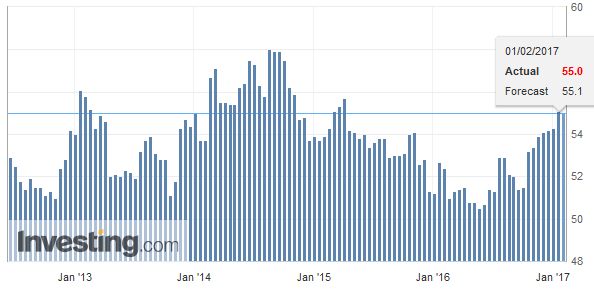

Swiss Franc Switzerland SVME Purchasing Managers Index (PMI), January 2017(see more posts on Switzerland SVME PMI, ) Source: Investing.com - Click to enlarge GBP / CHF The pound still remains on the back foot against the Swiss Franc with rates for GBP CHF sitting just below 1.25 for this pair. The pound is struggling to gain momentum against all of the major currencies as Brexit is just around the corner. The March deadline by which Theresa May has promised to invoke Article 50 and proceed with leaving the European Union is very much upon us and considerable volatility for sterling exchange rates is to be expected. A debate is taking place in parliament this week which will end in a vote to round up the required support from MP’s to deliver on Brexit and respect the referendum vote last June. There are a huge number of Scottish Nationalist Party (SNP) MP’s who are defying the will of the United Kingdom electorate by dissenting which could ultimately end up in a delay for Brexit. Nothing is certain in politics so expect further volatility for GBP CHF. Tomorrow sees the Bank of England interest rate decision where it is expected that there will be no change.

Topics:

Marc Chandler considers the following as important: China Manufacturing PMI, China Non-Manufacturing PMI, EUR, Eurozone Manufacturing PMI, Featured, France Manufacturing PMI, FX Daily, FX Trends, GBP, Germany Manufacturing PMI, Italy Manufacturing PMI, JPY, MXN, newsletter, Spain Manufacturing PMI, Switzerland SVME PMI, U.K. Manufacturing PMI, U.S. ADP Nonfarm Employment Change, U.S. Crude Oil Inventories, U.S. ISM Manufacturing Employment, U.S. ISM Manufacturing PMI, U.S. Manufacturing PMI, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

Swiss Franc |

Switzerland SVME Purchasing Managers Index (PMI), January 2017(see more posts on Switzerland SVME PMI, ) Source: Investing.com - Click to enlarge |

GBP / CHFThe pound still remains on the back foot against the Swiss Franc with rates for GBP CHF sitting just below 1.25 for this pair. The pound is struggling to gain momentum against all of the major currencies as Brexit is just around the corner. The March deadline by which Theresa May has promised to invoke Article 50 and proceed with leaving the European Union is very much upon us and considerable volatility for sterling exchange rates is to be expected. A debate is taking place in parliament this week which will end in a vote to round up the required support from MP’s to deliver on Brexit and respect the referendum vote last June. There are a huge number of Scottish Nationalist Party (SNP) MP’s who are defying the will of the United Kingdom electorate by dissenting which could ultimately end up in a delay for Brexit. Nothing is certain in politics so expect further volatility for GBP CHF. Tomorrow sees the Bank of England interest rate decision where it is expected that there will be no change. The Quarterly inflation report is also released and will be discussed at length by the Bank of England as inflation has once again become extremely topical of late. Any pickup in inflation in the coming months could add pressure on the Bank of England to take action although with Brexit around the corner this is unlikely to surface anytime soon even it went very high. Mark Carney will be speaking after the announcement and is likely to give new direction for the pound especially if there is mention to Brexit and the EU. |

GBP/CHF - British Pound Swiss Franc, February 01(see more posts on GBP/CHF, ) Source: Investing.com - Click to enlarge |

