CEPR Discussion Paper 18444, September 2023. HTML (local copy). Abstract: We analyze the role of retail central bank digital currency (CBDC) and reserves when banks exert deposit market power and liquidity transformation entails externalities. Optimal monetary architecture minimizes the social costs of liquidity provision and optimal monetary policy follows modified Friedman (1969) rules. Interest rates on reserves and CBDC should differ. Calibrations robustly suggest that CBDC provides...

Read More »Ep 40 – Dan Oliver Jr: Markets Will Force the Fed to Balance

Dan Oliver of Myrmikan Capital joins Keith and Dickson on the Gold Exchange Podcast to talk about the history of credit bubbles, the inevitability of central bank failings, and what history can tell us about the Fed’s current trajectory. Connect with Dan on Twitter: @Myrmikan and at Myrmikan.com Connect with Keith Weiner and Monetary Metals on Twitter: @RealKeithWeiner@Monetary_Metals [embedded content] Additional Resources CMRE.org Myrmikan.com Gold Backwardation...

Read More »Weekly Market Pulse: A Most Unusual Economy

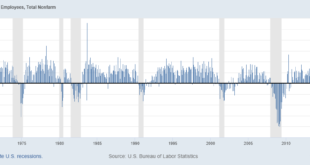

The employment report released last Friday was better than expected but the response by bulls and bears alike was exactly as expected. Both found things in the report to support their preconceived notions about the state of the economy. I do think the bulls had the better case on this particular report but there have been plenty of others recently to support the ursine side of the aisle too. My take is that everything about the economy right now, and really since...

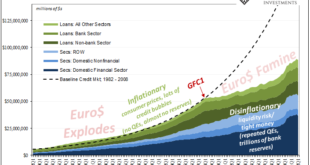

Read More »The Everything Data’s (Z1) Verdict: Not Inflation, Only More Of The Same

The only thing that changed was the CPI. What distinguishes 2021-22 from the prior post-crisis period 2007-20 is merely the performance of whatever consumer price index. This latter has been called inflation, yet the data conclusively support the market verdict pricing how it never was. What data? The “everything” data, the most comprehensive financial and monetary compendium yet available: The Financial Accounts of the United States, or Z1. While this doesn’t quite...

Read More »David Graeber’s “Debt”

Goodreads rating 4.19. Graeber’s book contains many interesting historical observations but lacks a concise argument to convince a brainwashed neoclassical economist looking for coherent arguments on money and debt. After 60 pages, 340 more seemed too much. Chapter one: … the central question of this book: What, precisely, does it man to say that our sense of morality and justice is reduced to the language of a business deal? What does it mean when we reduce moral obligations to debts? …...

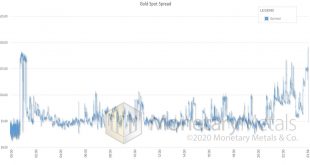

Read More »The Out Has Not Yet Begun to Fall, Market Report 31 March

So, the stock market has dropped. Every government in the world has responded to the coronavirus with drastic, if not unprecedented, violations of the rights of the people. Not to mention, extremely aggressive monetary policy. And, they are about to unleash massive fiscal stimulus as well (for example, the United States government is about to dole out over $2 trillion worth of loot). The question on everyone’s mind is what will be the consequences? The standard...

Read More »Is Now a Good Time to Buy Gold? Market Report 16 March

We got hate mail after publishing Silver Backwardation Returns. It seems that someone thought backwardation means silver is a backward idea, or a bad bet. “You are a *&%#! idiot,” cursed he. “Silver is the most underpriced asset on the planet,” he offered as his sole supporting evidence. He doesn’t know that backwardation means scarcity, not that a commodity’s price is too high. Since we wrote that on March 2 (our Reports are always based on the prior Friday’s...

Read More »“Our prosperity is temporary and illusory. “ – Jeff Deist

As we go through an important paradigm shift in politics, in the global economy, in equity markets, and of course in precious metals too, the fundamental economic principles we used to rely on seem to be increasingly under attack. Central bankers the world over are doubling down on reckless monetary policies, punishing savers and responsible, long-term investors. In Europe, we have already seen the damage that negative interest rates and protracted QE have inflicted, and will continue to...

Read More »“Our prosperity is temporary and illusory. “ – Jeff Deist

As we go through an important paradigm shift in politics, in the global economy, in equity markets, and of course in precious metals too, the fundamental economic principles we used to rely on seem to be increasingly under attack. Central bankers the world over are doubling down on reckless monetary policies, punishing savers and responsible, long-term investors. In Europe, we have already seen the damage that negative interest rates and protracted QE have inflicted, and will continue...

Read More »The Failure of a Gold Refinery, Report 12 Nov 2018

So this happened: Republic Metals, a gold refiner, filed bankruptcy on November 2. The company had found a discrepancy in its inventory of around $90 million, while preparing its financial statements. We are not going to point the Finger of Blame at Republic or its management, as we do not know if this was honest error or theft. If it was theft, then we would not expect it to be a simple matter of employees or...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org