Investec Switzerland. Stock markets around the world are set to close higher this week after investors interpreted a rise in oil prices as a positive sign for the global economy. The Swiss Market Index (SMI) outperformed global markets amid a strong performance from financials and pharmaceuticals. © Ssuaphoto | Dreamstime.com Sentiment was bolstered this week as oil prices moved above the level of 50 US dollar per barrel on signs that a two-year supply glut may be coming to an end. A drop in US stockpiles and shrinking output in both Nigeria and Venezuela contributed to price gains. Although oil fell again below the crucial level of 50 US dollar per barrel on Friday, oil prices are now up around 80% from January’s lows of .10 a barrel. Growing speculation that the US Federal Reserve may raise rates next month was also a core driver of investor sentiment this week. According to several members of the rate-setting Federal Open Market Committee, the US is on the verge of meeting most of the economic conditions required to merit higher interest rates. The news put US bond prices under pressure while the US dollar strengthened. Banks, which are expected to benefit from higher interest rates, rallied on the news giving the financial sector a boost.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Investec Switzerland, SMI

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

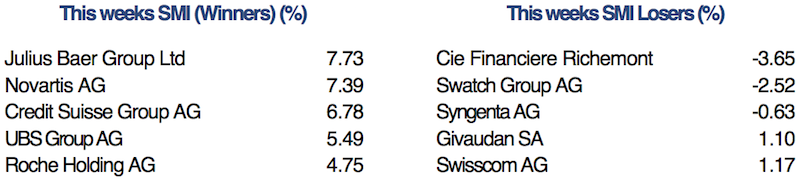

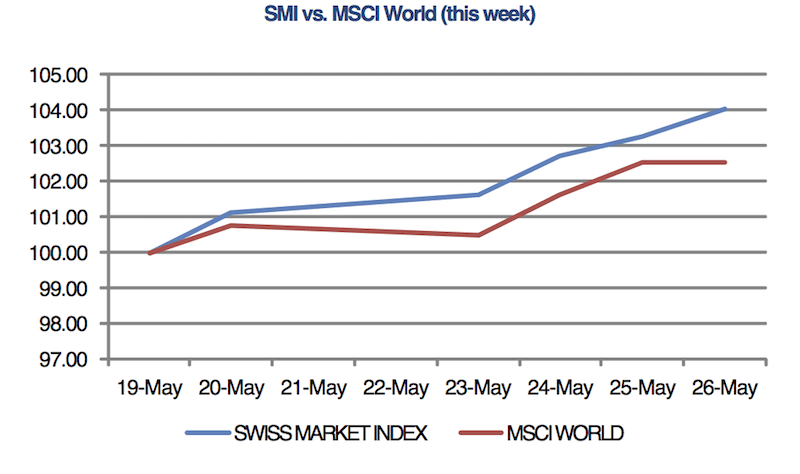

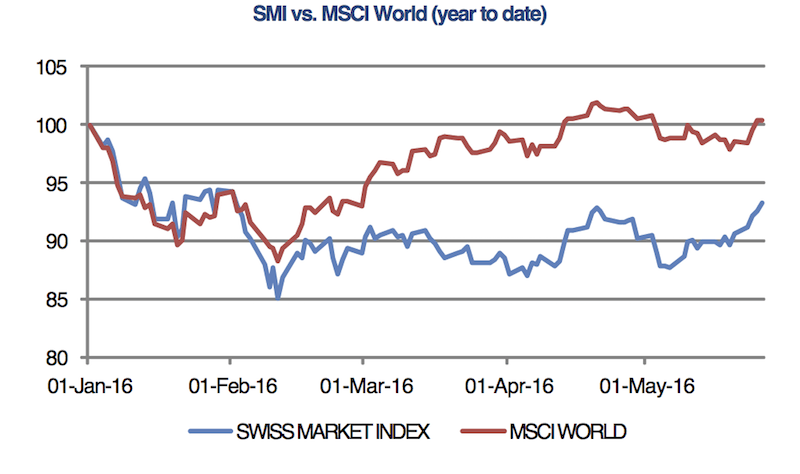

Stock markets around the world are set to close higher this week after investors interpreted a rise in oil prices as a positive sign for the global economy. The Swiss Market Index (SMI) outperformed global markets amid a strong performance from financials and pharmaceuticals.

© Ssuaphoto | Dreamstime.com

Sentiment was bolstered this week as oil prices moved above the level of 50 US dollar per barrel on signs that a two-year supply glut may be coming to an end. A drop in US stockpiles and shrinking output in both Nigeria and Venezuela contributed to price gains. Although oil fell again below the crucial level of 50 US dollar per barrel on Friday, oil prices are now up around 80% from January’s lows of $27.10 a barrel.

Growing speculation that the US Federal Reserve may raise rates next month was also a core driver of investor sentiment this week. According to several members of the rate-setting Federal Open Market Committee, the US is on the verge of meeting most of the economic conditions required to merit higher interest rates. The news put US bond prices under pressure while the US dollar strengthened. Banks, which are expected to benefit from higher interest rates, rallied on the news giving the financial sector a boost.

In Switzerland, watch exports had their first back-to-back, double-digit monthly decline in six years last month highlighting the industry’s accelerating slowdown. Shipments to China fell 11% in April after falling 16% in March. Exports have declined for the past 10 months straight as Swiss watch makers, such as Richemont and Swatch, face mounting challenges in key markets.

In other company news Novartis said this week that it expects to continue to increase its dividend while growing in a sustainable way thanks to new medicines, improved profitability and strong cash flow. Chief Executive Joe Jimenez further announced that the company is ready to sell its near $14 billion stake in rival Roche without demanding a premium. The company had built up its one-third stake in its rival’s voting stock between 2001 and 2003 under former Chairman Daniel Vasella.