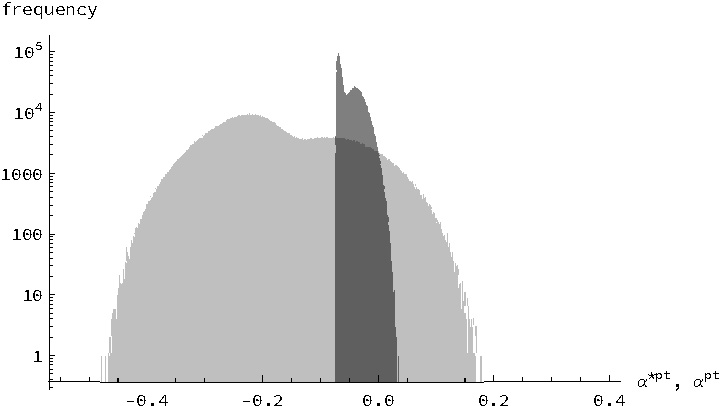

VoxEU, September 27, 2023. HTML. From the conclusions: … it is critical to account for indirect in addition to direct social costs and benefits when ranking monetary architectures. … the costs and benefits we consider point to an important role of central bank digital currency in an optimal monetary architecture unless pass-through funding is necessary to stabilise capital investment and very costly. … the interest rate on CBDC should differ from zero and from the rate on reserves. From the text: Notes: The dark grey area represents the efficiency advantage of CBDC needed to make it less costly than a two-tier system with optimum reserve holdings. The light grey area displays the same object but based on actual US reserve holdings rather than model-implied optimal ones. These

Topics:

Dirk Niepelt considers the following as important: Bank regulation, Central bank digital currency, Central bank loan, Contributions, Distortion, Liquidity, Pass-through funding, Payment, Payment operations, too big to fail

This could be interesting, too:

Dirk Niepelt writes Does the US Administration Prohibit the Use of Reserves?

Dirk Niepelt writes “Pricing Liquidity Support: A PLB for Switzerland” (with Cyril Monnet and Remo Taudien), UniBe DP, 2025

Dirk Niepelt writes “Report by the Parliamentary Investigation Committee on the Conduct of the Authorities in the Context of the Emergency Takeover of Credit Suisse”

Dirk Niepelt writes The New Keynesian Model and Reality

VoxEU, September 27, 2023. HTML.

From the conclusions:

… it is critical to account for indirect in addition to direct social costs and benefits when ranking monetary architectures.

… the costs and benefits we consider point to an important role of central bank digital currency in an optimal monetary architecture unless pass-through funding is necessary to stabilise capital investment and very costly.

… the interest rate on CBDC should differ from zero and from the rate on reserves.

From the text:

Notes: The dark grey area represents the efficiency advantage of CBDC needed to make it less costly than a two-tier system with optimum reserve holdings. The light grey area displays the same object but based on actual US reserve holdings rather than model-implied optimal ones. These distributions allow for pass-through costs and tax distortions, quantified by assuming taxing households causes deadweight burdens of 25% per tax dollar. The distributions are based on two million realisations.