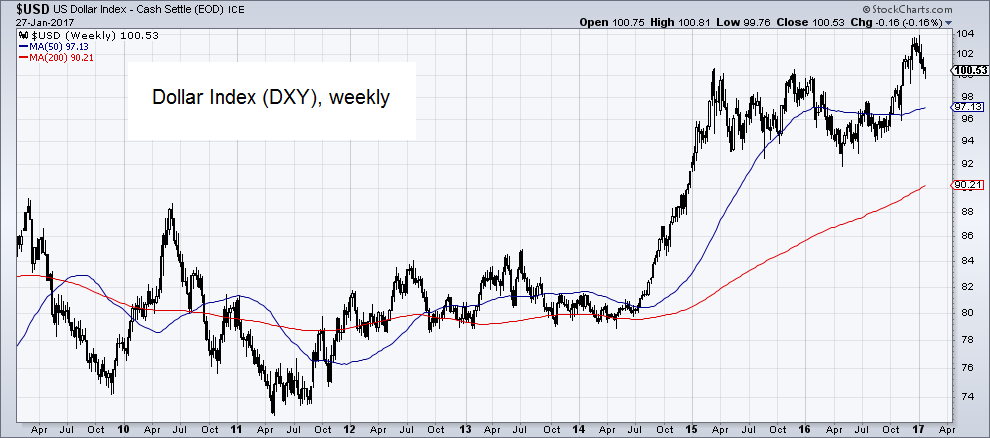

Rekindling the Dollar Debasement Strategy The U.S. dollar, as measured by the dollar index, has generally gone up since mid-2014. The dollar index goes up when the U.S. dollar gains strength (value) against a basket of currencies, including the euro, yen, pound, and several others. Conversely, the dollar index goes down when the U.S. dollar loses value. Between July 30, 2014 and December 28, 2016, the dollar’s value, as measured by the dollar index, increased from 79.78 to 103.30 – or 29 percent. Since then, the dollar index has dropped to about 100. In addition, President Trump has said that the dollar is “too strong” and Treasury Secretary Steven Mnuchin has called the dollar “excessively strong.” President Trump wants a weaker dollar to help with his program of bringing manufacturing jobs back to the U.S. The rationale is simple enough. A weaker dollar should make U.S. exports more attractive on international markets. Similarly, a weaker dollar should make foreign imports more expensive for U.S. consumers so they’ll buy products Made in USA. Unfortunately, the unintended consequences of currency debasement – such as price inflation, currency wars, moral decay and others – are more destructive to a nation’s wealth than any trade advantage that can be garnered.

Topics:

MN Gordon considers the following as important: Debt and the Fallacies of Paper Money, Featured, newslettersent, On Economy, On Politics, Precious Metals

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Rekindling the Dollar Debasement StrategyThe U.S. dollar, as measured by the dollar index, has generally gone up since mid-2014. The dollar index goes up when the U.S. dollar gains strength (value) against a basket of currencies, including the euro, yen, pound, and several others. Conversely, the dollar index goes down when the U.S. dollar loses value. Between July 30, 2014 and December 28, 2016, the dollar’s value, as measured by the dollar index, increased from 79.78 to 103.30 – or 29 percent. Since then, the dollar index has dropped to about 100. In addition, President Trump has said that the dollar is “too strong” and Treasury Secretary Steven Mnuchin has called the dollar “excessively strong.” President Trump wants a weaker dollar to help with his program of bringing manufacturing jobs back to the U.S. The rationale is simple enough. A weaker dollar should make U.S. exports more attractive on international markets. Similarly, a weaker dollar should make foreign imports more expensive for U.S. consumers so they’ll buy products Made in USA. Unfortunately, the unintended consequences of currency debasement – such as price inflation, currency wars, moral decay and others – are more destructive to a nation’s wealth than any trade advantage that can be garnered. A number of articles have been written over the last week on this subject showing why currency devaluation is a terrible strategy for making a country wealthy. One of the better reads we came across was an article by Antonius Aquinas published right here at Acting-Man: Donald and the Dollar. Hence, we’ll not rehash the examination. Rather, today we’ll venture south of the border in search of perspective and empirical school-of-hard-knocks experience. With a little luck we’ll learn something. |

