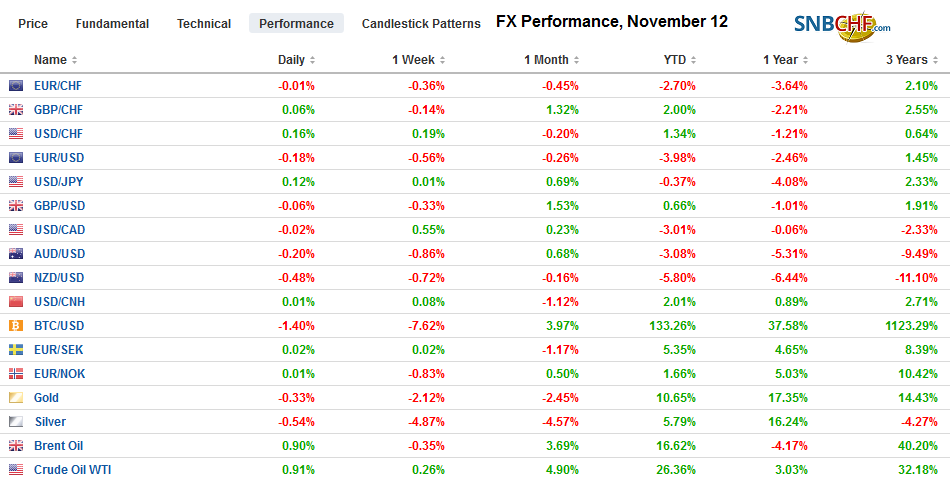

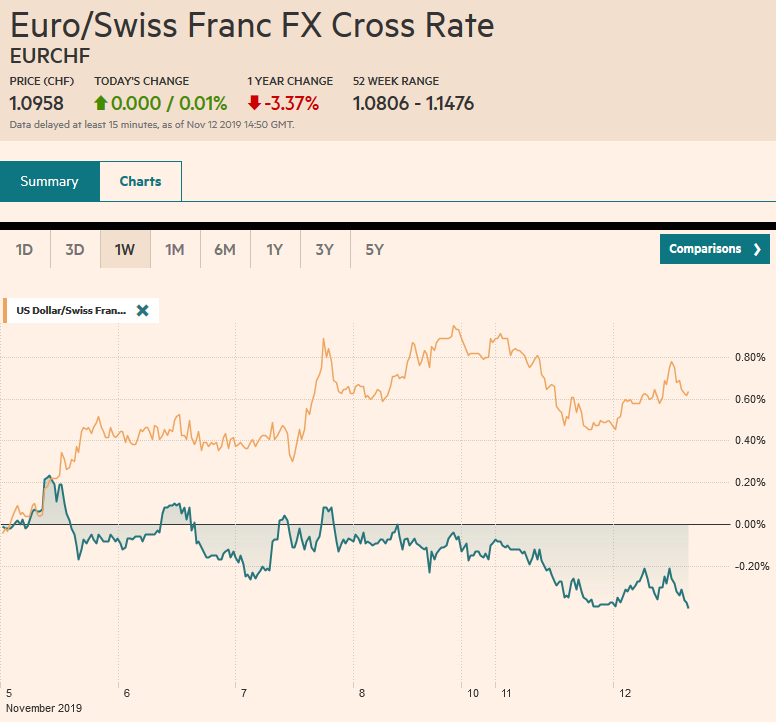

Swiss Franc The Euro has risen by 0.01% to 1.0958 EUR/CHF and USD/CHF, November 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global capital markets are calm as investors look for a new catalyst. The MSCI Asia Pacific Index snapped back after posting its first back-to-back decline in a month. All the equity markets were higher, but Australia. The Nikkei, Kospi, and Taiex led the advance with about a 0.8% gain. European shares closed firmly near session highs yesterday, even if still lower on the day, and there has been some follow-through buying today. The S&P 500 is little changed after ending a two-day advance yesterday with a 0.2% loss. Ten-year benchmark yields are firm near three-month highs. US

