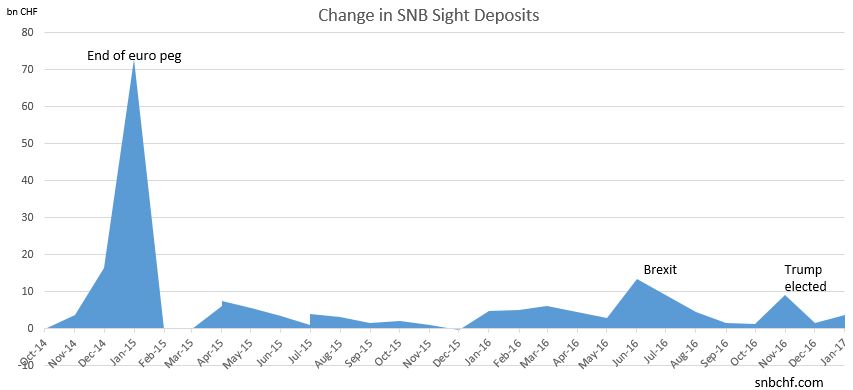

Headlines Week January 30, 2017 Recently inflation rose more quickly in the euro zone, but this was mostly caused by a temporary oil price effect. Therefore the ECB might be dovish for a longer period than the SNB. Consumer price inflation will decide who is more dovish. Ultimately inflation will depend on the two key parameters wages and rents. Rents will rise first in Switzerland, while the Euro zone has downwards pressures in the Southern countries. Wage pressures are weak in both. Wages are increasing more strongly only in Germany and Eastern European countries. FX week ending Jan 30 With the strong Swiss trade balance, the SNB let the euro fall to the lower area of the “in-official EUR/CHF minimum band” at 1.0680 Euro/Swiss Franc FX Cross Rate, January 30(see more posts on EUR/CHF, ) Source: markets.ft.com - Click to enlarge SNB sight deposits An increase in SNB sight deposits means that the central bank has intervened. This week’s data: The SNB intervenes for 0.5 bn. CHF. Change in SNB Sight Deposits January 2017(see more posts on sight deposits, ) Source: SNB - Click to enlarge Speculative Positions Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.

Topics:

George Dorgan considers the following as important: currency reserves. intervention, Featured, minimum reserves, monetary data, negative interest, newsletter, Reserves, sight deposits, SNB

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

Headlines Week January 30, 2017

Recently inflation rose more quickly in the euro zone, but this was mostly caused by a temporary oil price effect. Therefore the ECB might be dovish for a longer period than the SNB. Consumer price inflation will decide who is more dovish. Ultimately inflation will depend on the two key parameters wages and rents. Rents will rise first in Switzerland, while the Euro zone has downwards pressures in the Southern countries. Wage pressures are weak in both. Wages are increasing more strongly only in Germany and Eastern European countries. FX week ending Jan 30 With the strong Swiss trade balance, the SNB let the euro fall to the lower area of the “in-official EUR/CHF minimum band” at 1.0680 |

Euro/Swiss Franc FX Cross Rate, January 30(see more posts on EUR/CHF, ) Source: markets.ft.com - Click to enlarge |

SNB sight depositsAn increase in SNB sight deposits means that the central bank has intervened. This week’s data: The SNB intervenes for 0.5 bn. CHF. |

Change in SNB Sight Deposits January 2017(see more posts on sight deposits, ) Source: SNB - Click to enlarge |

Speculative PositionsSpeculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts.The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The reverse carry trade in form of the Long CHF started and lasted - without some interruptions - until the peg introduction in September 2011. In mid 2011, the long CHF trade became a proper carry trade - and not a reverse carry trade anymore - because investors thought that the SNB would hike rates earlier than the Fed. This week’s data: Speculators are net short CHF with 13.6K contracts against USD. This is nearly unchanged. |

Speculative Positions

source Oanda |

| Date of data (+ link to source) | avg. EUR/CHF during period | avg. EUR/USD during period | Events | Net Speculative CFTC Position CHF against USD | Delta sight deposits if >0 then SNB intervention | Total Sight Deposits | Sight Deposits @SNB from Swiss banks | “Other Sight Deposits” @SNB (other than Swiss banks) |

|---|---|---|---|---|---|---|---|---|

| 27 January | 1.0718 | 1.0725 | US Q4 GDP only +1.9% | -13644X125K | +0.5 bn. per week |

532.8 bn.

|

466.7 bn.

|

66.1 bn.

|

| 20 January | 1.0726 | 1.0663 | USD correction continues. | -13683X125K | +0.9 bn. per week | 532.3 bn. | 464.3 bn. | 68.0 bn. |

| 13 January | 1.0733 | 1.0593 | Fed meeting, USD correcting | -14246X125K | +1.7 bn. per week |

531.4 bn.

|

464.2 bn.

|

67.2 bn.

|

| 06 January | 1.0708 | 1.0499 | Good U.S. jobs report. | -13439X125K | +0.7 bn. per week |

529.7 bn.

|

467.6 bn.

|

62.1 bn.

|

| 30 December | 1.0728 | 1.0467 | -10091X125K | +0.7 bn. per week |

529.0 bn.

|

466.3 bn.

|

62.7 bn.

|

|

| 23 December | 1.0704 | 1.0421 | Again interventions at 1.07. | +7110X125K | +0.5 bn. per week |

528.3 bn.

|

463.6 bn.

|

64.7 bn. |

| 16 December | 1.0747 | 1.0533 | Slight SNB interventions at the line of defense of 1.07 EUR/CHF. | -25288X125K | +0.6 bn. per week | 527.9 bn. | 457.3 bn. | 70.6 bn. |

| 09 December | 1.0807 | 1.0683 | ECB continues QE for longer. | -25397X125K | -0.2 bn. per week | 527.3 bn. | 454.8 bn. | 72.5 bn. |

| 02 December | 1.0775 | 1.0638 | -24334X125K | -0.1 bn. per week |

527.5 bn.

|

457.6

|

69.9 bn.

|

|

| 25 November | 1.0736 | 1.0581 | CHF inflation hedge again. | N/A | +2.9 bn. per week |

527.6 bn.

|

463.0 bn.

|

64.6 bn.

|

For the full background of sight deposits and speculative positions see

SNB Sight Deposits and CHF Speculative Positions

Tags: currency reserves. intervention,Featured,minimum reserves,monetary data,negative interest,newsletter,Reserves,sight deposits