Weekly Dollar IndexThe US dollar has been quite strong since retesting its previous lows in 2011 (note that it has been even stronger against many currencies not included in DXY). Politicians and central bankers never seem to be content with a strong currency. This is quite bizarre, as a strong currency greatly benefits consumers, i.e., everyone. Politicians seem to believe it is better to create currency-related benefits for what is really only a small sector of the economy – which proves how deeply ingrained mercantilist fallacies are. Ironically, even these beneficiaries only ever see a temporary bump in their income and as a rule tend to suffer great harm in the long term. Just ponder US car companies in this context. Over many decades, no other sector has been whining more persistently about the allegedly unfair weakening of the yen by Japan’s government. The reality is this: in 1965, the yen stood at nearly 360 to the dollar. 30 years later, it had risen to 80, a gain of 350% – or putting it differently, the dollar declined by 78% against the yen in three decades. Have US car companies conquered the world as a result? Have Japan’s car makers lost market share in the US or elsewhere? The exact opposite has in fact happened (two of the US “big three” even went bankrupt and had to be bailed out). Ultimately, the magic elixir of currency debasement achieves none of the results promised by its promoters. |

Demise of the Mexican MiracleMexico City, if you’ve never been there, is quite a sight. The population is more than double the population of Los Angeles. What’s more, its pace of activity makes Los Angeles appear sleepy and its congested autopistas make Southern California highway’s feel, calm, organized, and sound. |

|

| The juxtaposition of pre-colonial ruins, Medieval Spanish architecture, and modern skyscrapers, all on the same city block, is extraordinarily fascinating. But what’s even more fascinating is the ever-present instruction of what happens when overzealous governments overspend, and then inflate their currency to pay their debts. Mexico offers ominous warning signs of what may be in store for the United States, given the government’s financial imprudence.

