Followers of the gold and silver price will have long been aware of the cases brought against large banks for manipulating the precious metals markets. This week has brought the issue to the fore as three former JP Morgan employees stand trial for “racketeering conspiracy as well as conspiring to commit price manipulation, wire fraud, commodities fraud and spoofing from 2008 to 2016”. JP Morgan Chase & Co. has long been known to have an oversized influence on the gold paper market. Accounting for upwards of 65% of the derivative contracts in precious metals put through U.S. banks. This is three times that of the next largest Citigroup. Inc. This week the criminal trial for three of JP Morgan Chase & Co.’s most influential precious metal traders started in

Topics:

Stephen Flood considers the following as important: 6a.) GoldCore, 6a) Gold & Monetary Metals, Commentary, Economics, Featured, Geopolitics, Gold, gold price, gold price prediction, gold price today, inflation, JP Morgan, News, newsletter, Precious Metals, S&P 500, S&P 500, silver, silver price, SPX, stock market

This could be interesting, too:

finews.ch writes Franken-Stablecoin-Vereinigung setzt Beirat ein

finews.ch writes Die stille Supermacht: Warum Indien für Investoren zunehmend relevant wird

finews.ch writes Spezielle Premiere an der Schweizer Börse

finews.ch writes Mehr Schweiz: AllianzGI macht den nächsten grossen Schritt

| Followers of the gold and silver price will have long been aware of the cases brought against large banks for manipulating the precious metals markets.

This week has brought the issue to the fore as three former JP Morgan employees stand trial for “racketeering conspiracy as well as conspiring to commit price manipulation, wire fraud, commodities fraud and spoofing from 2008 to 2016”. JP Morgan Chase & Co. has long been known to have an oversized influence on the gold paper market. Accounting for upwards of 65% of the derivative contracts in precious metals put through U.S. banks. This is three times that of the next largest Citigroup. Inc. This week the criminal trial for three of JP Morgan Chase & Co.’s most influential precious metal traders started in Chicago. |

|

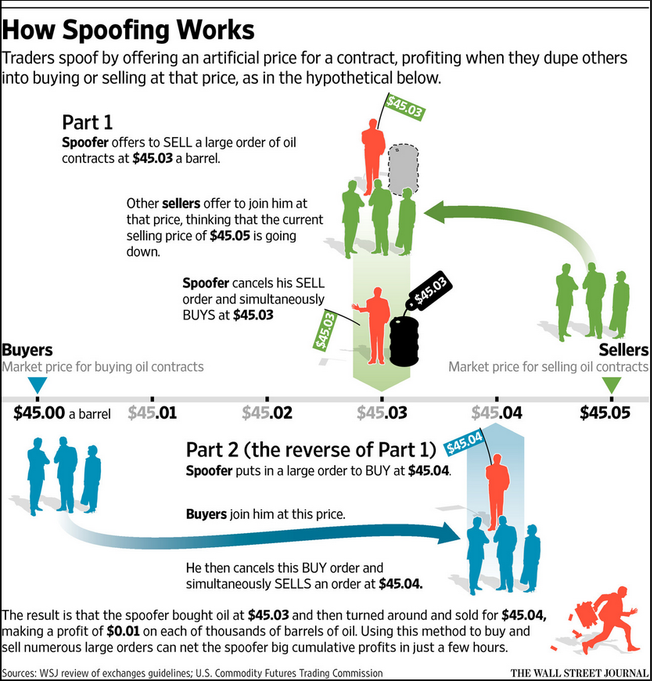

Gold Market Manipulation with Spoofing TradesOne of three on trial is Michael Nowak, former managing director for JP Morgan Chase & Co., who ran their precious metals business for more than 10 years. Bloomberg also described him as once the most powerful person in the gold market. Mr. Nowak made hundreds of millions of dollars in profit trading precious metals at JP Morgan. He was also a board member of the body that runs the London gold market. He now faces a slew of charges on manipulation of the gold market with spoofing trades. As we have always reminded readers, the banks – central or otherwise, never have your own best interest at heart. We detail some of the alleged crimes below but remember our refrain about gold…if you or Goldcore don’t hold it then you don’t own it. Spoofing is planting large fake orders to buy or sell futures contracts and then cancelling the order before the deal’s execution. The intent is to create false sentiment in the market. Then the trader can manipulate the actions of other market participants and change the price of a security, thereby making a profit. The infographic below from the Wall Street Journal shows an example of how a trader can profit from a spoofing scam using the oil futures market as an example. |

|

| Spoofing in futures works the same for oil or gold. This is ironic since everyone is coming to recognise that ‘paper gold’ is not the same as physical gold, which is obviously also true for oil.

