Consumer Ambivalence Photo credit: Pixelrobot What’s up with U.S. consumers? They seem to have come to their senses at the worst possible time. They can no longer be counted on to push economic growth up and to the right. Specifically, they’re not spending money on stuff.A little public service on etymology: “Double whammy” was reportedly first used in a 1941 Oakland Tribune article related to boxing. It means a devastating blow, setback or catastrophe. In today’s economy, it often means “good summary”. According to Wednesday’s Commerce Department report, U.S. retail and food services sales for March declined 0.3 percent from February. Apparently, U.S. consumers are tapering back on auto purchases and spending at restaurants, bars, and clothing and department stores. What’s more, sales have fallen or been flat for each of the first three months of the year. US retail sales, year-on-year growth is still positive (m/m growth rates have recently turned negative), but the downtrend from the post-recession peak is quite obvious. Apparently the message didn’t get through – click to enlarge. “We are seeing much less impulse buying and hearing more ‘I need to go home and think about it,’” said Randal Weeks, owner of Gray Living, a home décor store in McKinney Texas. Similar anecdotes are being reported by retailers across the country.

Topics:

MN Gordon considers the following as important: Debt and the Fallacies of Paper Money, Featured, newsletter, On Economy

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Consumer Ambivalence

Photo credit: Pixelrobot

What’s up with U.S. consumers? They seem to have come to their senses at the worst possible time. They can no longer be counted on to push economic growth up and to the right. Specifically, they’re not spending money on stuff.A little public service on etymology: “Double whammy” was reportedly first used in a 1941 Oakland Tribune article related to boxing. It means a devastating blow, setback or catastrophe. In today’s economy, it often means “good summary”.

| According to Wednesday’s Commerce Department report, U.S. retail and food services sales for March declined 0.3 percent from February. |  |

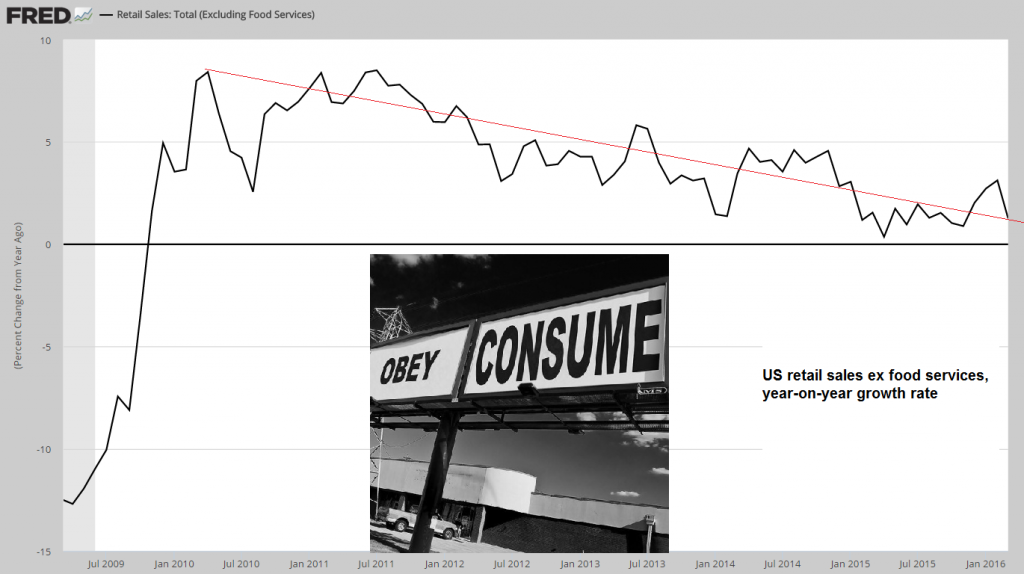

Apparently, U.S. consumers are tapering back on auto purchases and spending at restaurants, bars, and clothing and department stores. What’s more, sales have fallen or been flat for each of the first three months of the year. US retail sales, year-on-year growth is still positive (m/m growth rates have recently turned negative), but the downtrend from the post-recession peak is quite obvious. Apparently the message didn’t get through – click to enlarge.

“We are seeing much less impulse buying and hearing more ‘I need to go home and think about it,’” said Randal Weeks, owner of Gray Living, a home décor store in McKinney Texas. Similar anecdotes are being reported by retailers across the country. What in the world is prompting this consumer ambivalence?

“Shoppers feel uncertain because of a stock market that fell more than 10 percent in six weeks and the recent terror attacks in Europe, said Bob Phibbs, CEO of The Retail Doctor, a consulting company based in Coxsackie, New York. And Gray Living’s Weeks said a few of his customers have said they are uneasy because of the presidential election; they don’t have a sense of how it will turn out.

Perhaps these explanations have something to do with the consumer’s sudden resistance to spending. Still, such instances haven’t held consumers back in the past. There must be something much, much more profound at work.