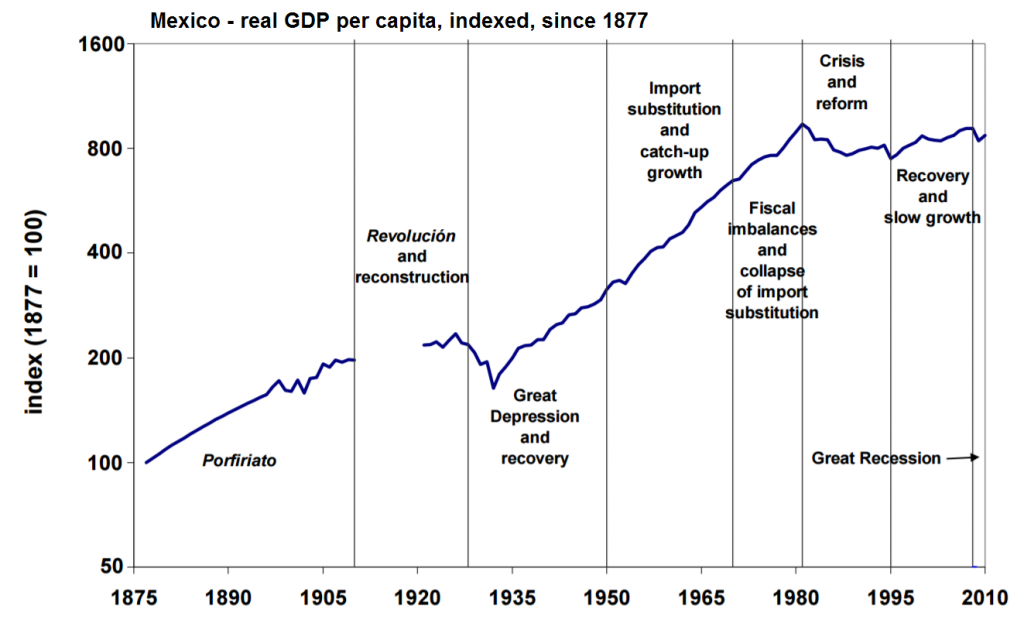

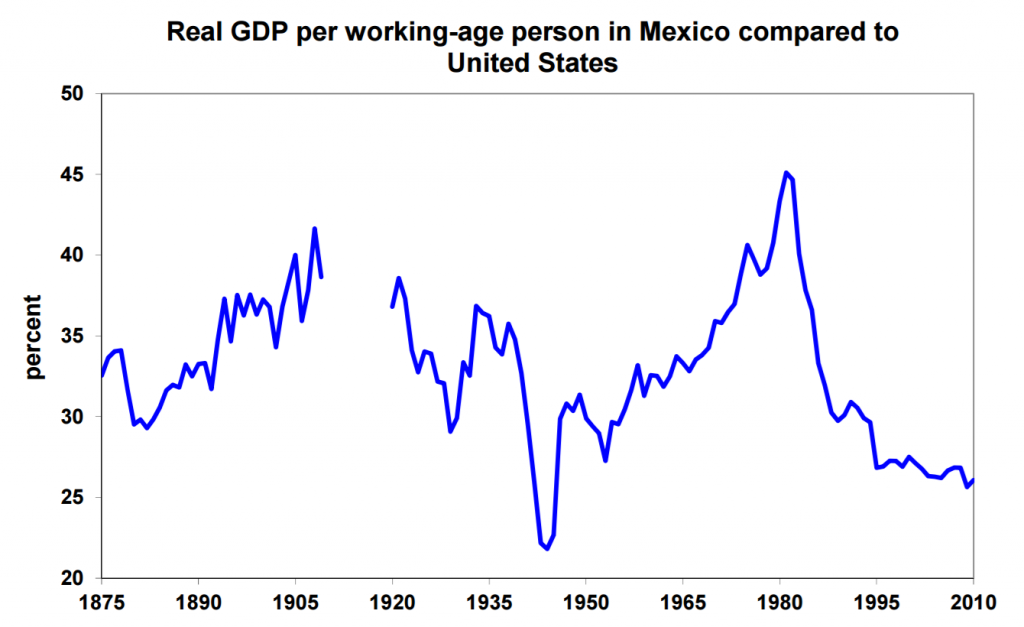

Like the United States, Mexico’s economy experienced robust growth during the mid-part of the 20th century. For this reason, the period from 1930 to 1970 was later called the “Mexican Miracle” by economic historians. Mexico’s GDP increased at an annual average rate of 4.2 percent between 1929 and 1945 and then it accelerated to an average of 6.5 percent per year between 1945 and 1972. Even during the inflationary 1970s, Mexico’s abundance of oil and other resources helped sustain 5.5 percent annual GDP growth from 1972 to 1981. |

Mexico GDP Long Term Mexico’s real per capita GDP from 1877 to 2010 (indexed). Before the time period shown on this chart, between 1810 and 1877, Mexico’s economic output declined by a cumulative 10.5% (wars against the US and France produced large economic setbacks). From 1877 to 1910, Mexico’s economy grew faster than the US economy. After another large setback in the wake of the revolution and during the Great Depression, growth recovered and really took off in 1950, once again outpacing US economic growth (see also further below). Since 1980, stagnation has set in - Click to enlarge |

| But the high water mark for Mexico, culminating with the 1968 Olympics in Mexico City, had already surged, and the flow of wealth had begun to recede. By the late 1970s living conditions had become second rate for the broad population.

