Investec Switzerland. Swiss stocks are set for a modestly positive end to the week despite stock markets coming under pressure on growing speculation that the US Federal Reserve could raise rates as early as next month. © Kenneth Graff | Dreamstime.com Stocks markets were volatile this week after the latest meeting minutes from the US Federal Reserve showed that most policymakers thought a June interest rate hike was appropriate given the continued improvement of the US economy. Several participants said however that they were concerned that the economic signals may not yet be clear enough. There were also concerns about the potential impact of the UK “Brexit” referendum on the global economy and outlook for US growth. Further pressure on sentiment came from oil after prices for both Brent and Crude oil fell from recent highs on the release of data that showed a surprise increase in US oil inventories. In Switzerland, a report showed that producer and import prices decreased at a slower-than-expected pace in April (-2.4% vs -2.7%). The decline was the smallest since December 2014. On a monthly basis, producer and import prices rose 0.3% in April, producer and import prices rose for the first time in five months in April and was mainly driven by higher prices of petroleum products.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Investec Switzerland

This could be interesting, too:

Investec writes Swiss to vote on tenancy laws this weekend

Investec writes Switzerland ranked second in digital competitiveness

Investec writes Swiss wages set to rise in 2025

Investec writes Federal Council hopes to boost savings with pension change

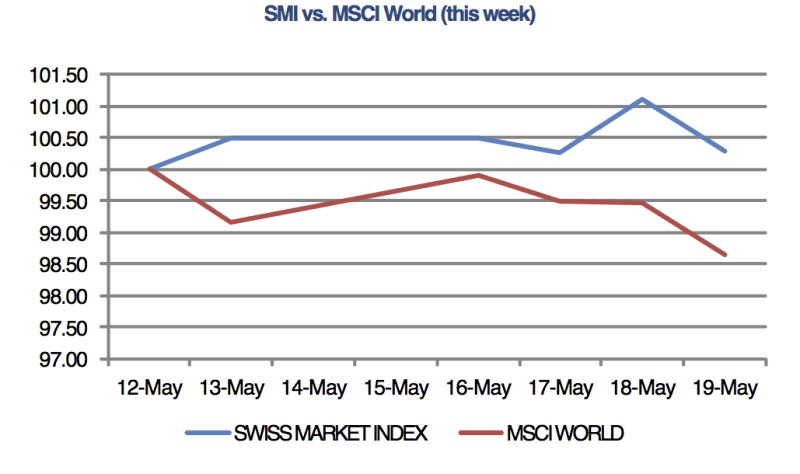

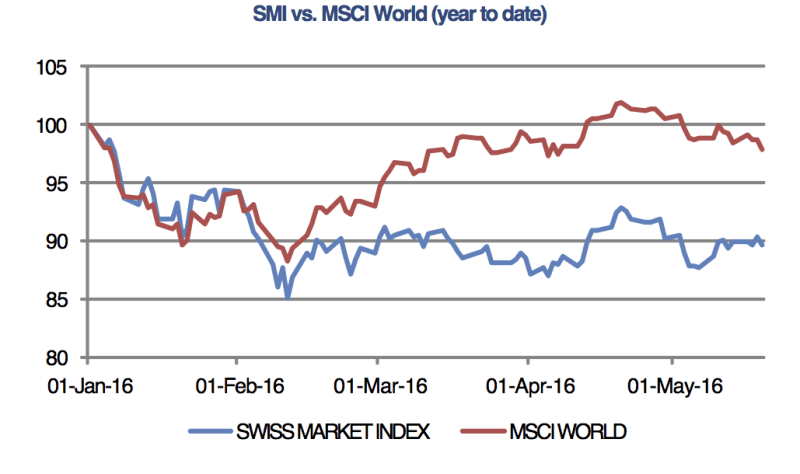

Swiss stocks are set for a modestly positive end to the week despite stock markets coming under pressure on growing speculation that the US Federal Reserve could raise rates as early as next month.

© Kenneth Graff | Dreamstime.com

Stocks markets were volatile this week after the latest meeting minutes from the US Federal Reserve showed that most policymakers thought a June interest rate hike was appropriate given the continued improvement of the US economy. Several participants said however that they were concerned that the economic signals may not yet be clear enough. There were also concerns about the potential impact of the UK “Brexit” referendum on the global economy and outlook for US growth. Further pressure on sentiment came from oil after prices for both Brent and Crude oil fell from recent highs on the release of data that showed a surprise increase in US oil inventories.

In Switzerland, a report showed that producer and import prices decreased at a slower-than-expected pace in April (-2.4% vs -2.7%). The decline was the smallest since December 2014. On a monthly basis, producer and import prices rose 0.3% in April, producer and import prices rose for the first time in five months in April and was mainly driven by higher prices of petroleum products.

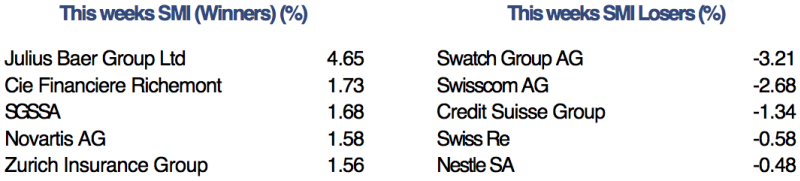

In company news, shares of Swatch Group lost ground after data showed that global watch exports fell 16% annually in March, the worst decline since March 2011. The contraction in Swiss-watch exports has gained pace since July 2015 as the three largest markets, Hong Kong, the US and China all pared back orders. In other news, Novartis said it will separate its oncology unit from its pharmaceuticals division following the purchase of assets last year from GlaxoSmithKline Plc.

In other news, Star investor Warren Buffet’s Berkshire Hathaway Inc announced early in the week that it took an Apple stake worth of nearly $1 billion. The investment was announced despite an increasing view among investors that Apple’s heady growth days may be over. According to the firm, Berkshire Hathaway‘s new investment in Apple was selected by one of Warren Buffett‘s stock picking lieutenants and not by the “Oracle of Omaha” himself.