Summary:

The US dollar is winding down the week on a firm note, but still in a consolidative mode. The euro and yen and Australian dollar are well within yesterday’s ranges while sterling and the Canadian dollar pushing through yesterday’s lows. Source Dukascopy Asian shares were mostly higher, though Chinese markets closed with slight losses. The MSCI Asia-Pacific Index rose (~0.7%) for a third session and secured a 2% gain for the week. European bourses are seeing some profit-taking ahead of the weekend, which trims their weekly gain. The Dow Jones 600 is off about 0.2% and is up 3% on the week. Today’s small loss reflects a divided market. Health care and utilities are leading on the upside while energy and telecom are the largest drags. Benchmark 10-year bond yields are mostly a couple of basis points lower while the short-end is flat. Source Investing.com The G7 Summit has come and gone. The language of the final statement looked a touch softer the Abe’s warning of Lehman-like risks. Still officials recognized downside risk to the world economy. Although there were some platitudes toward policy coordination, investors will have to wait to see what this means, if anything, in practice. One outstanding issue remains.

Topics:

Marc Chandler considers the following as important: Featured, Federal Reserve, FX Daily, FX Trends, Janet Yellen, Japan, newsletter, USD

This could be interesting, too:

The US dollar is winding down the week on a firm note, but still in a consolidative mode. The euro and yen and Australian dollar are well within yesterday’s ranges while sterling and the Canadian dollar pushing through yesterday’s lows. Source Dukascopy Asian shares were mostly higher, though Chinese markets closed with slight losses. The MSCI Asia-Pacific Index rose (~0.7%) for a third session and secured a 2% gain for the week. European bourses are seeing some profit-taking ahead of the weekend, which trims their weekly gain. The Dow Jones 600 is off about 0.2% and is up 3% on the week. Today’s small loss reflects a divided market. Health care and utilities are leading on the upside while energy and telecom are the largest drags. Benchmark 10-year bond yields are mostly a couple of basis points lower while the short-end is flat. Source Investing.com The G7 Summit has come and gone. The language of the final statement looked a touch softer the Abe’s warning of Lehman-like risks. Still officials recognized downside risk to the world economy. Although there were some platitudes toward policy coordination, investors will have to wait to see what this means, if anything, in practice. One outstanding issue remains.

Topics:

Marc Chandler considers the following as important: Featured, Federal Reserve, FX Daily, FX Trends, Janet Yellen, Japan, newsletter, USD

This could be interesting, too:

Swissinfo writes Swiss Senate approves free trade agreement with India

Swissinfo writes Swiss Partners Group acquires real estate platform Empira Group

Swissinfo writes Switzerland jostles to attract mobile millionaires

Patricio Martín writes US Dollar gains ground on sour market sentimet after Donald’s Trumps threats to BRICS

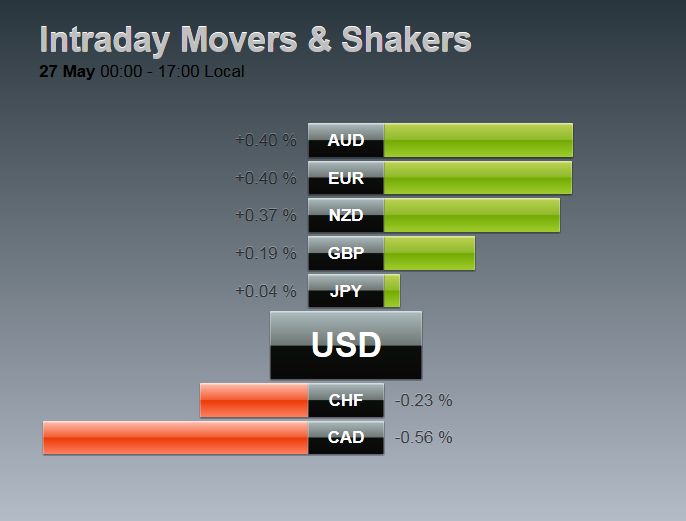

| The US dollar is winding down the week on a firm note, but still in a consolidative mode. The euro and yen and Australian dollar are well within yesterday’s ranges while sterling and the Canadian dollar pushing through yesterday’s lows. |