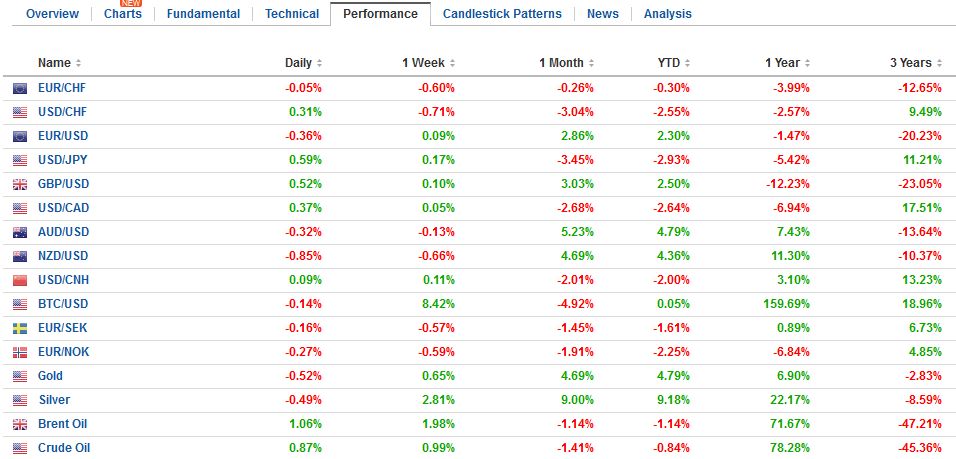

FX Rates(commentary will be sporadic for the next couple of weeks during a European business trip) The US dollar is consolidating yesterday’s losses that were spurred speculation that the US was abandoning the more than 20-year old strong dollar policy. The meaning of that policy was clear to global investors even if it was often parodied. It was first articulated in the aftermath of a series of attempts by Republicans and Democrats to use the dollar as a cudgel to beat concessions out of its trading partners, and especially Germany and Japan. When Rubin become Treasury Secretary in 1995, he distanced himself and the Clinton Administration from such attempts. No longer would the US use the dollar in such a way. And with a limited number of exceptions, this has remained the case. |

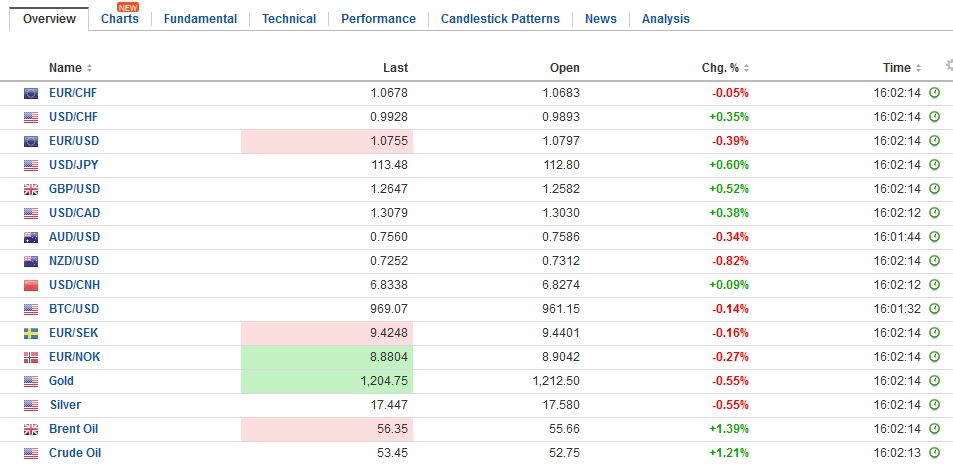

FX Daily Rates, February 01 |

| The euro frayed the 100-day moving average and approached the 50% retracement of its losses since the US election. The $1.0820 may be another inflection point. A move above there could spur another round of short-covering that lifts the single currency into the $1.0875-$1.0935 area. On the other hand, a break below $1.0740 could neutralize the technical tone.

The dollar broke out of the JPY112.60-JPY115.60 range during the North American session but closed in it. The JPY112.00 area that held yesterday is the 38.2% retracement objective of the dollar’s gains since the election. The greenback has recovered to almost JPY113.65 today. Initial resistance is seen near JPY114.00. Sterling is the strongest major currency against the dollar today, gaining about 0.3%, a little above $1.26. It bottomed yesterday near $1.24. Last week’s high was near $1.2675. The market expected a more upbeat though neutral BOE tomorrow. The intraday technicals warn that a move much beyond last week’s high may be difficult if such an advance materializes, there is scope for as much as another cent. |

FX Performance, , February 01 |

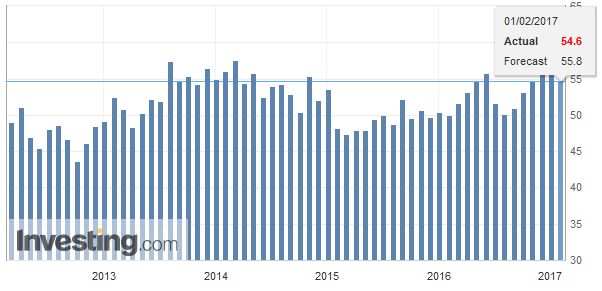

ChinaEarlier today, China, EMU, and the UK reported January PMI figures. China’s official manufacturing PMI slipped to 51.3 from 51.4 in December. Some expected a larger pullback. |

