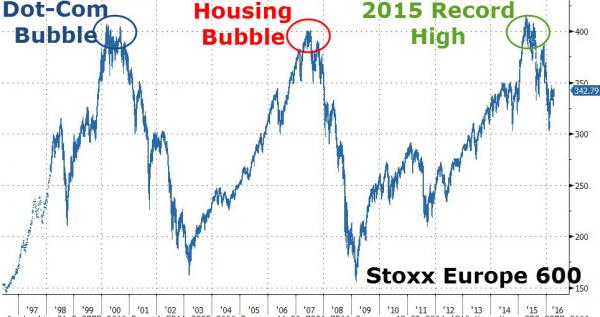

A year ago today, European equities hit their highest levels ever. But, as Bloomberg reports, the euphoria about Mario Draghi’s stimulus program didn’t last, and trader skepticism is now rampant. The Stoxx Europe 600 Index has lost 17% since its record, and investors who piled in last year are now unwinding bets at the fastest rate since 2013 as analysts predict an earnings contraction. The trading pattern looks familiar: a fast run to just over 400 on the gauge, then disaster... To Benedict Goette of Crossbow Partners, the odds of another crisis are higher than a rally to fresh records. “The 2009-2015 rally originated from two main drivers: a massive stimulus, and credit expansion in China,” said Goette, who’s a partner at his firm in Zug, Switzerland and helps oversee 1 billion Swiss francs ( billion). “European earnings have not followed suit so far. Skepticism regarding central-bank operations has started to emerge.” Bloomberg notes that investors have withdrawn money from funds tracking the region’s equities for nine straight weeks, the longest streak since May 2013, according to a Bank of America Corp. note dated April 7 that cited EPFR Global data.

Topics:

Tyler Durden considers the following as important: Bank of America, China, Switzerland

This could be interesting, too:

Fintechnews Switzerland writes Top 12 Fintech Courses and Certifications in Switzerland in 2025

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Dirk Niepelt writes “Pricing Liquidity Support: A PLB for Switzerland” (with Cyril Monnet and Remo Taudien), UniBe DP, 2025

Dirk Niepelt writes “Report by the Parliamentary Investigation Committee on the Conduct of the Authorities in the Context of the Emergency Takeover of Credit Suisse”

A year ago today, European equities hit their highest levels ever. But, as Bloomberg reports, the euphoria about Mario Draghi’s stimulus program didn’t last, and trader skepticism is now rampant. The Stoxx Europe 600 Index has lost 17% since its record, and investors who piled in last year are now unwinding bets at the fastest rate since 2013 as analysts predict an earnings contraction. The trading pattern looks familiar: a fast run to just over 400 on the gauge, then disaster...

To Benedict Goette of Crossbow Partners, the odds of another crisis are higher than a rally to fresh records.

“The 2009-2015 rally originated from two main drivers: a massive stimulus, and credit expansion in China,” said Goette, who’s a partner at his firm in Zug, Switzerland and helps oversee 1 billion Swiss francs ($1 billion).

“European earnings have not followed suit so far. Skepticism regarding central-bank operations has started to emerge.”

Bloomberg notes that investors have withdrawn money from funds tracking the region’s equities for nine straight weeks, the longest streak since May 2013, according to a Bank of America Corp. note dated April 7 that cited EPFR Global data.