What went wrong? During the 1970s, the successive administrations of Luis Echeverría Álvarez and José López Portillo, dramatically expanded the Country’s social development policies. Specifically, they increased public spending and financed the spending with debt – like the successive administrations of George W. Bush and Barack Obama. |

Mexico vs US Growth Real GDP growth per working age person, Mexico vs. the US, 1877 – 2010. Mexico’s relative decline since the 1980s has been startling. This time it had nothing to do with a revolution or a global depression. Incidentally, it is quite remarkable that Mexico is considered such a big winner of NAFTA. Trade balances are immaterial to a nation’s wealth generation potential (note though that statistics cannot be used to prove or disprove economic laws – that can only be done by means of sound economic theorizing. We mention this in order to stress that the developments depicted in this chart are the result of a multitude of influences) - Click to enlarge |

| During this period, Mexico’s debt soared over 300 percent from $6 billion in 1970 to $20 billion in 1976. Incidentally, the U.S. national debt has soared about 350 percent from $5.7 trillion in 2001 to $20 trillion today. The effect of Mexico’s monetary mischief were many violent devaluations of the peso, from 12.50 pesos per dollar in 1954 to 20 pesos per dollar in late 1976. This simply eviscerated the middle class.

Then, in 1981 and 1982, oil prices crashed on the international market, just as interest rates spiked. After that, the government really made a mess of things. In 1982, outgoing President López Portillo suspended payments of foreign debt, devalued the peso and nationalized the banking system, along with many other industries that were severely affected by the crisis. |