China Manufacturing Purchasing Managers Index (PMI), January 2017(see more posts on China Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

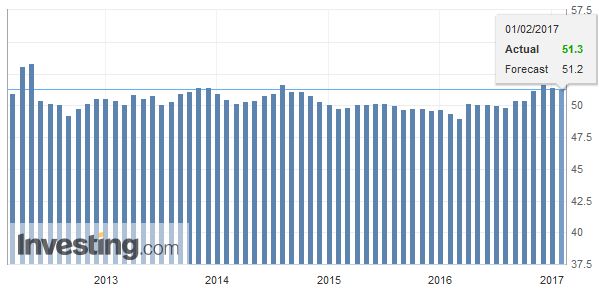

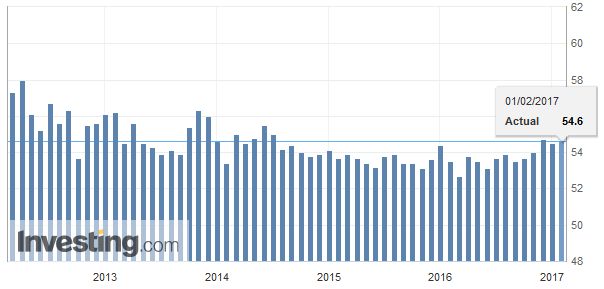

| The non-manufacturing PMI edged higher to 54.6 from 54.5. |

China Non-Manufacturing Purchasing Managers Index (PMI), January 2017(see more posts on China Non-Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

United StatesThe US has a full calendar today that could encourage investors to focus again on the underlying economy rather than political rhetoric. The US reports the January manufacturing ISM and auto sales, but the main features are the ADP jobs estimate and the FOMC meeting. |

U.S. ISM Manufacturing Purchasing Managers Index (PMI), January 2017(see more posts on U.S. ISM Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

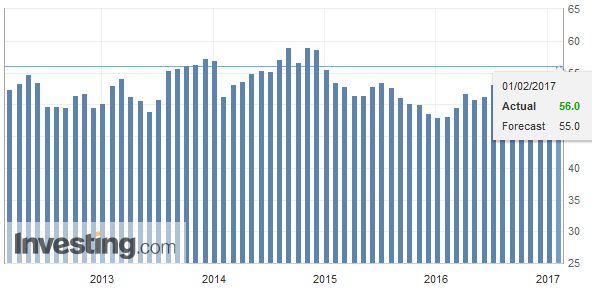

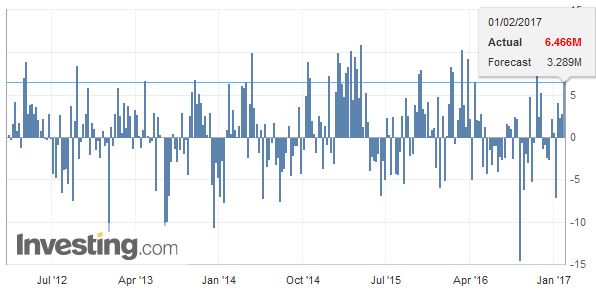

| While there is not always a good fit month-to-month between the ADP and the non-farm payrolls, the general trend tracks fairly well, which is no coincidence. It is designed to do so and is adjusted periodically to ensure it. |

U.S. ADP Nonfarm Employment Change, January 2017(see more posts on U.S. ADP Nonfarm Employment Change, ) Source: Investing.com - Click to enlarge |

| The Bloomberg median is for a 168k increase in private sector employment after 153k in December. The news wire survey found a median expectation for a 179k increase in private sector employment in December after 144k increase in December. |

U.S. ISM Manufacturing Employment, January 2017(see more posts on U.S. ISM Manufacturing Employment, ) Source: Investing.com - Click to enlarge |

| The PMI is expected to be solid, while auto sales are expected to slow sequentially but remain at historically high levels. |

U.S. Manufacturing Purchasing Managers Index (PMI), January 2017 Source: Investing.com - Click to enlarge |

|

The new US Administration is unconventional, to say the least. Many investors recognize the conflicting impulses. On one hand, the domestic agenda of tax cuts, deregulation, and infrastructure investment is seen as dollar positive. On the other hand, the desire to unwind the direct investment strategy and the international supply chains in favor of the more traditional export orientation is seen as negative for the currency, as befits mercantilism.