Topics:

Marc Chandler considers the following as important: 4) FX Trends, 4.) Marc to Market, Brexit, Currency Movement, EUR/CHF, Featured, FX Daily, newsletter, South Korea, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

Swiss FrancThe Euro has risen by 0.01% to 1.0958 |

EUR/CHF and USD/CHF, November 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Global capital markets are calm as investors look for a new catalyst. The MSCI Asia Pacific Index snapped back after posting its first back-to-back decline in a month. All the equity markets were higher, but Australia. The Nikkei, Kospi, and Taiex led the advance with about a 0.8% gain. European shares closed firmly near session highs yesterday, even if still lower on the day, and there has been some follow-through buying today. The S&P 500 is little changed after ending a two-day advance yesterday with a 0.2% loss. Ten-year benchmark yields are firm near three-month highs. US 10-year Treasurys are flat near 1.93%. The dollar slightly firmer against nearly all the major currencies. The New Zealand dollar and the British Pound are paring yesterday’s gains. Emerging market currencies are mixed.Eastern and Central European currencies, including the Russian rouble, are under modest pressure, while Asian currencies, led by the South Korean won and the Philippine peso, are mostly higher, including the Chinese yuan, though the dollar remains above CNY7.0. Gold is testing the $1450 area after peaking in early September a little shy of $1560. Light sweet crude oil for December delivery is in the middle of the $56-$58 recent range. |

FX Performance, November 12 |

Asia Pacific

Violence in Hong Kong has increased. More arrests are being made, but there is no end in sight. The council elections on November 24 are at risk, though no official word has been given. All 16 councils are up for election. This is for 452 of the 479 seats. Even though the candidates must be approved, the postponement of the election would likely further antagonize the protests.

Japan’s government is considering tax incentives, according to reports, to promote corporations using their vast retained earnings to buy unlisted companies that are less than ten-years-old. Separately, Japan reported machine orders fell 37.4% in October (year-over-year) after a 35.5% decline in September. Yesterday Japan reported that core machine orders fell 2.9% in September but that the industry outlook for October was better. The October machine orders saw the largest decline since the 10-year low was seen in June (-37.7%). The precipitous decline began in October 2018.

Yesterday, South Korea reported its exports fell 20.8% year-over-year in the first ten days of November, with semiconductor chip exports off a full third. Today it saw demand at its 10-year bond auction slump to nine-month lows despite a 30 bp jump in yields since the last auction. Besides the backing up of global yields, supply is a concern. The government has proposed selling KRW130 trillion of bonds next year after bringing almost KRW100 trillion to market this year. Next week, the government will auction KRW500 bln of 20-year bonds.

The dollar continues to straddle the JPY109 level. It remains within the range set last Thursday (~JPY108.65-JPY109.50). The intraday technical studies suggest an attempt higher is likely in the US morning. It has not been below JPY109.10 since early in the Asian session. The Australian dollar closed below its 20-day moving average (~$0.6860) yesterday for the first time since mid-October, and some mild follow-through selling has seen it slip to about $0.6830. This corresponds to the (38.2%) retracement of the rally from the October 1 lows (~$0.6670). The next retracement is near $0.6800.

Europe

After US President Trump advised Brexit Party head Farage to work with the Tories, Farage called on Johnson to abandon his withdrawal agreement. This was a non-starter from the get-go, and yesterday Farage unilaterally backed down and indicated that despite candidates spending their own funds, the Brexit Party would not run candidates in Tory strongholds (317 districts) and risk splitting the leave vote. This was enough to give sterling its biggest advance in three weeks (~0.8%). Farage has claimed to have been offered a peerage (appointment to a seat in the House of Lords). However, it may not be sufficient to help the Tories increase their support. What is needed, and maybe Farage’s next move is to agree to not run candidates in Labour-held districts in which a majority voted to leave.

