(I am in Mexico at the World Trade Center General Assembly, participating on a panel about USMCA–NAFTA2.0–for which approval remains elusive. It is possible that the US threatens to pull out of NAFTA 1.0 to force action by the US Congress. Mexico is due to pass legislation this week that may meet demands by the some in the US and Canada for stronger labor protections. However, with the steel and aluminum tariffs still in place, and Trump’s threats to shut the southern border ensure the US has frosty relations with its neighbors. My travel schedule makes prevents a timely delivery of the usual daily set-up over the next few days. Instead, I will focus on some thematic issues.) Swiss Franc The Euro has risen

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Brexit, China, Featured, newsletter, Open Door

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

(I am in Mexico at the World Trade Center General Assembly, participating on a panel about USMCA–NAFTA2.0–for which approval remains elusive. It is possible that the US threatens to pull out of NAFTA 1.0 to force action by the US Congress. Mexico is due to pass legislation this week that may meet demands by the some in the US and Canada for stronger labor protections. However, with the steel and aluminum tariffs still in place, and Trump’s threats to shut the southern border ensure the US has frosty relations with its neighbors. My travel schedule makes prevents a timely delivery of the usual daily set-up over the next few days. Instead, I will focus on some thematic issues.)

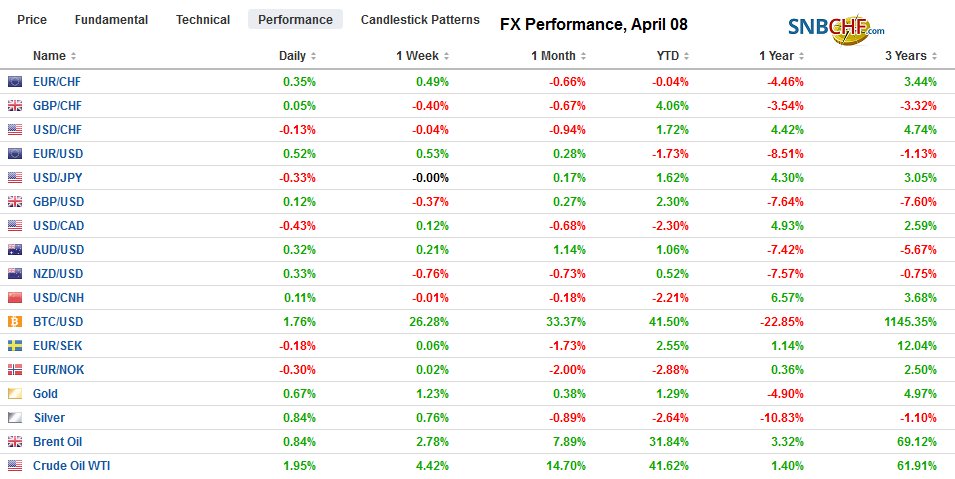

Swiss FrancThe Euro has risen by 0.30% at 1.1249 |

EUR/CHF and USD/CHF, April 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesBrexit has been fraught with problems from the get-go. The referendum was ill-expressed, poorly if not disingenuously argued, and failed to specify a threshold of victory needed to overturn the treaty. The Conservatives and Labour colluded to agree to enforce the non-binding resolution. There seemed to be little discussion of the implications of other UK obligations, such as the Good Friday Agreement. Article 50 was arguably triggered prematurely. The political elite, barely recovering from the loss of gravitas over the Great Financial Crisis and the nationalization of the banks, has shown itself to be both petty and incompetent. Prime Minister May will meet with EU leaders in the middle of the week to make a case for the June 30 extension. What has changed is that belatedly, after losing her parliament majority, Prime Minister May has reached out to Labour. Labour also favors Brexit and is also opposed to free-movement, but is seeks a softer version. Reports suggest that May has offered to modify the Withdrawal Agreement to enshrine a customs arrangement and a confirmation referendum. The public would have a chance to validate the agreement. |

