Update January 10, 2021: Sight Deposits have risen by +1.9 bn CHF, this means that the SNB is intervening and buying Euros and Dollars. We had finally arrived in the inflation scenario I was speaking about before. Inflation is the period, when both the Swiss franc and gold must go up. BUT : U.S. CPI is at 5%, at the highest value since the year 1990 (excluding one outlayer in Summer 2008). But European inflation has gone down to 1.9%., In...

Read More »SNB Sight Deposits: Inflation Fear Decreasing, SNB Selling Euros

Update September 20 2021: SNB Selling Dollars and Euros Sight Deposits have fallen: The change is -0.2 bn. compared to last week, this means the SNB is selling euros and dollars. We had finally arrived in the inflation scenario I was speaking about before. Inflation is the period, when both the Swiss franc and gold must go up. BUT : U.S. CPI is at 5%, at the highest value since the year 1990 (excluding one outlayer in Summer 2008). But European...

Read More »Weekly SNB Sight Deposits and Speculative Positions: SNB selling euros and dollars – March 29, 2021

Update March 29 2021: SNB selling euros and dollars Sight Deposits have fallen: The change is -0.2 bn. compared to last week, this means the SNB is selling euros and dollars. Speculative Positioning: Speculators are long CHF against USD. Since March 13, they have shifted to a long EUR position against USD. The following shows the recent developments. Sight Deposits, i.e. SNB interventions FX rates Speculative positions CHF: Since April, speculators...

Read More »What Can Kill a Useless Currency, Report 28 Oct 2018

There is a popular notion, at least among American libertarians and gold bugs. The idea is that people will one day “get woke”, and suddenly realize that the dollar is bad / unbacked / fiat / unsound / Ponzi / other countries don’t like it / <insert favorite bugaboo here>. When they do, they will repudiate it. That is, sell all their dollars to buy consumer goods (i.e. hyperinflation), gold, and/or whatever other...

Read More »Useless But Not Worthless, Report 21 Oct 2018

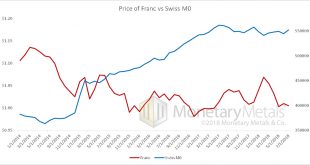

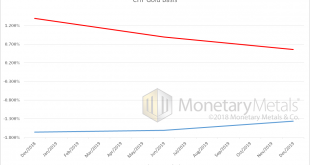

Let’s continue to look at the fiasco in the franc. We say “fiasco”, because anyone in Switzerland who is trying to save for retirement has been put on a treadmill, which is now running backwards at –¾ mph (yes, miles per hour in keeping with our treadmill analogy). Instead of being propelled forward towards their retirement goals by earning interest that compounds, they are losing principal. They will never reach their...

Read More »Permanent Gold Backwardation, Report 30 Sep 2018

Sometimes, one just needs to look in the right place. And often in those cases, it just takes a conversation to alert one where to look. We had a call with a Swiss company this week, to discuss gold financing for their business. They reminded us that there is a negative interest rate on Swiss francs. And then they said that a swap of francs for gold has a cost. That is, the CHF GOFO rate is negative (the dollar based...

Read More »Weekly Sight Deposits and Speculative Positions: SNB interventions are rising again

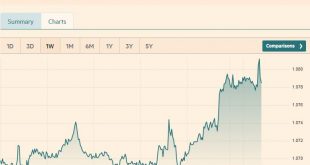

Headlines Week April 03, 2017 We were arguing in the previous months, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. The tendency of point 3 had been interrupted when the ECB appeared to be less dovish. FX Last week:...

Read More »Weekly Sight Deposits and Speculative Positions: SNB interventions are rising again

Headlines Week March 27, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. Point 3 was not fulfilled last week. FX Llst weeks: The EUR/CHF suddenly appreciated with the ECB...

Read More »Weekly Sight Deposits and Speculative Positions: EUR/CHF suddenly higher after ECB

Headlines Week March 20, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. Point 3 was not fulfilled last week. FX Last week: The EUR/CHF suddenly appreciated with the ECB meeting,...

Read More »Weekly Sight Deposits and Speculative Positions: EUR/CHF suddenly higher after ECB

Headlines Week March 13, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. Point 3 was not fulfilled last week. FX Last week: The EUR/CHF suddenly appreciated with the ECB meeting...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org