The collapse of Greensill Capital has been the biggest financial scandal of the year so far, having set off a massive public corruption scandal in the UK that has deeply embarrassed the ruling Conservative Party due to the close involvement of former PM David Cameron, who was on the Greensill payroll and was caught trying to steer relief funds meant for small businesses to Greensill to help avert its collapse. Most recently, Credit Suisse cited Greensill as its...

Read More »“Everything Is On Fire”

Authored by Egon von Greyerz via GoldSwitzerland.com, “Everything is on fire” – Heraclitus (535-475 BC) What Heraclitus meant was that the world is in a constant state of flux. But the big problem in the next few years is that the world will experience a fire of a magnitude never seen before in history. I have in many articles and interviews pointed out how predictable events are (and people). This is particularly true in the world economy. Empires come and go,...

Read More »UBS Reportedly Re-Starts Layoffs After “Doubling” One Time Bonuses To Some Associates

On one hand, UBS seems hell bent on keep its new Gen Z employees who have recently been promoted to associate positions. After all, it was just hours ago that we wrote about how the bank was showering some newly promoted employees with one-time $40,000 bonuses. Yet on the other hand, UBS apparently isn’t as determined to hang on to certain other employees. The bank has reportedly re-started its “Reduction in Force” job cut plan this week, according to Bloomberg, who...

Read More »UBS, Desperate To Retain Talent, Now Offering $40,000 Bonuses To Newly Promoted Associates

It looks like the hiring (and retention) shortage isn’t just for rank-and-file minimum wage jobs. UBS has now said that, amidst historic competition and a “retention crisis” in the investment banking world (which we noted weeks ago), it is going to pay a one time $40,000 bonus to its global banking analysts when they are promoted. This is double what some of the bank’s competitors are offering. It’s part of a push for lenders “to reward and retain younger employees...

Read More »Credit Suisse Hires Former Prime Brokerage Head To Restore Business After Archegos Blowup

After firing a raft of senior employees including its head of risk, Lara Warner, Credit Suisse has been struggling to move past a series of major risk-management failures that together could cost the bank $10 billion, or more, though the final tally of losses from the Archegos blowup isn’t yet known as the bank weighs whether it should cover some client losses associated with the “low risk” trade-finance funds that collapsed earlier this year. Following reports that...

Read More »Gold Is Laughing At Powell

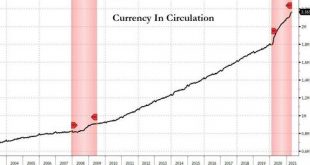

Authored by Matthew Piepenburg via GoldSwitzerland.com,Recently, my colleague, Egon von Greyerz, and I had some unabashed yet blunt fun calling out the staggering levels of open hypocrisy and policy desperation unleashed by former Fed Chairman, Alan Greenspan.Poor Alan was an easy target of what I described as the “patient zero” of the reckless interest rate suppression and unbridled monetary expansion policies of the Fed which have always led to equally reckless...

Read More »The $3 Trillion Hidden Exposure Behind The Archegos Blowup

Authored by Nick Dunbar of Risky FinanceWhen the family office Archegos Capital abruptly imploded in late March, prompting $50 billion in block trades and $10 billion in losses at Credit Suisse, Nomura, UBS and Morgan Stanley, many bank analysts were taken by surprise. Last week, many of these analysts sounded frustrated listening to Credit Suisse’s earnings call in which senior management skirted round without giving any real detail about the disaster.“Do you think...

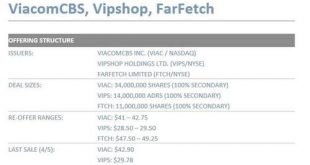

Read More »Credit Suisse Dumping Huge Archegos Blocks; Liquidating Millions In VIACS, VIPS And FTCH

Literally moments ago we said that the Archegos portoflio was being sold off all day on fears of “stealth” prime broker deleveraging, as tens of millions of shares were yet to be accounted for. Then, moments after 5pm, Credit Suisse – the firm that was hammered the hardest by the Archegos implosion and which had yet to provide a detailed breakdown of its Bill Hwang-linked P&L – confirmed what we said, when it unveiled a massive secondary offering dump, including...

Read More »Gold Could Offer A Way Out Of Switzerland’s Failing Inflationist Experiment

Never mind that the US Treasury’s indictment late last year of Switzerland as a currency manipulator rested on some flawed evidence and does not identify the crime. The clash between Washington and Berne marks another episode in this alpine nation’s dark history of trucking with foreign repression rather than developing its potential as a global haven and beacon of freedom. Occasionally there have been bright interludes but none so far with respect to the last...

Read More »Jim Bianco: “This Is One Of The Biggest Moments Of Truth In Financial Market History”

Authored by Christoph Gisiger via TheMarket.ch, To contain the economic and financial ramifications of the coronavirus pandemic, Central Banks are going all in. Jim Bianco, founder and chief strategist of Bianco Research, warns that this time, monetary policy might be unable to stop financial markets from collapsing. The Federal Reserve brings out the bazooka: It cuts the federal funds rate down to zero and will buy $700 billion in Treasuries and mortgage-backed...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org