However, lofty expectations and profit at any cost, plus their use of

It is estimated that traders working for Norwak placed more than 50,000 spoofing trades over a decade. Edmonds has also pleaded guilty for the manipulation of silver contracts. |

We note that spoofing as a business practise requires leverage and the willingness to cheat. Goldcore refutes both these items.

Spoofing became more prominent through the 2000s as algorithms improved, causing the rise in high frequency trading, which allowed for very quick execution of trades.

Regulation around high frequency trading lagged the industry and not until The Dodd-Frank Act in 2010 really defined and made it illegal. But it has taken even longer for the government to investigate and crack down on violators.

The Dodd-Frank Act was new U.S. legislation after the 2008 financial market meltdown.

One of the most well-known cases of spoofing is the ‘flash crash’ in 2010. This was when almost $1 trillion erasing in market value from U.S. stock markets. In a matter of about 10 minutes, the DJIA (Dow Jones Industrial Average) plummeted almost 1000 points, then recovered almost 600 points over the next 30 minutes.

A London-based trader determined in 2015 the primary cause of the flash crash was spoofing. He entered a very large order for e-mini S&P 500 stock index futures contracts with the intent to cancel the order prior to execution.

His large order stampeded certain high-frequency algorithms into aggressive selling executed that triggered the massive market declines.

In 2020 after years of investigation, the US government ordered JP Morgan to pay US$920 million to settle spoofing claims in the precious metals futures market.

If you don’t hold it then you don’t own it

JP Morgan is not alone in its manipulation of the precious metals market. ‘In 2021, two Bank of America Corp. precious-metals traders were convicted in Chicago. A year earlier, a jury found two from Deutsche Bank AG guilty, while others reached plea agreements and cooperated with authorities.’ (Bloomberg).

JP Morgan is the largest bank in the space and the trading desk worked as a group to manipulate the market.

Hence U.S. prosecutors have also added charges under the Racketeer Influenced and Corrupt Organizations Act. They are usually reserved for gangs and the mafia!

Also, manipulation in the gold paper market is an ongoing battle. Also, not knowing the intent of the counterparty is always a factor. We are unaware of spoofing in the physical metals market nor can we envision how global banks could attempt such actions.

This is why we always recommend to those who wish to hold gold and silver as part of a balanced portfolio, to buy physical gold. As we said earlier, if you or GoldCore don’t hold it then you don’t own it.

On Sunday we released the second episode of our hit new show The M3 Report. The M3 Report brings the viewer the best of GoldCore commentary analysis, fantastic guests, Chart Watch, and bonus clips from industry experts.

Presented by our very own Dave Russell the show takes an irreverent look at financial markets and the double speak of policy makers, to help you better understand what’s really going on with your money.

In this latest offering Dave and the team take on inflation, they ask is the futility of inflation simply the futility of central bankers?

Dave discusses this (and more) in the exclusive interview with Dr. Marc Faber, whilst Gareth Soloway brings us some brilliant chart analysis in Chart Watch.

And don’t miss Trading Places! What would you do if you were Head of the Fed? We asked six of our favourite guests. We’re not ruining anything by saying that no one wants to be Head of the Fed!

If you haven’t already then make sure you’re subscribed to GoldCoreTV, so you’ll be the first to see new releases!

Tags: Commentary,Economics,Featured,Geopolitics,Gold,gold price,gold price prediction,gold price today,inflation,JP Morgan,News,newsletter,Precious Metals,S&P 500,silver,silver price,SPX,stock market