|

U.S. Crude Oil Inventories, January 2017(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

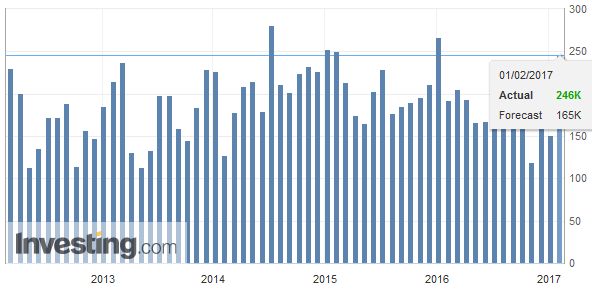

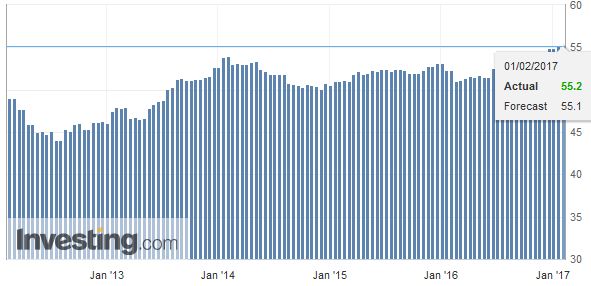

EurozoneThe eurozone manufacturing PMI increased to 55.2 from 55.1 of the flash estimate and 54.9 in December. In Q4 it averaged 54.0. The 2016 average was 52.5 compared with 52.2 in 2015. |

Eurozone Manufacturing Purchasing Managers Index (PMI), January 2017(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

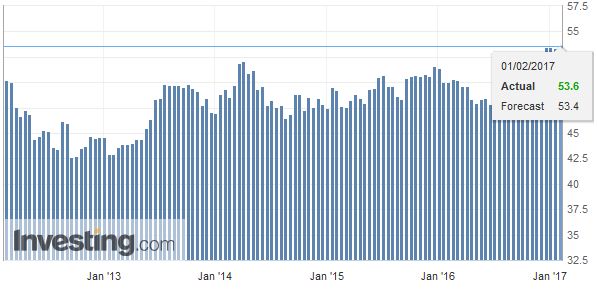

| The improvement is due to France and Spain. France’s PMI ticked up to 53.6 from 53.4 in the flash. |

France Manufacturing Purchasing Managers Index (PMI), January 2017(see more posts on France Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

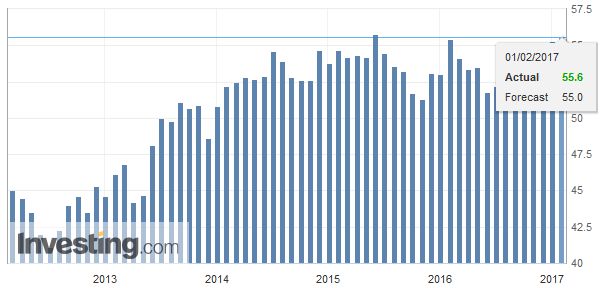

| Spain’s came in at 55.6, up from 55.3. Many expected it to slip to 55.0. |

Spain Manufacturing Purchasing Managers Index (PMI), January 2017(see more posts on Spain Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

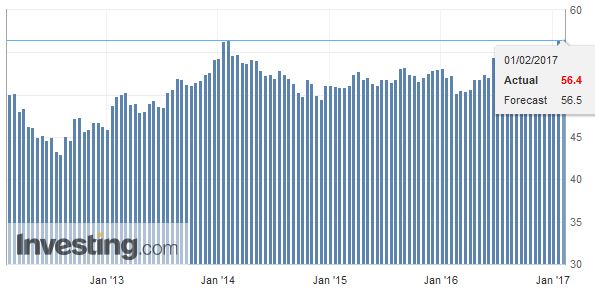

| Germany’s 56.5 flashes were trimmed to 56.4. It was 55.6 in December. |

Germany Manufacturing Purchasing Managers Index (PMI), January 2017(see more posts on Germany Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