Source Dukascopy |

| Asian shares were mostly higher, though Chinese markets closed with slight losses. The MSCI Asia-Pacific Index rose (~0.7%) for a third session and secured a 2% gain for the week. European bourses are seeing some profit-taking ahead of the weekend, which trims their weekly gain. The Dow Jones 600 is off about 0.2% and is up 3% on the week. Today’s small loss reflects a divided market. Health care and utilities are leading on the upside while energy and telecom are the largest drags. Benchmark 10-year bond yields are mostly a couple of basis points lower while the short-end is flat. |

Source Investing.com |

The G7 Summit has come and gone. The language of the final statement looked a touch softer the Abe’s warning of Lehman-like risks. Still officials recognized downside risk to the world economy. Although there were some platitudes toward policy coordination, investors will have to wait to see what this means, if anything, in practice.

One outstanding issue remains. Will Japan go ahead with the sales tax increase planned for next year? Through at least last week’s finance ministers and central bankers G7 meeting, the Abe Administration was signaling it would. However, now reports suggest that by playing up the risks of a crisis, Abe will announce a postponement of the tax increase, perhaps as a part of a larger fiscal program.

Japan reported new CPI figures earlier today. They were largely in line with expectations. The headline rate fell 0.3% year-over-year after 0.1% decline in March. Excluding fresh food and energy, prices fell 0.3% year-over-year; the same rate as in March. If all food and energy were excluded, prices rose at a steady 0.7% pace. A different measure, which excludes fresh food and energy. Prices rose 0.9%, slowing from 1.1% in March. It finished last year at a 1.3% pace, the peak (thus far).

The takeaway here is that Japanese price pressures appear to be either steady at low levels or actually moving in the wrong direction. This keeps many observers looking for more action from the BOJ. Although it meets in the middle of next month, the July meeting seems favored.

Activity in the European session is subdued. There may be more interest with US economic data today. The main feature is Yellen’s speech at Harvard’s Radcliffe Day at 1:15 PM ET. Her comments are particularly important because many recall her speech two months ago in NY where she put the kibosh on the talk from several regional presidents about an April hike.

However, even though some are expecting her to be dovish again, we think the risks lie in the other direction; that if anything, she confirms that conditions for another rate hike are nearly in place. There are two things that are different this time. First, Dudley confirmed that a June-July rate hike looked appropriate. For Yellen to lean in the opposite direction now strikes us as unprecedented. Second, it is not just the regional presidents, but Fed Governor Powell also was on message.

That said, we see asymmetrical risk. Confirmation of what is already understood might not create a strong market reaction even if it was not ahead of a long holiday weekend for the UK and US. As intimated, the market would likely respond stronger if Yellen was, in fact, dovish and contradicted the NY Fed President and a Governor. The dollar would suffer quickly (more than it would rise on reiterating what has already been said).

The US data included a revision to Q1 GDP, which will include an estimate for Q1 corporate profits for the first time, and University of Michigan’s final May reading of consumer sentiment. Although there are still those, who argue that the US is headed for a recession, and may even see a fall in corporate profits as another tell, GDP numbers are strengthening. Q1 GDP is likely to be revised up from the 0.5% initial estimate to something closer to 1.0%. It is still poor, just not as poor, and it underscores unreliability of the initial estimate.

Meanwhile, more important than the past Q1 is the current Q2. Estimates for growth have been increasing. The Atlanta Fed’s GDPNow tracker now stands at 2.9%. Private investment could be a small contributor rather than a drag on growth, and net exports may be less of a drag, according to the data released in recent days. Next week’s employment data are the focus, but strike activity may obscure the trends while consumption data including April PCE and May auto sales may be ultimately more important.