In the third quarter of 2019, one in which the global economy continued to cycle lower, global central banks across the world continued to slash interest rates and launched/expanded quantitative easing programs with very little success at troughing global growth. Still, US equity indices powered to new highs, climbing a wall of worry of President Trump’s “trade optimism” tweets. It seemed quite evident over the quarter that President Trump’s tweeting of constant fake trade news and record stock buybacks juiced the market to new highs, however, what was really taking place was the Swiss National Bank (SNB) printing money out of thin air buying stocks with no regard for price or cost. SNB’s motive was to boost market confidence that a 2016-style rebound in the

Topics:

Tyler Durden considers the following as important: 1) SNB and CHF, 1.) Zerohedge on SNB, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

| In the third quarter of 2019, one in which the global economy continued to cycle lower, global central banks across the world continued to slash interest rates and launched/expanded quantitative easing programs with very little success at troughing global growth. Still, US equity indices powered to new highs, climbing a wall of worry of President Trump’s “trade optimism” tweets.

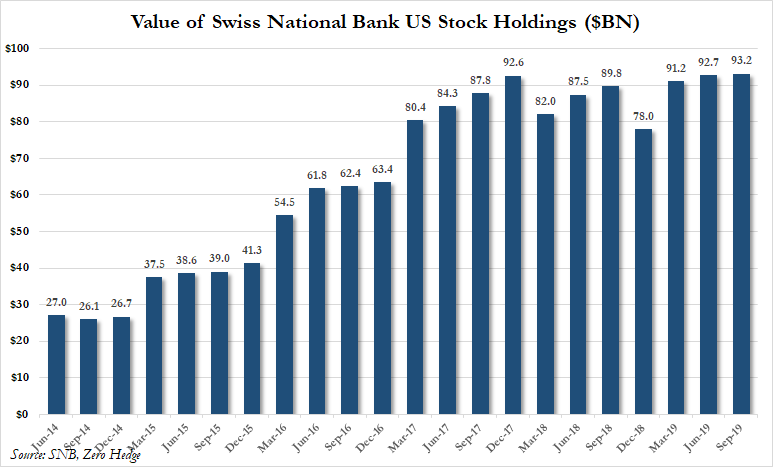

It seemed quite evident over the quarter that President Trump’s tweeting of constant fake trade news and record stock buybacks juiced the market to new highs, however, what was really taking place was the Swiss National Bank (SNB) printing money out of thin air buying stocks with no regard for price or cost. SNB’s motive was to boost market confidence that a 2016-style rebound in the economy was imminent by sending stock indexes to new highs. The SNB’s latest 13F showed total holdings of US stocks have hit a record high, now valued at $94.1 billion, up 1.5% in 3Q. |

Value of Swiss National Bank US Stock Holdings, 2014-2019 |

| Some notable observations: in the third quarter, after the SNB printed money out of thin air, it then added 1.28 million shares of BABA, 970K shares of FIS, 628K of JD, 537K of JNPR, 472K of GPN, and 257K of MSFT.

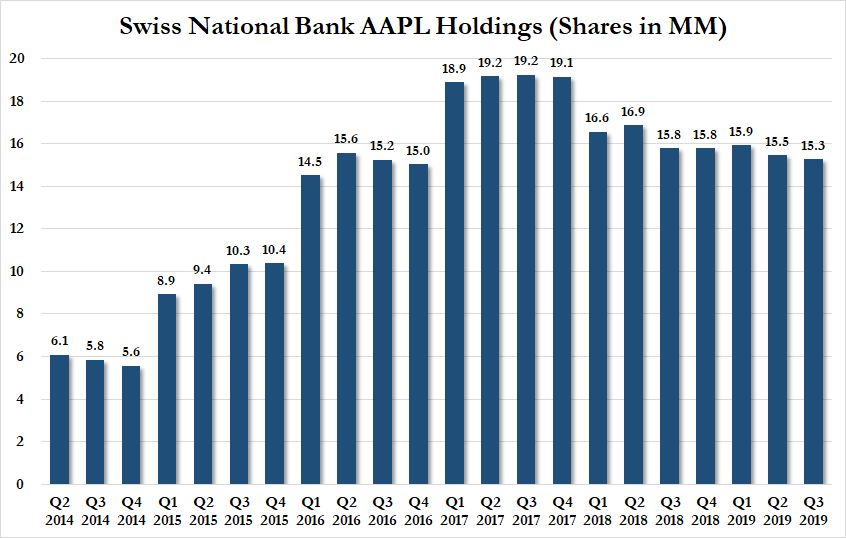

Other notable observations: it sold 1.85 million shares of FDC, -301K shares of ORCL, -229K shares of CSCO, and -188K shares of AAPL. |

Swiss National Bank AAPL Holdings, 2014-2019 |

| Top holdings continue to be AAPL (3.63% of total portfolio), MSFT (3.58% of total portfolio), AMZN (2.55% of total portfolio), FB (1.50% of total portfolio), and GOOG (1.34% of total portfolio).

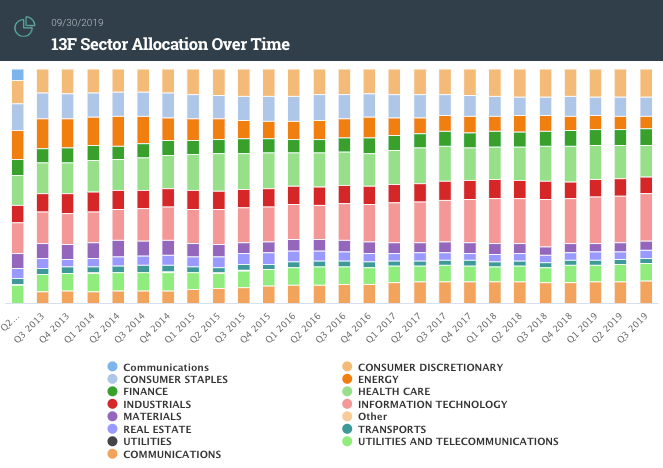

SNB’s asset allocation over the last six years has been heavyweight technology, healthcare, and consumer discretionary stocks. SNB printing money out of thin air and buying a handful of stocks that push the broader equity market to new highs, has created an illusion that President Trump’s “trade optimism” could lead to a global economic recovery. And when a global recovery doesn’t come — the trade war will be blamed. |

13F Sector Allocation Over Time |

Tags: Featured,newsletter