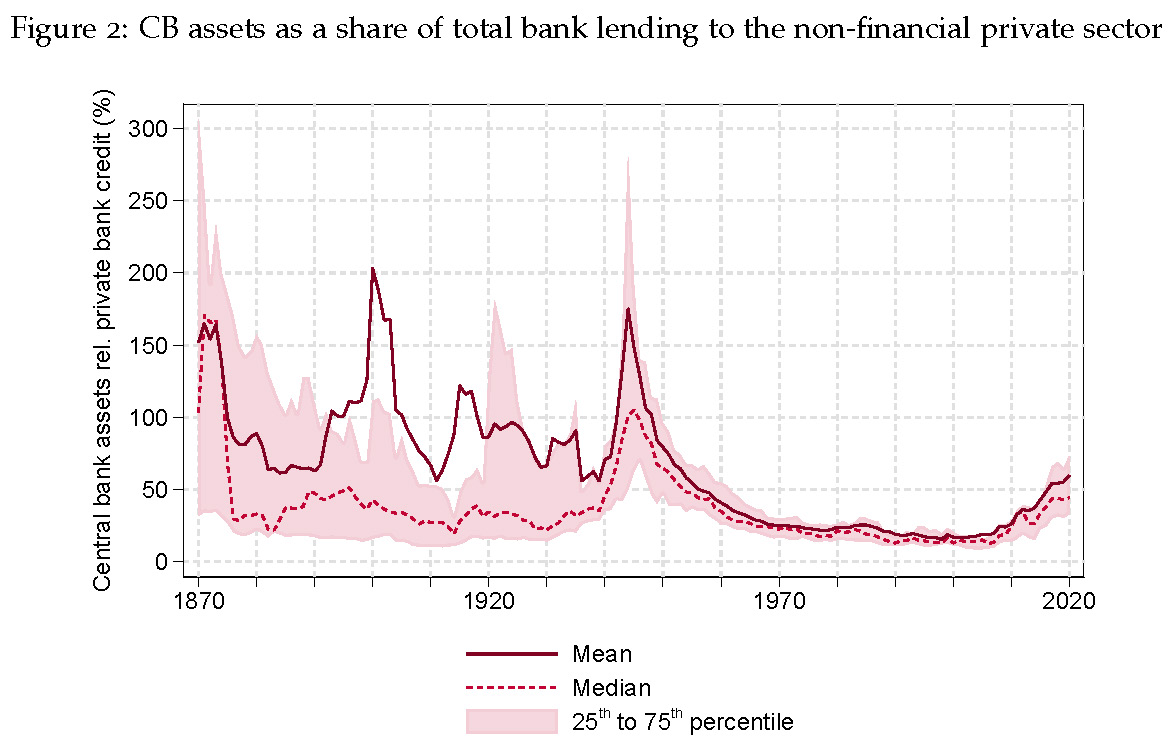

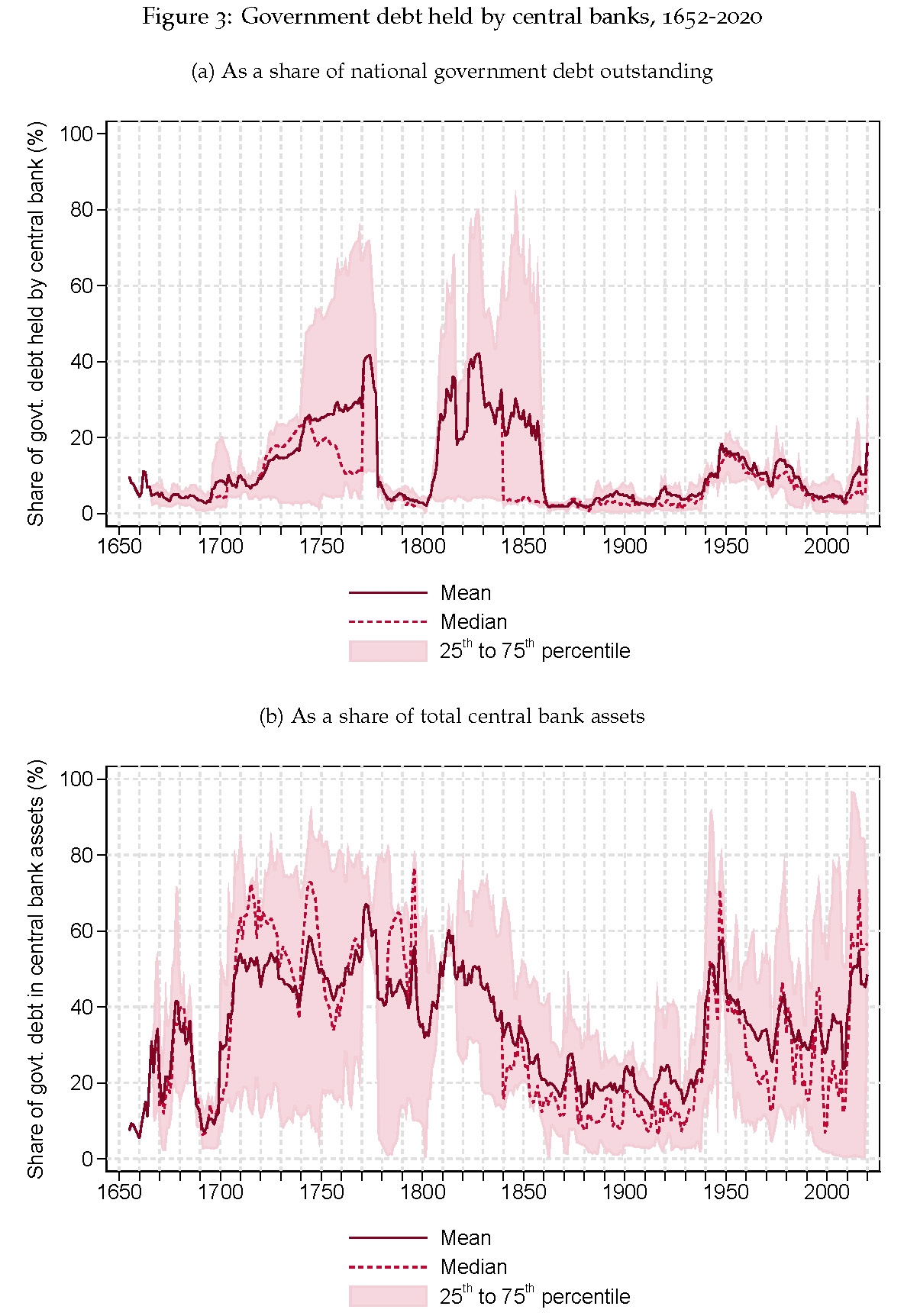

… time and again, central banks deployed their power to create liquidity in a bid to insulate economies from disasters. … first began to be linked to geopolitical tail events during the 17th and 18th centuries – occurring with increasing regularity during wars and revolutions –, … the context of central bank liquidity support gradually but consistently shifted towards financial crises: … central banks’ sensitivity to financial crises has risen sharply over the 20th century and increasingly became a systematic response to financial distress after the Great Depression. …

… central bank liquidity support systematically cushioned economic effects of financial crises throughout modern history of advanced economies. …

Historically, central bank liquidity support in crises is associated with a rising probability of future episodes of excessive risk-taking by financial intermediaries that end in another financial crisis. If central banks refrained from using their balance sheet to support markets in the last crisis, episodes of renewed excessive risk taking are much rarer.