The expected March 2016 lift-off and negative short-term seasonal patterns are likely to result in a challenging short-term environment for the gold price. Our scenario favours a medium-term consolidation above the 00/oz threshold. The recent trend of the gold price has been closely linked to how the Fed’s tightening cycle is likely to pan out. The rationale is that higher rates make gold less attractive. While gold has no credit risk, it is a non-yielding asset. As a result, when real rates on almost “default-free” assets like US Treasuries start to rise, the opportunity cost of holding gold increases. Consequently, the Fed’s decision not to raise rates on 17 September has been supportive for gold. However, the rather hawkish tone of the FOMC meeting on 28 October suggests that the Fed is looking to raise rates at some point over the next few months, which should reduce the upside potential on gold. Furthermore, a more hawkish Fed is likely to strengthen the greenback, implying a lower price of gold when expressed in US dollars. One could argue that the upcoming Fed tightening cycle is one of the most telegraphed in history and that it should also be the most gradual and with the lowest terminal rate. As a result, the negative impact on investment demand should be reduced.

Topics:

Luc Luyet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The expected March 2016 lift-off and negative short-term seasonal patterns are likely to result in a challenging short-term environment for the gold price. Our scenario favours a medium-term consolidation above the $1000/oz threshold.

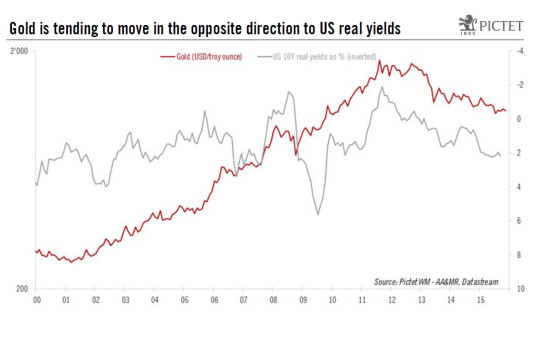

The recent trend of the gold price has been closely linked to how the Fed’s tightening cycle is likely to pan out. The rationale is that higher rates make gold less attractive. While gold has no credit risk, it is a non-yielding asset. As a result, when real rates on almost “default-free” assets like US Treasuries start to rise, the opportunity cost of holding gold increases. Consequently, the Fed’s decision not to raise rates on 17 September has been supportive for gold. However, the rather hawkish tone of the FOMC meeting on 28 October suggests that the Fed is looking to raise rates at some point over the next few months, which should reduce the upside potential on gold. Furthermore, a more hawkish Fed is likely to strengthen the greenback, implying a lower price of gold when expressed in US dollars.

One could argue that the upcoming Fed tightening cycle is one of the most telegraphed in history and that it should also be the most gradual and with the lowest terminal rate. As a result, the negative impact on investment demand should be reduced. Nevertheless, gold as an investment (either through ETFs or through the purchase of physical bars or official coins), which represents slightly less than 20% of total demand, is facing a more challenging environment, especially as inflationary pressures remain elusive.

Jewellery demand likely to remain strong

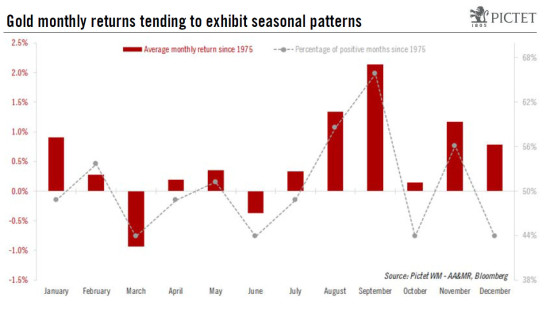

Amounting to more than 50% of total demand, jewellery is the major component of gold purchases. This demand comes mainly from China and India (which together account for more than 60% of jewellery demand). Gold has great significance in the cultures of both countries, where it tends to be viewed as a symbol of wealth and prosperity. As a result, gold demand usually increases ahead of the Indian festival and wedding season, which usually takes place from late September until January, thereby avoiding the monsoon season and the summer heat. Similarly, in China, the Chinese New Year usually leads to a boost in gold demand. In consequence, jewellery demand tends to show some seasonal patterns. Given that the Chinese New Year will take place on 8 February 2016 we are thus likely to see reduced demand from India and China after that event.

Aside from our in-house forecast of a March 2016 rate hike by the Fed, gold could endure a rough start in 2016. However, reducing the jewellery demand in India and China to cultural events alone would be erroneous. Indeed, buying jewellery is also an investment as it tends to do well in inflationary environments. As a result, gold represents an effective saving mechanism, as it preserves wealth during periods of high inflation, which occur much more frequently in emerging countries than in developed countries. Consequently, barring some improvements to the currently limited access to financial assets, sustainable economic growth in these countries is likely to lead to a greater demand for gold.

