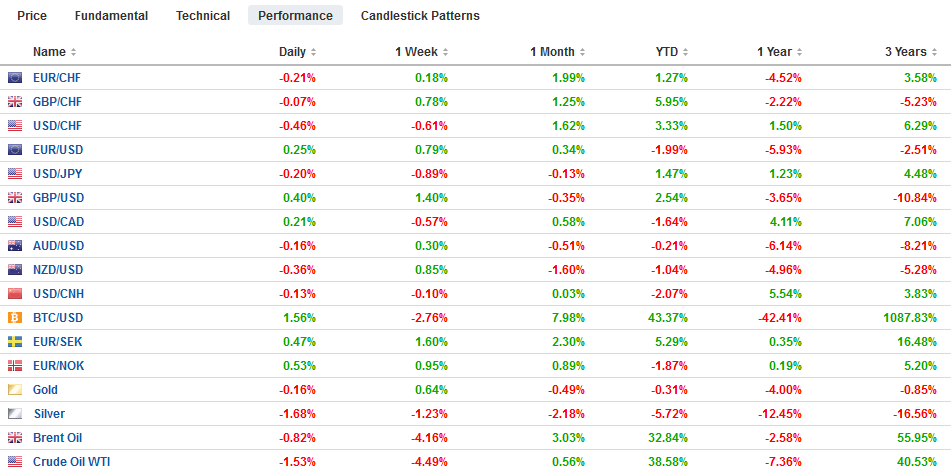

Swiss Franc The Euro has fallen by 0.23% at 1.1401 EUR/CHF and USD/CHF, May 01(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The May Day holiday has shut most markets in Asia and Europe, making for subdued market action. Equity markets that are open, like Australia and the UK, advanced and US shares are trading higher helped by Apple’s upbeat forecasts and sales that beat expectations. Indeed, there is a risk that the S&P 500 gaps higher at the open after closing on the highs of the day, which were a new record. The US dollar is narrowly mixed but mostly softer. The New Zealand dollar is a notable exception. Disappointing employment growth boosts the

Topics:

Marc Chandler considers the following as important: 4) FX Trends, China, EUR/CHF and USD/CHF, Featured, FOMC, newsletter, U.K. Manufacturing PMI, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.23% at 1.1401 |

EUR/CHF and USD/CHF, May 01(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The May Day holiday has shut most markets in Asia and Europe, making for subdued market action. Equity markets that are open, like Australia and the UK, advanced and US shares are trading higher helped by Apple’s upbeat forecasts and sales that beat expectations. Indeed, there is a risk that the S&P 500 gaps higher at the open after closing on the highs of the day, which were a new record. The US dollar is narrowly mixed but mostly softer. The New Zealand dollar is a notable exception. Disappointing employment growth boosts the chances of a rate cut next week. The Federal Reserve though is the central bank of the day. President Trump’s demand for a rate, where he says a 100 bp would see growth surge, is likely to fall on deaf ears. The market hardly flinched at the latest tweets. |

