Someone once said that the stock market is always climbing a wall of worry. Maybe that had been true in some long-ago day, but whether or not it might nowadays is beside the point. The nugget of truth which makes the prosaism memorable is the wall rather than the climber. There’s always something going on somewhere to get worked up over. And it matters to far more than financial actors, the entire global economy must surmount what can seem like an unending series of...

Read More »There Have Actually Been Some Jobs Saved, Only In Place of Recovery

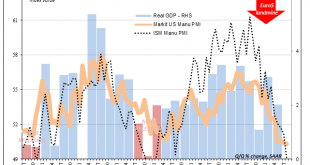

The ISM reported a small decline in its manufacturing PMI today. The index had moved up to 59.3 for the month of October 2020 in what had been its highest since September 2018. For November, the setback was nearly two points, bringing the headline down to an estimate of 57.5. At that level, it really wasn’t any different from where it had been at its multi-year high the month before. Neither are indicative of any sort of “V” shaped recovery, or any shaped recovery....

Read More »FX Daily, June 3: Dollar is Sold and ROW is bought

Swiss Franc The Euro has risen by 0.42% to 1.0791 EUR/CHF and USD/CHF, June 3(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Two recent trends continue. Equities are moving higher, and the dollar remains heavy. Equity markets in the Asia Pacific region rose at least one percent, and South Korea, Singapore, and Malaysia rallied 2-3%. Europe’s Dow Jones Stoxx 600 is up more than 1% for the third consecutive...

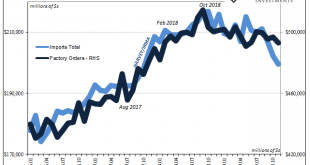

Read More »More Trends That Ended 2019 The Wrong Way

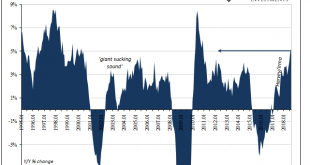

Auto sales in 2019 ended on a skid. Still, the year as a whole wasn’t nearly as bad as many had feared. Last year got off on the wrong foot in the aftermath of 2018’s landmine, with auto sales like consumer spending down pretty sharply to begin it. Spending did rebound in mid-year if only somewhat, enough, though, to add a little more to the worst-is-behind-us narrative which finished off 2019. That’s the version that is being described, Jay Powell’s underlying...

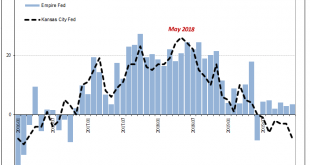

Read More »Manufacturing Clears Up Bond Yields

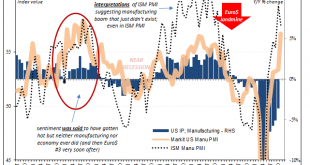

Yesterday, IHS Markit reported that the manufacturing turnaround its data has been suggesting stalled. After its flash manufacturing PMI had fallen below 50 several times during last summer (only to be revised to slightly above 50 every time the complete survey results were tabulated), beginning in September 2019 the index staged a rebound jumping first to 51.1 in that month. Subsequent months of data had continued the trend. By November, the PMI registered 52.6...

Read More »United States: The ISM Conundrum

Bond yields have tumbled this morning, bringing the 10-year US Treasury rate within sight of its record low level. The catalyst appears to have been the ISM’s Manufacturing PMI. Falling below 50, this widely followed economic indicator continues its rapid unwinding. Back in November 2018, at just about 59 the overall index had still been close to its multi-decade high. Over the next nine months through the latest update for August 2019, it has shed almost 10 points....

Read More »FX Daily, September 03: Pound Punished in High Drama

Swiss Franc The Euro has fallen by 0.29% to 1.0831 EUR/CHF and USD/CHF, September 03(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A showdown between UK Prime Minister Johnson and Parliament over Brexit pushed sterling below $1.20. The euro is extended its losses after finishing last week below $1.10. Growth concerns are seeing equities retreat. Japanese and Chinese shares managed to eke out gains, but...

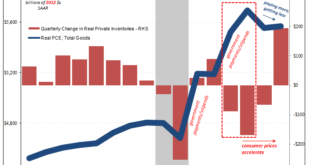

Read More »US Industrial Downturn: What If Oil and Inventory Join It?

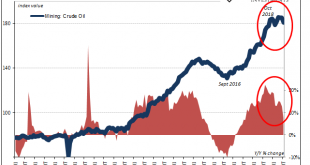

Revised estimates from the Federal Reserve are beginning to suggest another area for concern in the US economy. There hadn’t really been all that much supply side capex activity taking place to begin with. Despite the idea of an economic boom in 2017, businesses across the whole economy just hadn’t been building like there was one nor in anticipation of one. The only place where there was a truly robust trend was the oil patch. Since the last crash a few years ago,...

Read More »Just The One More Boom Month For IP

The calendar last month hadn’t yet run out on US Industrial Production as it had for US Retail Sales. The hurricane interruption of 2017 for industry unlike consumer spending extended into last September. Therefore, the base comparison for 2018 is against that artificial low. As such, US IP rose by 5.1% year-over-year last month. That’s the largest gain since 2010. While that may be, over the last five months American...

Read More »FX Daily, April 02: Monday Blues

Swiss Franc The Euro has fallen by 0.03% to 1.1746 CHF. EUR/CHF and USD/CHF, April 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar drifted a little lower in Asia to start the week while equities had a slightly heavier bias. The MSCI Asia Pacific Index slipped 0.1%. European bourses are mostly closed for the extended Easter holiday, while the S&P is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org