Those watching the gold price and price of silver will have noticed the sharp uptick following the Federal Reserve’s announcement, yesterday. This was despite the Fed doing exactly what everyone expected them to do. For now, the Federal Reserve is sticking to its relatively well-telegraphed plan but how long will it be until they need to move the goalposts in order to do so? . Gold and Silver prices rose sharply on the Fed’s statement on Wednesday. The change of...

Read More »What happens if the debt ceiling raises

It’s that time again when the US government has to prepare itself for an internal battle to raise the debt ceiling so it can meet various obligations. This is a merry dance that has been danced before, as we mention below. For sure, every time it happens fewer and fewer people are convinced of the trustworthiness of the US dollar. This combined with the recent announcement by Saudi Arabia of its willingness to consider trading in currencies other than the US Dollar...

Read More »Here are three things you can learn from the Fed

Anyone who has decided to buy gold, or follows the gold price will be aware of how powerful the US Federal Reserve is. This year the Federal Reserve will turn 110 years old, only in recent years is dollar hegemony appearing to falter. Below we look at the central bank’s origins and three lessons we can learn from the history of the world’s most powerful bank, in order to help our investment decisions in 2023. Is the FED’s institutional history about to repeat...

Read More »Weekly Market Pulse: Currency Illusion

When we think about the challenges facing an investor today, the big problems, the things we worry about that could cause a lot more harm than some interest rate hikes, are mostly outside the United States. China is prominent this weekend because of demonstrations against their zero COVID policies. The Chinese people appear to be pretty well fed up with the endless lockdowns and have finally decided to try and do something about it. Unfortunately, I’m not sure...

Read More »Weekly Market Pulse: Good News, Bad News

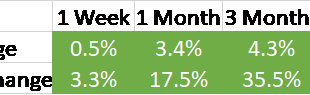

One thing I can tell you for certain about last week’s big rally on Thursday and Friday: there were a lot of people who desperately wanted a good excuse to buy stocks. And buy they did after a better-than-expected CPI report Thursday morning, pushing the S&P 500 up nearly 6% on the week with all of that coming on Thursday and Friday. The same could be said of bonds which also had a good week, with the aggregate index up 2.3%. The stock market rally probably says...

Read More »Weekly Market Pulse: Just A Little Volatility

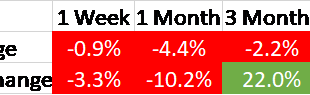

Markets were rather volatile last week. That’s a wild understatement and what passes for sarcasm in the investment business. Stocks started the week waiting with bated (baited?) breath for the inflation reports of the week. It isn’t surprising that the market is focused firmly on the rear view mirror for clues about the future since Jerome Powell has made it plain that is his plan, goofy as it is. Stocks were down slightly Monday and Tuesday fearing the worst and...

Read More »Weekly Market Pulse: Same As It Ever Was

History never repeats itself. Man always does. Voltaire Mark Twain is credited with a similar saying, that history doesn’t repeat but it rhymes. Of course, there is scant evidence that Clemens said anything of the sort just as Voltaire may or may not have penned the quote above. But both men were much wittier than I – than most – so I’ll take them both as being representative if not genuine. I have been a professional investor for now over 30 years and I have seen...

Read More »Weekly Market Pulse: Opposite George

It all became very clear to me sitting out there today, that every decision I’ve ever made, in my entire life, has been wrong. My life is the complete opposite of everything I want it to be. Every instinct I have, in every aspect of life, be it something to wear, something to eat… It’s all been wrong. Every one. – George Constanza If every instinct you have is wrong, then the opposite would have to be right. – Jerry Seinfeld From the Seinfeld episode “The Opposite” I...

Read More »A muddled message from The Fed

If you have decided to buy gold bullion or to buy silver coins in the last few months then you may have been delighted with how last night’s Fed press conference went. If you’re still wondering if or how to invest in gold then it might be worth paying attention to what central banks are doing in the coming weeks. After all, how do central banks make their decisions when it comes to monetary policy? In years before it might have been quite straightforward...

Read More »Gold traders on trial: Only buy physical

Followers of the gold and silver price will have long been aware of the cases brought against large banks for manipulating the precious metals markets. This week has brought the issue to the fore as three former JP Morgan employees stand trial for “racketeering conspiracy as well as conspiring to commit price manipulation, wire fraud, commodities fraud and spoofing from 2008 to 2016”. JP Morgan Chase & Co. has long been known to have an oversized influence on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org