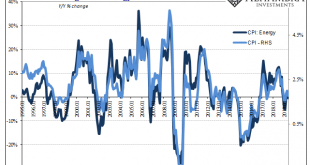

While the world fixated on the US CPI, it was other “inflation” data from across the Pacific that is telling the real economic story. Having conflated the former with a red-hot economy, the fact American consumer prices aren’t tied to the actual economic situation has been lost in the shuffle of the FOMC’s hawkishness, with markets obliged to price wrong-way Jay. The short end of the yield curve (USTs and elsewhere) is plotting like FOMC dots, whenever oil and crude...

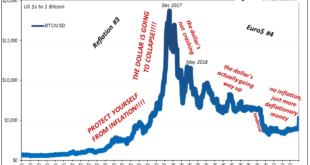

Read More »It’s Not Nothing, It’s Everything (including crypto)

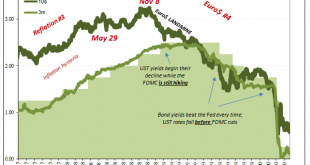

Markets got aggressive long before the FOMC did. Everything, and I mean everything, has been trending the other way. Jay Powell says inflation risks are most pressing when markets have consistently priced the opposite for a whole lot longer. It’ll be revised history when ultimately the mainstream attempts to write it over the months ahead, many will try to snatch some limited victory from the jaws of defeat. Should recession happen and bring an end to the...

Read More »The Hawks Circle Here, The Doves Win There

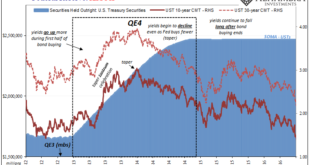

We’ve been here before, near exactly here. On this side of the Pacific Ocean, in the US particularly the situation was said to be just grand. The economy was responding nicely to QE’s 3 and 4 (yes, there were four of them by that point), Federal Reserve Chairman Ben Bernanke had said in the middle of 2013 it was becoming more than enough, creating for him and the FOMC coveted breathing space so as to begin tapering both of those ongoing programs.A full and complete...

Read More »The Curve Is Missing Something Big

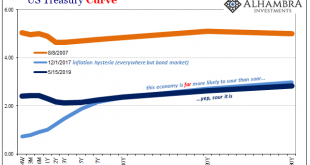

What would it look like if the Treasury market was forced into a cross between 2013 and 2018? I think it might be something like late 2021. Before getting to that, however, we have to get through the business of decoding the yield curve since Economics and the financial media have done such a thorough job of getting it entirely wrong (see: Greenspan below). And before we can even do that, some recent housekeeping at the front of the curve where bill lives. Treasury...

Read More »From QE to Eternity: The Backdoor Yield Caps

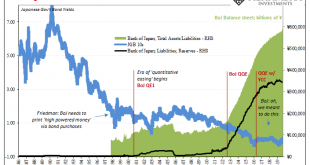

So, you’re convinced that low rates are powerful stimulus. You believe, like any good standing Economist, that reduced interest costs can only lead to more credit across-the-board. That with more credit will emerge more economic activity and, better, activity of the inflationary variety. A recovery, in other words. Ceteris paribus. What happens, however, if you also believe you’ve been responsible for bringing rates down all across the curve…and then no recovery....

Read More »The Fallen Kings & The Bond Throne of Collateral

There is no schadenfreude at times like these, no time to dance on anyone’s grave. Victory laps are a luxury that only central bankers take – always prematurely. The world already coming apart because of GFC1, what comes next with GFC2 and then whatever follows it? Another “bond king” has thrown in the towel. Franklin Templeton’s candidate for the title has been Michael Hasenstab, and like all the other Kings he’d been betting that interest rates would have...

Read More »The Greenspan Moon Cult

Taking another look at what I wrote about repo and the latest developments yesterday, it may be worthwhile to spend some additional time on the “why” as it pertains to so much determined official blindness, an unshakeable devotion to otherwise easily explained lunar events. The short version: monetary authorities as well as the “experts” describe almost perfectly risk averse behavior among the central money dealing system in outbreaks like September’s repo – but...

Read More »Still Stuck In Between

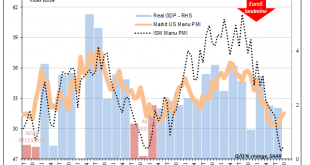

Note: originally published Friday, Nov 1 There wasn’t much by way of the ISM’s Manufacturing PMI to allay fears of recession. Much like the payroll numbers, an uncolored analysis of them, anyway, there was far more bad than good. For the month of October 2019, the index rose slightly from September’s decade low. At 48.3, it was up just half a point last month from the month prior. Most of that was related to a curious surge in New Export Orders. Having dropped to...

Read More »As Chinese Factory Deflation Sets In, A ‘Dovish’ Powell Leans on ‘Uncertainty’

It’s a clever bit of misdirection. In one of the last interviews he gave before passing away, Milton Friedman talked about the true strength of central banks. It wasn’t money and monetary policy, instead he admitted that what they’re really good at is PR. Maybe that’s why you really can’t tell the difference Greenspan to Bernanke to Yellen to Powell no matter what happens. Testifying before Congress today, in prepared...

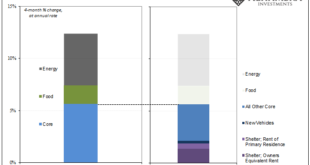

Read More »When Verizons Multiply, Macro In Inflation

Inflation always brings out an emotional response. Far be it for me to defend Economists, but their concept is at least valid – if not always executed convincingly insofar as being measurable. An inflation index can be as meaningful as averaging the telephone numbers in a phone book (for anyone who remembers what those things were). If you spend $1,000 a month on food for your family, and food prices rise 6% generally...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org