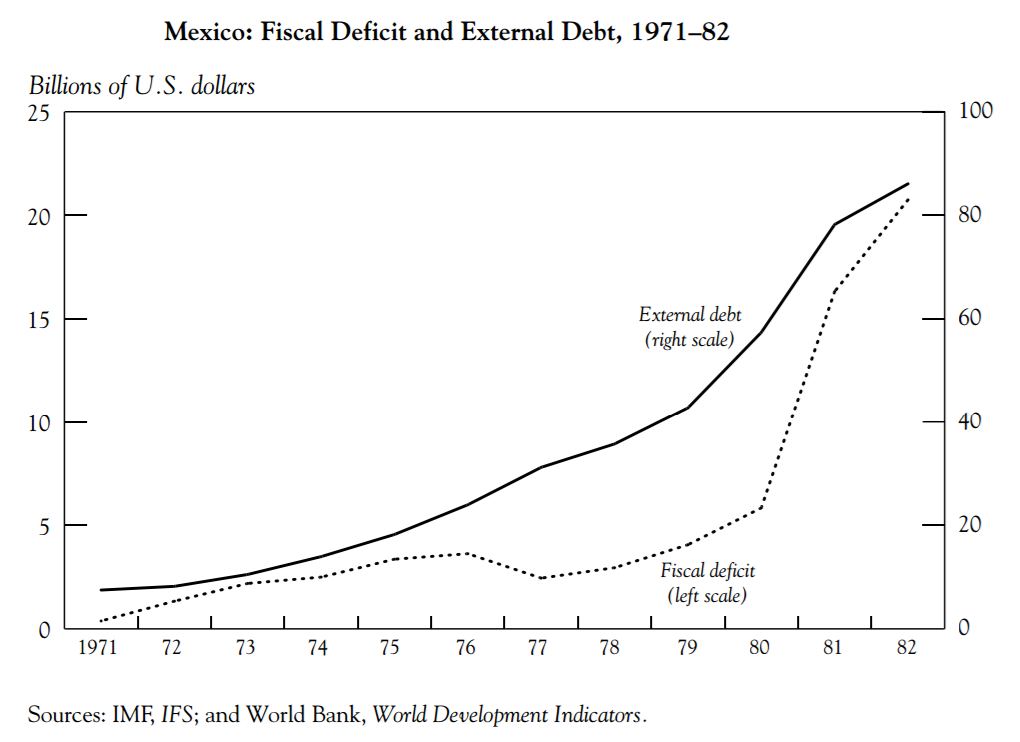

Mexico Debt and Deficit Mexico’s external debt (rhs, in USD billion) and fiscal deficit (lhs, in percent of GDP) from 1971 to 1982 – in 1982, a major debt crisis erupted. The windfall from the surge in oil prices during the 70s made the government overconfident. After 1976, the annual growth rate of the budget deficit even decreased temporarily, but external debt kept soaring (along with a sharply declining peso). Things quickly came to a head when oil prices began to fall after 1980 and government revenue collapsed. For more color on Mexico’s arrant economic policies during the 1970s see this NBER report (pdf) - Click to enlarge |

| Any hope for a quick return to economic progress vanished. Between 1983 and 1988, Mexico’s GDP grew at an average annual rate of just 0.1 percent. At the same time, price inflation increased at an average rate of 100 percent per year.

By the early 1990s it looked like Mexico had finally turned over a new leaf. After 12-years of economic malaise the Country was primed for an economic boom. NAFTA had been approved and everyone just knew that Mexico was going to be the next big thing. The world took note and foreign investment flooded into the country inflating the value of the peso. |

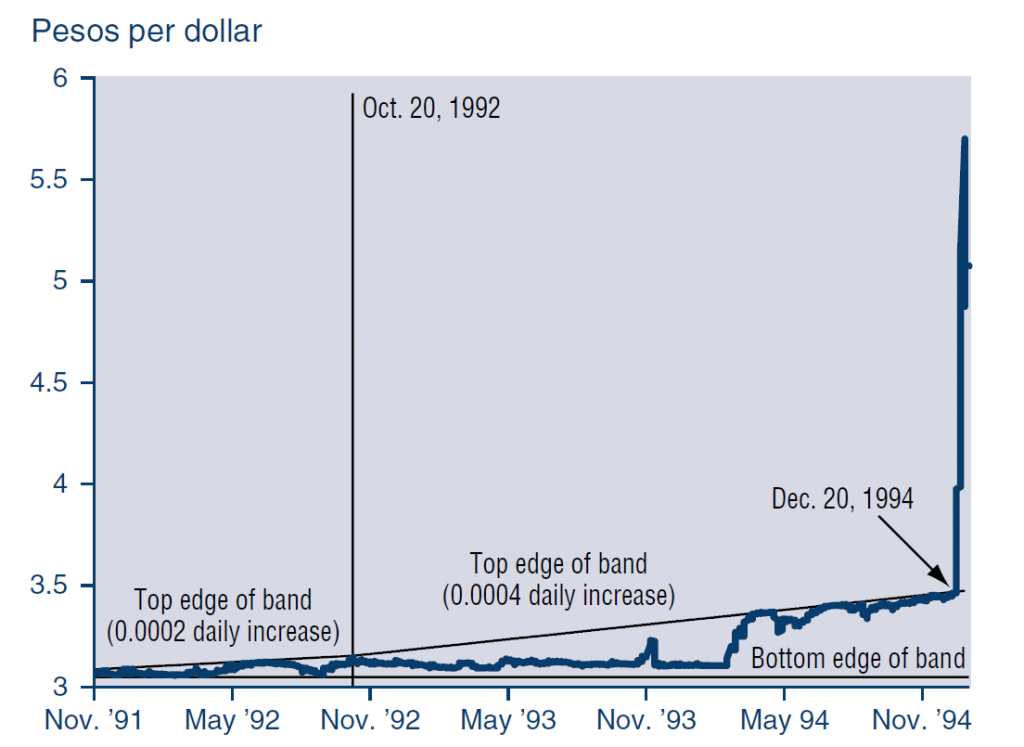

Peso Crisis The 1994 peso crisis – the black lines at the bottom indicate the upper and lower boundaries of the target band of Mexico’s “crawling peg”. At the end of the year the target band could no longer be defended, as the central bank’s interventions and persistent capital flight had almost depleted the country’s foreign exchange reserves (see next chart). The peso finally crashed. By December of 1994, both the capital and the current account were in deficit – they had stopped mirroring each other in February of 1994 - Click to enlarge |

| The administration of President Carlos Salinas de Goratri couldn’t believe its good fortune. Like any good government they spent the bonanza, and then they spent some more. After that, things quickly spiraled out of control. On March 23, 1994, presidential candidate Luis Donaldo Colosio-Murrieta was assassinated at a campaign rally in Tijuana.