Overall, jewellery demand is likely to continue to grow in the next few years and, barring short-term seasonal patterns, to provide a significant price support, especially as demand tends to improve when the gold price trades near historical low levels.

India actively trying to curb its gold imports

It will be worth monitoring the Gold Monetisation Scheme (GMS) and the Sovereign Bond Gold Scheme (SBGS), approved by the Indian government in its effort to reduce the huge gold imports and to mobilise the pile of gold sitting idle in Indian households and temples. The GMS will allow the gold depositor to earn interest while the deposited gold (which will be melted down into standard gold bars) could be lent to jewellers, hence reducing the need to import gold. The SBGS will aim to divert gold investment towards more productive assets by offering a bond with a principal linked to the price of gold and bearing a minimum nominal interest rate. The GMS should have limited impact as the interest rate is unlikely to be sufficiently high to compensate for the melting of family jewels or offerings to gods. On the other hand, the SBGS, which will be launched on 26 November, could be successful and lead to a significant reduction in Indian imports in the future. However, it is still too early to price in such an impact as it will mostly depend on people’s trust.

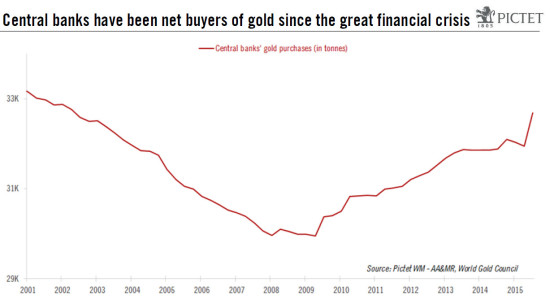

Central banks to remain net buyers of gold

Central bank activity, which accounts for more than 10% of total demand, is also still worth monitoring. Gold holdings as a percentage of foreign exchange reserves are highest at European central banks and in the United States, partly as a legacy of the Gold Standard. This notwithstanding, the newly created ECB has roughly 25% of its FX reserves in gold. The yellow metal has certain key characteristics that are likely to support official demand: it has no counterparty risk, it is an effective way to diversify US dollar holdings given its historical negative correlation and it can be used as a hedge against inflation. Indeed, since the great financial crisis, these attributes have led central banks to be net buyers of gold, and we expect this trend to continue, providing a small support for the gold price.

The remaining part of the demand for gold comes from industrial needs. However, with less than 10% of total demand and a fairly steady behavioural pattern, future industrial demand is unlikely to have a major influence on the gold price.

Mining output to decline but with limited impact

On the supply side, mine production, which represents roughly 70% of the total supply, has been very resilient since 2011 (and has even increased), despite the sharp decline in gold prices. This has been possible as a result of lower production costs from cost-cutting measures, lower oil prices and weaker local currencies (mostly emerging currencies). Costs have also been reduced through cuts in capex. Although reduction in capex may take a few years to affect mine output, these cuts should eventually take their toll. Consequently, output is unlikely to grow in the next few years. Recycling represents the other component of supply. Although it should increase in the long term, its short-term contribution tends to be linked to the gold price as recycling is less attractive when the gold price is low. Overall, the supply picture is likely to support higher prices.

However, there is a big caveat. With most commodities, when demand remains robust and supply is set to decline, the market should move to “deficit” given limited stocks. In the gold market, though, as the metal is accumulated (and not consumed), the stocks above ground are far greater than the mine supply (roughly 60 times greater according to consensus), implying that gold mines are only part of the overall supply. As a result, even though the supply/demand balance is set to favour a higher gold price, the positive effects are reduced as a result of the massive existing gold stock.

Short-term risks but medium-term forces remain supportive

To sum up, gold is part currency, part commodity and is therefore influenced by various factors. At the beginning of 2016, the probable Fed lift-off and its implied effect on real yields are likely to weigh on gold, especially as jewellery demand should be seasonally negative.

However, this short-term weakness is likely to be offset by other factors. First, jewellery demand in the next few years should remain strong, especially when prices are low. Second, the Fed’s tightening cycle is expected to be very gradual while other central banks (like the ECB, the BoJ and the PBoC) are expected to remain very accommodating, thus reducing the opportunity costs to hold gold. Third, central banks should remain net buyers of gold to diversify exposure away from fiat currencies, offering some support to gold. Finally, most commodities have been plagued by oversupply issues. The expected weakening in mine production should support higher prices, although the existing gold stocks will limit its positive effects. As a result, we favour a medium-term consolidation above the $1000/oz psychological threshold.