Recent moves will reassure financial markets. Nevertheless, excess credit growth raises the risk of a crash in China in a few years’ time. Lending to the economy reached record levels in China in January, suggesting that the authorities are prepared to do more to support growth. A stabilisation of the yuan and an admission by the authorities of mistakes in their approach to financial markets are also positive signs. Market fears around China may therefore temporarily abate. However, reliance on credit expansion to sustain economic growth is storing up problems for the future. Total lending in China (credit from all sources) rose to a monthly record of 3.42trn yuan (USD520bn) in January, up from 1.82trn yuan in December and above expectations of 2.2trn yuan. Local-currency lending by domestic banks increased to 2.4trn yuan, also a record, compared with expectations of 1.9trn yuan. There had already been some expectation that January would be a big month for lending, which was factored into estimations. First, banks have fresh lending quotas for the new calendar year and tend to front-load, lending especially heavily in January. Second, lending was accelerated by the Chinese new year, which fell 11 days earlier than in 2015. However, the surge in credit exceeded even these expectations.

Topics:

Bhaskar LAXMINARAYAN considers the following as important: China, crash, credit, credit growth, growth, Macroview

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes French Government on Precipice, Presses Euro Lower

Marc Chandler writes Ueda Lifts Yen, Leaving Euro and Sterling Pinned Near Lows

Marc Chandler writes FX and Rates Unwind Yesterday’s Powell Effect, US Index Futures Slide

Recent moves will reassure financial markets. Nevertheless, excess credit growth raises the risk of a crash in China in a few years’ time.

Lending to the economy reached record levels in China in January, suggesting that the authorities are prepared to do more to support growth. A stabilisation of the yuan and an admission by the authorities of mistakes in their approach to financial markets are also positive signs. Market fears around China may therefore temporarily abate. However, reliance on credit expansion to sustain economic growth is storing up problems for the future.

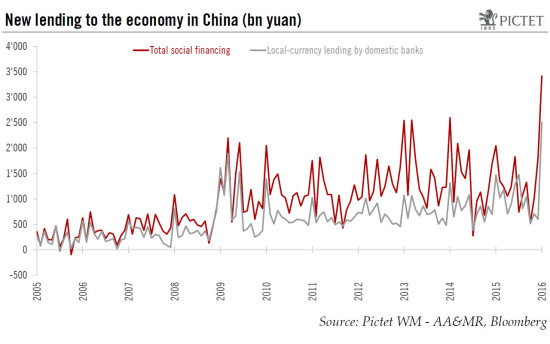

Total lending in China (credit from all sources) rose to a monthly record of 3.42trn yuan (USD520bn) in January, up from 1.82trn yuan in December and above expectations of 2.2trn yuan. Local-currency lending by domestic banks increased to 2.4trn yuan, also a record, compared with expectations of 1.9trn yuan.

There had already been some expectation that January would be a big month for lending, which was factored into estimations. First, banks have fresh lending quotas for the new calendar year and tend to front-load, lending especially heavily in January. Second, lending was accelerated by the Chinese new year, which fell 11 days earlier than in 2015. However, the surge in credit exceeded even these expectations. External deleveraging by Chinese corporates concerned about yuan depreciation played some role, but foreign-currency denominated loans declined by only 172bn yuan.

It appears therefore that the Chinese authorities are providing additional stimulus to the economy in order to support growth. Real GDP growth slowed to 6.8% y-o-y in the fourth quarter of 2016, the slowest quarterly rate of growth since 2009, for full-year growth of 6.9%. The authorities are targeting growth of 6.5%-7% this year, and against a background of continued weakness in the manufacturing sector, the strong start to the year for lending affirms that they are determined to meet that target—especially in light of the approaching party congress in 2017, when the president, Xi Jingping, will be looking to consolidate his position. This offers reassurance in the face of continued market fears about slowing growth in China.

Another major concern for markets has been the depreciation of the yuan. Here, too, recent moves offer encouragement. On 15 February the PBoC fixed the yuan 0.3% higher against the USD, prompting the spot rate to rise 1% overall against the USD to 6.49, its strongest level this year. Essentially, given recent dollar weakness, this was necessary merely to keep the yuan stable. Nevertheless, it provides an important signal that the People’s Bank of China (PBoC) is not seeking to devalue the currency further at this stage. The Chinese authorities would welcome a weaker yuan, but moves in this direction in August, December and January have highlighted the undesired effects of increasing capital flight and unsettling global equity markets. Nevertheless, a stable CNY basket in a strong USD environment calls for a weaker CNY against USD, and we forecast a year-end rate of CNY6.85 per USD—a relatively modest depreciation.

A further positive sign is that the authorities have publicly accepted that mistakes have been made in their approach to managing financial markets. Policy mis-steps (such as the ill-conceived ‘circuit-breakers’ designed to alleviate equity-market sell-offs, introduced in January and swiftly withdrawn) and poor communication (such as over the depreciation of the yuan) exacerbated market volatility in January. Since then, the China Securities Regulatory Commission (CSRC) and the PBoC have received public criticism, most notably with the prime minister, Li Keqiang, commenting on 15 February with regard to the market turmoil in January that “the major responsible departments took inadequate actions and had internal management issues”. He also stressed that intervention was justified. Nevertheless, such open discussion of policy failings, which is unusual in China, suggests that lessons have been learned and that the authorities are keen to reassure markets.

Large injections of credit into the economy bode well for the growth outlook in the short term. Such policy support is in line with our forecast for the authorities to deploy stimulus measures as needed (‘stop-go’ policies) to achieve their growth target for this year—we forecast real GDP growth of 6.5%, at the lower end of the target range.

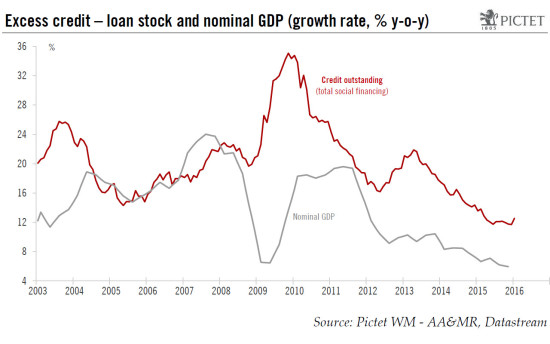

Excess credit growth will though add to imbalances in the economy, at a time when China is going through a difficult transition to a new growth model. At 13.3% y-o-y in January, credit growth remains well above nominal GDP growth, as it has ever since 2009 (see chart). New debt-fuelled stimulus increases the risk of a ‘Minsky moment’ for the economy—a sudden, sharp collapse of asset prices—in a few years’ time.

However, we do not think that such a collapse is imminent, contrary to some recent analysis. The eventual crystallisation of losses in the banking and large shadow-banking sectors is a concern, but at present the system has ample liquidity and recapitalisation is not an immediate issue. The authorities also retain considerable policy leeway. For instance, government debt is just 40% of GDP (compared with typically around 100% of GDP in developed economies). They can therefore continue to support growth in the near term.

For now, markets have been encouraged by recent policy moves. The Shanghai Composite Index rose by 3.3% on 16 February, its biggest gain this year. If global markets remain stable, further gains could follow. However, the rebound is likely to be tactical and short-lived. Pending reforms could create instability—notably new rules for stricter classification and provisioning for non-performing loans, which could lead to fresh concerns about the health of the banking sector. Recent newsflow has been positive, supporting a rally in equities, but China will remain a source of volatility for global markets.