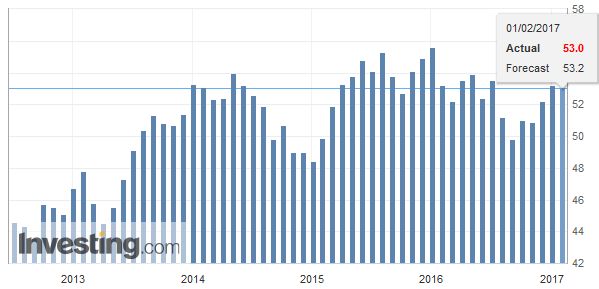

| Italy was an outright disappointment. Its manufacturing PMI slipped to 53.0 from 53.2. It had been expected to firm. |

Italy Manufacturing Purchasing Managers Index (PMI), January 2017(see more posts on Italy Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

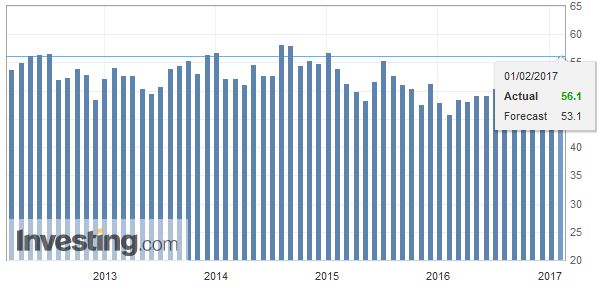

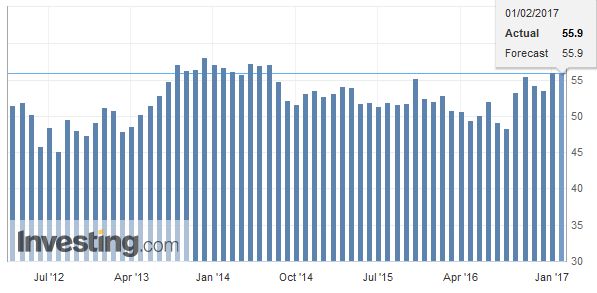

| The UK’s manufacturing PMI eased to 55.9 from 56.1, as expected. |

U.K. Manufacturing Purchasing Managers Index (PMI), January 2017(see more posts on U.K. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

At the same time, rhetoric may have a short half-life if it becomes routine and not backed by near-term policy. The Mexican peso may be a good example. The Trump Administration’s thrust weakened the peso dramatically, and yet over the past two weeks, a period which included a spat over “the wall” that led to the canceling of a meeting between the two Presidents, the peso has been the strongest currency in the world.

With German officials opposed to the ECB’s unorthodox monetary policy, and even now pressing it to reconsider, the Trump Administration will find it difficult to convincingly attribute the depreciation of the euro over the last couple of years to Berlin and Frankfurt. Ultimately, the German steel has been mixed with softer alloys in making the euro. Although Germany could not hold a referendum on EMU, it seems clear that most Germans wanted to keep the Deutsche mark. It was sacrificed as a condition for the unification of Germany. The US has long encouraged a strong, integrated Europe.

The FOMC statement is unlikely to contain any surprises. Its economic assessment may be adjusted slightly to reflect the recent data. Market-based measures of inflation expectations, such as the breakevens, have moved higher, but remain modest (~2% for the five and 10-year breakevens). The economy is proceeding as officials expected. Specifics about fiscal policy are still not known, but this is unlikely to be featured in the FOMC statement. At the same time, the statement will offer no clues into the next meeting in the middle of March, which coincides with around when the debt ceiling is expected to be reached.

Global equities have stabilized. After US markets closed lower, Apple’s better than expected results seemed to lend support in Asia where the MSCI Asia Pacific Index recovered from early weakness to eke out a little more than a 0.1% gain, the fifth advance in the past six sessions. European equities are also recovering from yesterday’s slide. The Dow Jones Stoxx 600 is up nearly 1% and may snap a three-day slide. Industrials, materials and health care are leading the market higher today. Benchmark 10-year yields are higher across the board, and the widening of European spreads against Germany continues, and it is not just the periphery. The French premium continues to trend higher, and even Austria and the Dutch are not immune.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,China Manufacturing PMI,China Non-Manufacturing PMI,Eurozone Manufacturing PMI,Featured,France Manufacturing PMI,FX Daily,Germany Manufacturing PMI,Italy Manufacturing PMI,MXN,newsletter,Spain Manufacturing PMI,Switzerland SVME PMI,U.K. Manufacturing PMI,U.S. ADP Nonfarm Employment Change,U.S. Crude Oil Inventories,U.S. ISM Manufacturing Employment,U.S. ISM Manufacturing PMI,U.S. Manufacturing PMI