Doing the Opposite

If you recall, way back in 2000, when the economy was crumbling from the tech bubble implosion, Dallas Fed President Robert McTeer told everyone that “everything would be OK if we’d all just hold hands and buy SUVs.” The Fed then proceeded to provide gobs of easy credit. And, for many years, consumers did their part to borrow and spend it. Moreover, after 9/11, consumption became patriotic.

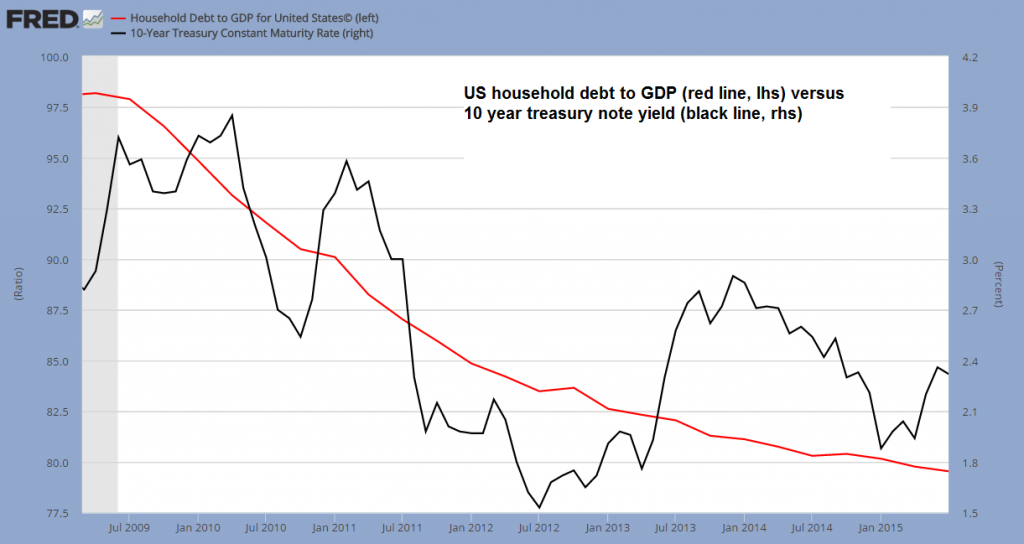

By artificially holding down government bond yields, central bankers believed the big banks would increase lending and create consumer demand. The increased consumption, said their theory, would stimulate the economy and push inflation up to the Fed’s 2-percent target. In practice, this hasn’t happened.

| Households refuse to borrow more, even as interest rates continue to decline |

Charts by St. Louis Federal Reserve Research click to enlarge. |

In fact, as interest rates have fallen economic growth has stagnated. Presently, Swiss and Japanese 10-year government bonds are yielding negative returns. Investors are, in effect, paying these governments for the privilege of lending them money. Nonetheless, consumers are not borrowing and spending…they are hoarding cash.

Similarly, Fed policies have continued to focus on stimulating growth with the issuance of cheap credit. By comparison, the U.S. 10-Year Treasury note is yielding about 1.7 percent. Yet even this paltry rate is having the opposite effect of what the Fed intended.

Somehow all the smart and clever government economists miscalculated what it is, exactly, their policies would be doing. Specifically, ultra-low or negative rates are not encouraging consumers to borrow and spend money. To the contrary, they’re encouraging an increase in savings.

Double Whammy Economics

The rationale for why ultra-low interest rates encourage saving, not spending, was recently elaborated by Larry Fink, CEO of Blackrock, in his annual letter to shareholders. Here is the key excerpt…

“Not nearly enough attention has been paid to the toll these low rates — and now negative rates — are taking on the ability of investors to save and plan for the future. People need to invest more today to achieve their desired annual retirement income in the future. For example, a 35-year-old looking to generate $48,000 per year in retirement income beginning at age 65 would need to invest $178,000 today in a 5 percent interest rate environment. In a 2 percent interest rate environment, however, that individual would need to invest $563,000 (or 3.2 times as much) to achieve the same outcome in retirement.

“This reality has profound implications for economic growth: consumers saving for retirement need to reduce spending if they are going to reach their retirement income goals and retirees with lower incomes will need to cut consumption as well. A monetary policy intended to spark growth, then, in fact, risks reducing consumer spending.”

This critical and seemingly obvious insight has been utterly lost on the Fed and their cohorts the world over. Central bank efforts to stimulate demand with ultra-low interest rates have been an abject failure. Moreover, they’ve also had the ill-effect of producing the largest misallocation and malinvestment of capital resources the world has ever seen.

This includes misdirecting capital into U.S. stocks and Treasuries, residential real estate, Chinese real estate, emerging market stocks, mining of raw materials, shale oil wells, and just about every financial asset you can point to.

No doubt, the double whammy of choking off economic growth and puffing up financial assets has destructive financial and economic consequences. Presently, we’re discovering a little more of the damaging effects almost every day. Soon full-scale destruction may bear down on us.

M N. Gordon is the editor and publisher of the Economic Prism.