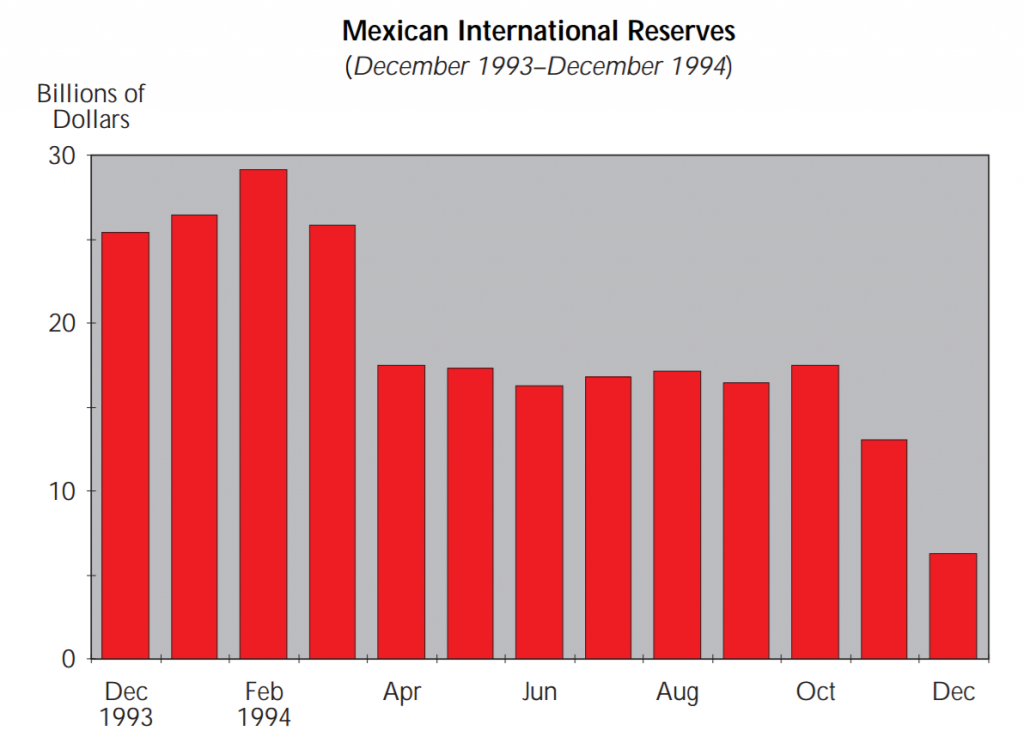

By the end of 1994 Mexico was running a deficit of 7 percent of GDP and the central bank had to intervene in foreign exchange markets to maintain the peso’s peg to the U.S. dollar. Foreign investors called the central bank’s bluff. They pulled their capital and the peso crashed in spectacular fashion. In the space of one week the peso fell 44-percent against the dollar. Mexico’s economy crashed too. Mexico’s foreign reserves plunged from a peak of $29.2 billion in February of 1994 to around $6 billion by December. In February there were reportedly discussions about revaluing the peso upward, due the sharp growth in reserves up to that point. Then the country fell into the throes of a political crisis, starting with the assassination of the presidential candidate of the PRI on March 23 1994. It steadily worsened from there. Surging US yields provided an additional incentive for investors to withdraw their capital. Mexico offered investors the option to switch from peso-denominated to short-term USD-denominated bonds, hoping to stem capital outflows by assuming the exchange rate risk. At the end of June 1994 the value of these USD-denominated bonds began to exceed the country’s forex reserves – a time bomb, as it turned out. By December the total amount of these bonds was $29 billion. Foreign investors were the major holders (mainly US mutual funds). Most Mexican investors didn’t believe in their government’s ability to repay these bonds and simply sent their capital abroad instead. The Bank of Mexico “sterilized” its foreign exchange interventions by expanding the domestic monetary base, wrongly believing the outflows to be temporary. Net domestic credit surged right along with it. The peso crash resulted inter alia in a reversal of this policy and domestic credit contracted sharply, leading to a sizable decline in economic output. Banks had moreover amassed $25 billion in foreign funding by selling short term commercial paper – this funding source dried up overnight. Non-performing loans in Mexico’s banking system soared, eventually reaching more than 50% of all outstanding loans by mid-1995. |

Mexico Forex Reserves 1994 |

Adventures in Currency DebasementCurrencies, both north and south of the Rio Grande, ain’t what they use to be. Several generations ago they were as reliable as a rooster’s call at dawn. Now they’re as crooked as a politician’s spine. We know this not by reading the history books, nor by hearsay, but by the honest, verifiable, silver dollar and silver peso we’re holding in our hands. One coin, the Peace Dollar, is a United States silver dollar minted in the 1920s. At the time of its mint, one coin equaled one dollar and each dollar contained 0.77344 troy ounces of silver. The other coin, the 1922 Un Peso, is a Mexican silver peso. At the time of its mint, one coin equaled one peso, and each peso contained 0.3856 troy ounces of silver. |