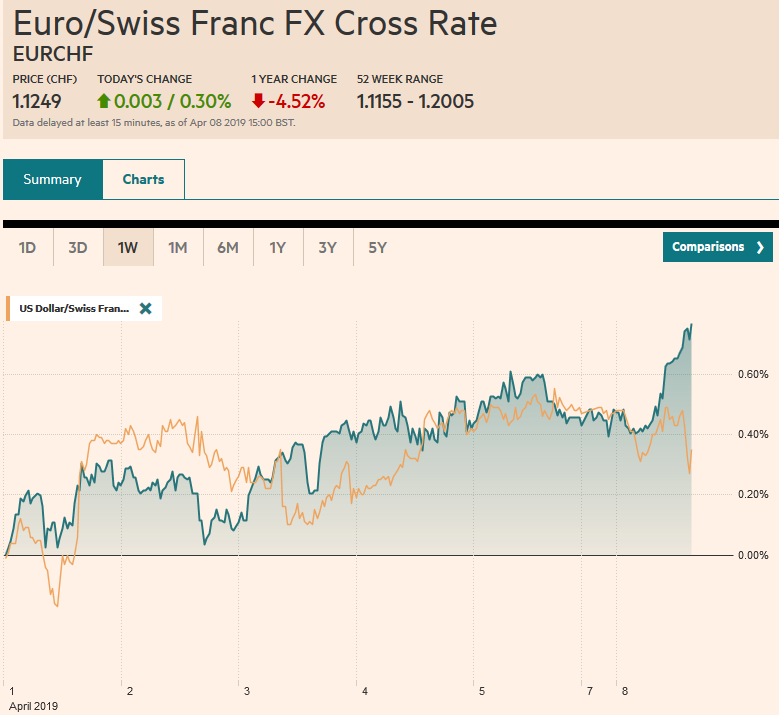

FX Performance, April 08 |

In addition, May offered to resign once Brexit is decided. It is important that if May is replaced by someone from the hard Brexit camp, such as Boris Johnson, that they cannot simply reverse the agreement. In effect, May is finally trying to use Labour minimize the influence of the hard Brexit camp, which, of course, does not sit well with many Tories who value party loyalty above nearly all else.

Meanwhile, May’s political credibility is running low in Brussels. She continues to appear tone-deaf and without a clear well-thought ought strategy. Reportedly, she was told that after this short-extension from the end of March to April 12, the UK had three choices: leave without an agreement, approve the Withdrawal Bill, or seek a long delay. The EU also indicated that another extension required a clear plan with credible political backing. While she has reached out to Labour, it is not clear that it will support her. Until now the unpopularity of Labour leader has given the Conservatives a clear advantage, but the poor handling of Brexit has seen the Conservative lead whittled down to nearly a dead-heat.

The April 12 deadline was not picked haphazardly. It is the last date the UK can declare its intentions to participate in the EU Parliament elections at the end of next month. If the UK is a member of the EU, it ought to compete in the election. On the other hand, if it leaves by the time the new parliament sits or the European Commission, that might be good enough.

However, recent social media comments by one of the hard Brexit leaders (Rees-Mogg) argued that if the UK is required to continue to participate in the EU, then it ought to be obstructionist and mischievous. Yet, if invoking Article 50, means that the UK is not in good standing and ought not to be forced to participate, but would still be subject to the EU rules for which it has surrendered the right to influence.

This did not sit well with many EU members. Several countries appear to be pushing against May’s request. France, Spain, Belgium, and Austria appear willing to accept a no-deal exit with only the smallest of extensions after April 12 to minimize the risk of an instant financial crisis. European Council President Tusk has proposed a “flextension,” whereby the UK would be given a year-extension with an option of leaving earlier if a deal is ratified.

The EU’s other challenge this week is China. There is a dispute over the statement, which could prevent it from being issued. This is what happened in 2016, and 2017 as disputes over China’s behavior in the South China Sea and trade made a joint statement impossible. After half of the EU members signed memorandums of understanding with China on the Belt-Road Initiative, and several countries opted not to ban Huawei, as the US, Japan, and Australia have down. A few EU countries including the UK joined the Asian Infrastructure Investment Bank, now the EC seemingly just realized that the PRC is a strategic rival rather than an economic partner. Nothing like trying to close the proverbial barn door after the horses have bolted.

It appears that China’s negotiations with the EU are being hampered partly by talks with the US. Essentially, the US is seeking bilateral agreement with China that we have suggested appear to be a 21st-century version of the traditional spheres of influence. The US is trying to secure a pre-determined share of China’s soy and energy market, for example. It wants US firms to be allowed to have wholly-owned subsidiaries in China. Reports suggest the Trump Administration is insisting that Europe (and others) do not benefit from US negotiations.

At the start of the 20th century, the US defended China’s territorial integrity against the imperial powers in Europe and Japan that was carving up the Middle Kingdom into spheres of influence and “concessions” (think of the Bund District or Hong Kong itself). The US could have challenged other spheres. It could have sought its own sphere of influence. Instead, the rising revisionist power the time, challenge the whole approach. It rejected fixed spheres in favor of variable shares. The variability would be determined by economic prowess not a political concession from the Emperor.

Now the US appears to be abandoning its earlier strategy (Open Door) and opting to return to the spheres of influence approach. The defection is bound to increase the rivalry between leading industrial nations as well as emerging markets. There is also an underlying defeatism. At the start of the 20th century, the US was confident that on a fair playing field, it could secure a greater share than if by pursuing a sphere of influence.

The economic nationalists in the Trump Administration apparently think the US can secure more with political concessions from China than from pursuing a level playing field for everyone. As the Democrats gear up for the 2020 elections, the risk is that they seek to outflank the Trump and the Republicans by being even more confrontational toward China. Until the US and China reach a trade agreement, the EU and China may not be able to make much progress.

At the same time, we remain concerned that as much as China wants to create a wedge between the US and the EU, the Trump Administration seems almost eager to push Europe away. The US could have organized a wide front, including Europe, Canada, Australia, New Zealand, Japan, and other Asian countries, pushed China to adhere to the letter and spirit of the WTO Agreement. Instead, the US seems to have purposely pursued a zero-sum strategy. The US-EU trade talks have not formally begun, and the tension is already palpable. Even the areas of negotiation are disputed. The US continues to levy a tariff on EU steel and aluminum imports on national security grounds. Trump has repeatedly threatened to slap a 25% tariff on European auto imports. The Trump Administration wants countries that host US bases to cover the costs plus an additional 50%.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: Brexit,China,Featured,newsletter,Open Door