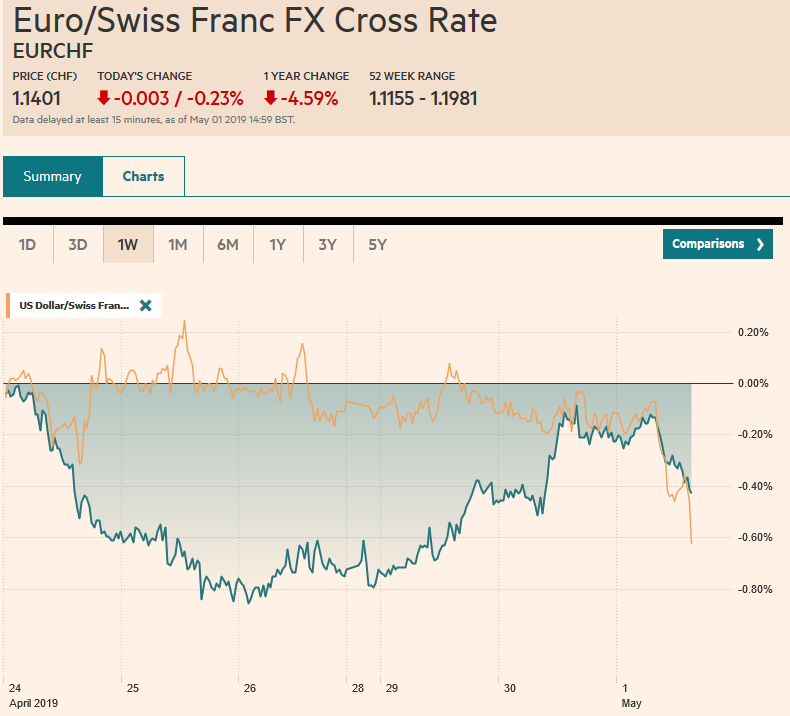

FX Performance, May 01 |

Asia Pacific

Many were already looking for a rate cut next week by the Reserve Bank of New Zealand and the weaker employment report fans such expectations. The decline in the unemployment rate (4.2% vs. 4.3%) was the result of a sharp decline in the participation rate (70.4% vs. 70.9%). The most important takeaway was the 0.2% decline in Q1 employment. The median forecast in the Bloomberg survey called for a 0.5% gains after a 0.1% increase in Q4 18. Private wages, with and without bonus payments increased by 0.3%, which were also slower than expected (0.5%). Both the forward market and the OIS imply that about a 60% chance of a cut next week has been discounted.

South Korean exports fell for the fifth consecutive month in March, but the 2% year-over-year decline was almost a third of the decline that the median forecast anticipated. Weakness in semiconductors (-0.9%) continued, but there were a small uptick memory chip exports. Imports were also stronger than expected, rising 2.4% compared with forecasts of a 1.0% decline.

US-China trade talks are thought to be entering the final stages, and there is still hope that an agreement can be reached in the coming weeks and that a meeting between the two presidents is possible toward the end of the month. The Financial Times reports today that Trump has softened the language demanding that China stop its commercial cyber theft. This plays into fears that Trump is mostly interested in transactional (short-term) benefits rather than deeper structural reforms. Reports indicate that China is resistance US demands to change its industrial policy, including its industry subsidies. Recall that at the end of last week, FBI Director Wray warned that China had “pioneered a societal approach to stealing innovations and that all of the 56 FBI field offices are conducting economic espionage investigations across most industries that almost invariably lead to China. Separately, China announced its intention to remove limits on foreign ownership of local banks and make it easier for foreign insurance firms to enter the on-shore market.

The dollar has been confined to a less than a fifth of a yen range within the ranges seen yesterday. The five-day average slipped below the 20-day average yesterday for the first time in a month. The greenback is holding above JPY111.25, and below there support is seen near JPY110.80. There is a $380 mln options at JPY111.35, which expires today, but is very much in play. A move above JPY111.60 would help lift the tone. The Australian dollar is also trading inside yesterday’s ranges with the help of mixed PMI readings and the lack of much participation. Initial resistance is pegged near $0.7070, while support is seen ahead of $0.7030. Note that Japanese and Chinese markets are closed for the rest of the week.