|

| The exchange rate was real simple. Based on their silver content, two pesos equaled one dollar. Nowadays, both pesos and dollars are merely paper promissory notes issued by their country’s central banks. Their value is derived by their track record of stewardship, the size of their country’s military, and the international currency market’s perception of their government’s ability to make payments on their debt.

Today it takes about 21.32 pesos to buy one dollar. As you can see, the Mexican government has been less upright in managing its currency than the U.S. government has over the last 90 years. But when you use silver as the measuring stick, the picture changes… It took about $1.29 to buy an ounce of silver in the 1920s, while today it takes $16.75 to buy an ounce of silver. This means silver presently costs 1,198-percent more in dollar terms than it did in the 1920s. In pesos, however, it’s a downright disgrace. It took 2.58 pesos to buy an ounce of silver in 1922, while today it takes 357.11 pesos to buy an ounce of silver. Astonishingly, in peso terms, silver now costs 13,741-percent more than it did in the 1920s. It doesn’t take much time traveling around Mexico City to discover that behind the hustle and bustle, not only has the government successfully vaporized its currency, it has successfully vaporized the country’s middle class as well. You can actually see its nonexistence everywhere you look. And if you squint your eyes just right, you can see the ashes of its prior existence within the cracks of decay. Here’s the point… |

Weekly Peso |

Conclusion

President Trump plans to build a wall along the southern border to keep immigrants from Mexico and Central America from entering the U.S. illegally. We don’t question President Trump’s intentions or his desire to ‘Make America Great Again.’ Still, we must point out, that he is also considering the types of currency devaluation schemes that compelled the multitudes to move north to begin with.

No doubt, Mexico offers a textbook lesson on how governments exact ruin among their citizenry. One day, perhaps soon, similar consequences of government monetary mischief will be splattered across El Norte too.

For many decaying urban and industrial areas – and Middle American small towns and abandoned farmhouses – the consequences already left their mark decades ago. Debasing the dollar with the objective of restoring prosperity will only accelerate the decline.

Charts by: StockCharts, Minneapolis Fed, Atlanta Fed, IMF, Banco de México, investing.com

Chart and image captions by PT

Tags: Featured,newslettersent,On Economy,On Politics,Precious Metals