Financial stress is threatening the fragile euro area recovery, especially the credit cycle. More negative rates are likely to be part of the ECB’s response We expect the ECB to cut the deposit rate to -0.50% by June, probably in two steps (by 10bp in March and by another 10bp in June), as part of its response to weaker inflation prospects and tighter financial conditions. That said, the adverse consequences of negative rates are becoming increasingly visible as foreign central banks are engaging more aggressively in Negative Interest Rate Policy (NIRP), with mixed results. For the euro area in particular, we deem the net effects of negative rates in the euro area as counterproductive, albeit nor insurmountable. Importantly, the marginal impact on the currency – the ECB’s ultimate target, in our view – has decreased significantly. The ECB should try and mitigate the side-effects of more negative rates. Firstly, a multi-tiered deposit system similar to the one introduced by the Bank of Japan would help reduce the cost for the banking sector, which is skewed towards core countries anyway. Specifically, a higher share of bank excess reserves could be exempted from negative rates, including part of the liquidity borrowed from TLTROs, creating an incentive for banks to lend to the real economy, i.e. killing two birds with one stone.

Topics:

Frederik Ducrozet considers the following as important: ECB, euro area, Macroview, TLTROs

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes FX Becalmed Ahead of the Weekend and Next Week’s Big Events

Financial stress is threatening the fragile euro area recovery, especially the credit cycle. More negative rates are likely to be part of the ECB’s response

We expect the ECB to cut the deposit rate to -0.50% by June, probably in two steps (by 10bp in March and by another 10bp in June), as part of its response to weaker inflation prospects and tighter financial conditions. That said, the adverse consequences of negative rates are becoming increasingly visible as foreign central banks are engaging more aggressively in Negative Interest Rate Policy (NIRP), with mixed results. For the euro area in particular, we deem the net effects of negative rates in the euro area as counterproductive, albeit nor insurmountable. Importantly, the marginal impact on the currency – the ECB’s ultimate target, in our view – has decreased significantly.

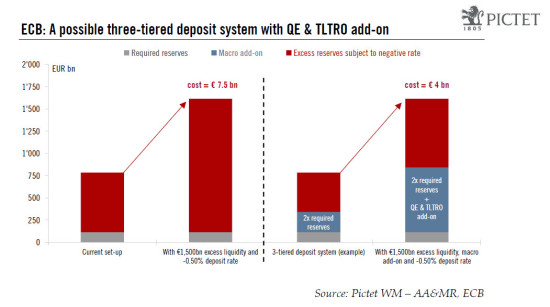

The ECB should try and mitigate the side-effects of more negative rates. Firstly, a multi-tiered deposit system similar to the one introduced by the Bank of Japan would help reduce the cost for the banking sector, which is skewed towards core countries anyway. Specifically, a higher share of bank excess reserves could be exempted from negative rates, including part of the liquidity borrowed from TLTROs, creating an incentive for banks to lend to the real economy, i.e. killing two birds with one stone. Secondly, we expect the ECB to make TLTRO more attractive through maturity extensions (beyond September 2018), lower borrowing costs (at a negative spread relative to the ECB’s refi rate), and possibly new operations. Lastly, the ECB could remove the yield floor for QE purchases (set at the deposit rate), thereby helping implementation of the programme to run more smoothly.

From a broader macro angle, the banking sector is much more robust than a few years ago and conditions are still in place for credit flows to pick up in the coming months, provided that financial tensions ease. We still expect the credit impulse to improve in the next few months, supporting domestic demand. Despite rising external risks, we have left our euro area GDP growth forecast unchanged, at 1.8% for this year.

Even so, there are limits to what more negative rates can achieve in the euro area and side-effects should not be understated, including for the non-bank sector such as money market funds. We continue to believe that a more appropriate response would be for the ECB to boost its credit and quantitative easing programmes. We expect the ECB to increase the monthly pace of QE by up to EUR20bn, to EUR80bn per month, while broadening the universe of eligible securities and adjusting the technical features of the programme in a more flexible way, including issue limits.