United KIngdom

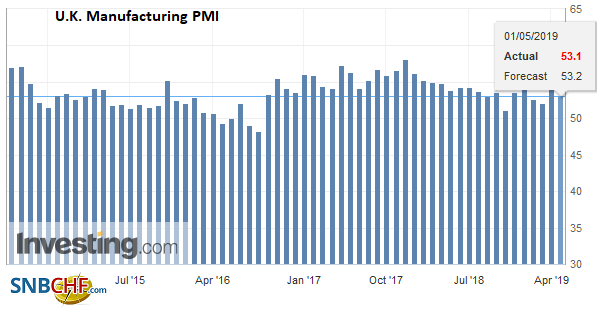

The UK’s manufacturing sector slowed according to the Purchasing Managers Index. Slower inventory accumulation and weaker exports pushed the manufacturing PMI off of 13-month highs see in March (55.1) to 53.1. Note it averaged 53.6 in Q1 and 52.9 in Q4 18. Separately, Nationwide’s house price index rose 0.4% in April for a 0.9% year-over-year rise. Both were sequentially stronger than March. The Bank of England meets tomorrow and updates its economic forecasts in its Quarterly Inflation Report. There is practically no chance of a change in policy. Prime Minister May wants to wrap up the talks with Labour next week. Labour has not clarified its stance on a second referendum and this itself speaks to the weakness of the pro-European wing of the party. Reports suggest the rank and file are more committed to a second referendum, but the leadership, including Corbyn, are fearful of alienating “leave” voters. Tomorrow, the UK holds local elections, and a drubbing of the Tories that is expected would likely add to the pressure on May to step down. The euro edged higher to reach its best level since April 23 a little shy of $1.1235, where the 20-day moving average is found. Above there is the (61.8%) retracement objective of the decline since April 17 near $1.1245 and last week’s highs around $1.1260. Sterling is the strongest of the majors, rising about 0.3% on top of yesterday’s nearly 0.75% gain. Yesterday’s gain lifted sterling back above its 200-day moving average (~$1.2960), which it had sunk below on April 23. If sterling closes higher today, it will be the fourth consecutive session and the longest rally since the end of February. The next technical target is close to $1.3125. |

U.K. Manufacturing PMI, May 2019(see more posts on U.K. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

United States

There is no reason to expect a shift in the Fed’s posture. It remains on hold as it patiently awaits clearer economic signals. The central bank’s economic assessment (contained in the first part of the FOMC statement) needs to be tweaked to recognize some stronger growth impulses in Q1, yet concerns will remain as the private sales to domestic parties–which strips away inventories, net exports, and government–was the weakest in a few years. The jobs market remains robust, and there seems to be an increasing shortage of unskilled and lightly skilled workers. Investors will learn Friday whether this shortage is boosting wage pressures.

Rather than its full employment mandate, it is the stable price objective that is proving more difficult. Price pressures remain modest. The GDP price deflator was halved to 0.9% year-over-year from 1.7% in Q4 18. The March PCE deflator slowed to 1.3% from 1.4%. There is some confusion, but this rather than the core rate is what the Fed targets at 2.0% (here is a link to the Fed’s Statement on Long-Run Goals and Monetary Policy Strategy, where it is clearly stated). Note that the 2-10 year yield curve has doubled to about 24 bp since March 22. It is the steepest since last November. The steepening though can be mostly accounted for by the decline in the 2-year yield (15 bp), which itself is a function of the market pricing in a greater chance of a Fed cut before the end of the year. The implied yield of the January fed funds futures contract has eased 12 bp or about 80% of the decline in the two-year yield.

On the eve of the FOMC decision, President Trump has doubled down on his criticism of the Fed and called for a 100 bp rate cut in rates. This is twice the size of the cut Kudlow and Moore have advocated. The market barely blinked in response. Separately, the chances of Moore’s approval had looked reasonable about a week ago, but the latest revelations have weakened his position. The magic number is four. Given the 52-48 seat majority that the Republicans have in the Senate, a loss more than three votes doom the nomination. Three GOP senators now seem reluctant to confirm Moore if presented with a formal nomination. There is also a debate over whether Trump’s criticism of the Fed or his dollar comments reflect a new norm or whether Trump is regarded as a case to himself. We suspect the latter, but time will be the judge.

The US dollar moved below CAD1.34 yesterday, and in so doing, has now re-entered its previous trading range against all the major currencies. This seemed to reflect the US dollar weakness more than the strength of the Canadian dollar. Indeed, Canada’s news yesterday including an unexpected contracted (0.1%) in February’s monthly GDP, which reduced the year-over-year pace to 1.1% from 1.6% (economists expected a 1.4% rate). The US dollar found support near CAD1.3370, a (61.8%) retracement objective of the greenback’s rally from the April 17 low of CAD1.3275. It had dipped but closed back above the 20-day moving average (CAD1.3385). Still, if it cannot resurface above CAD!.3400-CAD1.3420, the US bears may give the downside another go. Mexico’s GDP also unexpectedly contracted. Growth fell to -0.2% in Q1 quarter-over-quarter. Economists expected a 0.3% gain. The peso weakened. The dollar climbed to MXN19.08 and was subsequently sold to finish below MXN18.95. Initial support for the dollar is seen around MXN18.90 and then MXN18.75.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China,EUR/CHF and USD/CHF,Featured,FOMC,newsletter,U.K. Manufacturing PMI