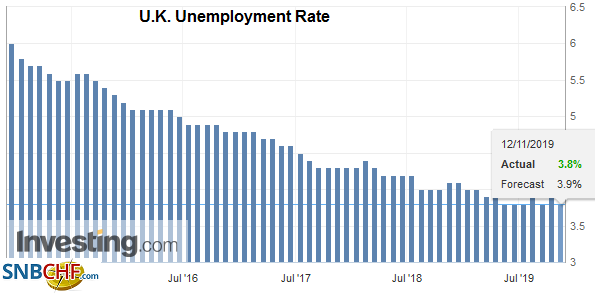

| Separately, the UK reported a mostly disappointing jobs report. The claimant count (those claiming unemployment benefits) rose to 33k in October, the highest since June 2017.Average weekly earnings, reported with a delay, slipped to 3.6% from 3.8%. The only good news was that the ILO’s measure of unemployment fell to 3.8% from 3.9%. |

U.K. Unemployment Rate, September 2019(see more posts on U.K. Unemployment Rate, ) Source: investing.com - Click to enlarge |

Germany’s ZEW survey shows bounced back, perhaps with the help of two-months of solid gains in the DAX. In September and October, the German stock market rose a combined 7.5% to reach new highs for the year. Investors surveys showed their current assessment edged higher to -24.7 from -25.3, the first increase since May. In the other hand, investors are feeling more optimistic about the future. The expectations component rose to -2.1 from -22.8. It matches the May reading.

The euro remains stuck within yesterday’s range (~$1.1015-$1.1045). There are two sets of expiring options that may be in play. There are roughly 535 mln euros at $1.1025, and almost 1.4 bln euros struck between $1.1075 and $1.1085. Sterling is also inside yesterday’s range (~$1.2780-$1.2900). The technical indicators warn it may remain mired in that range today.

America

President Trump speaks before the Economic Club of NY today. Although there is headline risk, it is unlikely to be the forum to announce new initiatives or plans. He is likely to celebrate the strength of the economy and equity market under his watch. Still, it must be regarded as a somewhat hostile audience. Many if not most of Wall Street economists cringe at his overt denigration of the Federal Reserve, and claiming it is a greater enemy than China. A repeat of the President’s call for negative interest rates would go over like a lead zeppelin. Nor does Trump’s penchant for tariffs strike a responsive chord among this crowd. If he wants to please his audience, Trump could confirm that the decision on tariffs on auto imports, which an investigation by the Commerce Department concluded six months ago were a threat to national security, could be postponed another six months as some reports suggested.

The US economic calendar is light but picks up starting tomorrow with the October CPI. Three Fed officials speak today (Clarida, Harker, and Kashkari). There seems to be a consensus among Fed officials that sufficient easing has been delivered and that monetary policy acts with a lag. There is practically no expectation for the Fed to ease at next month’s meeting. The economic calendar for Canada, Mexico, and Brazil has no market-moving reports.

After consolidating yesterday, the US dollar is extending its recent gains against the Canadian dollar. It has reached a new one-month high near CAD1.3255 in the European morning. Intraday technical readings are getting stretched before the North American session begins. The US dollar is approaching the 200-day moving average near CAD1.3275, and above there is last month’s high near CAD1.3350. The dollar fell against the Mexican peso in the first three weeks of October and has traded broadly sideways since. The range is roughly MXN19.00 to MXN19.25. The central bank meets Thursday, and a 25 bp cut is expected, which would bring the target rate to 7.5%, which is still high in nominal and real terms. The Dollar Index has recouped half of last month’s decline (~99.66 to ~97.10) around 98.40. It tested this area before the weekend and yesterday. Provided the 98.00 area holds now, there is potential toward 98.70.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,Currency Movement,EUR/CHF,Featured,FX Daily,newsletter,South Korea,USD/CHF