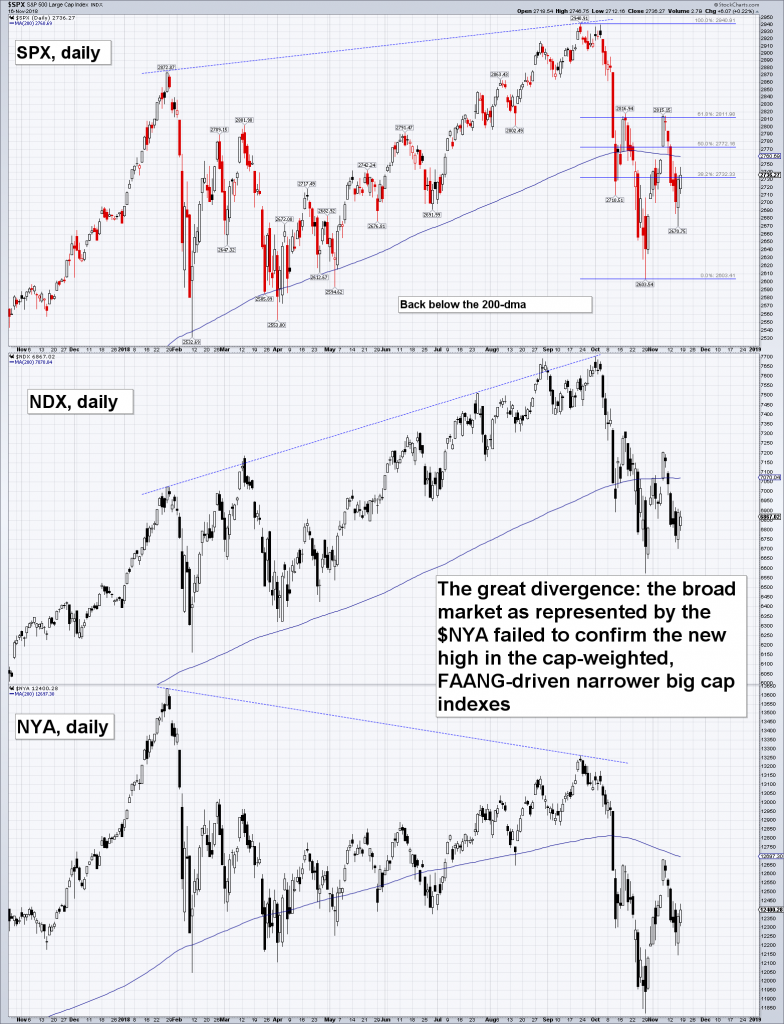

Investment Grade Junk All is now bustle and hubbub in the late months of the year. This goes for the stock market too. If you recall, on September 22nd the S&P 500 hit an all-time high of 2,940. This was nearly 100 points above the prior high of 2,847, which was notched on January 26th. For a brief moment, it appeared the stock market had resumed its near decade long upward trend. Chartists witnessed the take out of the January high and affirmed all was clear for the S&P 500 to continue its ascent. They called it a text book confirmation that the bull market was still intact. Now, just two months later, a great breakdown may be transpiring. Obviously, this certain fate will be revealed in good time. Still, as

Topics:

MN Gordon considers the following as important: 7) Markets, Central Banks, Featured, newsletter, The Stock Market

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Investment Grade JunkAll is now bustle and hubbub in the late months of the year. This goes for the stock market too. If you recall, on September 22nd the S&P 500 hit an all-time high of 2,940. This was nearly 100 points above the prior high of 2,847, which was notched on January 26th. For a brief moment, it appeared the stock market had resumed its near decade long upward trend. Chartists witnessed the take out of the January high and affirmed all was clear for the S&P 500 to continue its ascent. They called it a text book confirmation that the bull market was still intact. Now, just two months later, a great breakdown may be transpiring. Obviously, this certain fate will be revealed in good time. Still, as we wait for confirmation, one very important fact is clear. The Federal Reserve is currently executing the rug yank phase of its monetary policy. As the Fed simultaneously raises the federal funds rate and reduces its balance sheet, credit markets are slipping and tripping all over themselves. |

Indexes, Nov 2017 - 2018 We actually did not believe in the validity of the September breakout attempt: the extremely large divergence between the broad market and the narrow big cap leadership was one of many signs that an internal breakdown in the stock market was well underway. It is probably legitimate to refer to the January 2018 high as the “orthodox” stock market peak – the point at which most stocks topped out. [PT] - Click to enlarge |

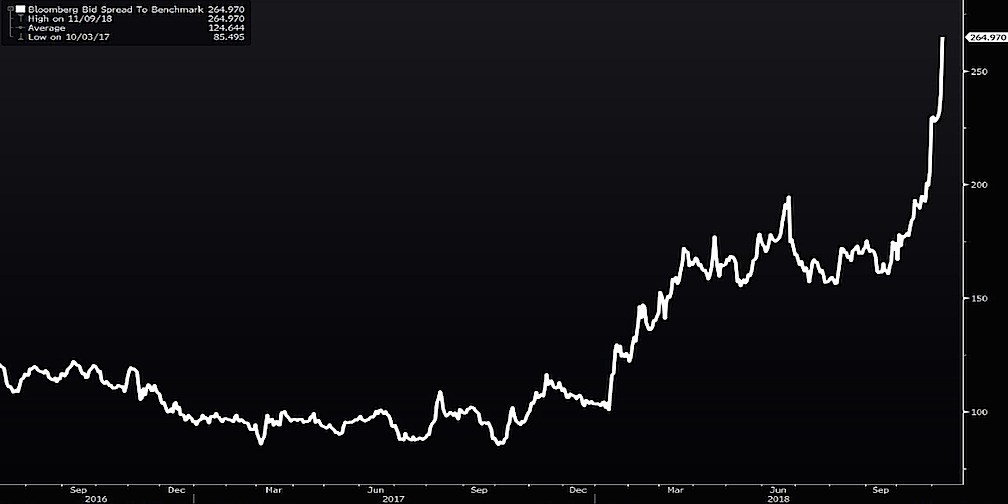

| This week, for example, seven-year investment grade bonds issued by GE Capital International traded with a spread of 2.47 percent. For perspective, this is equivalent to the spread of BB rated junk bonds. In other words, the credit market doesn’t consider GE bonds to be investment grade, regardless of whether compromised credit rating agencies say they are.

But it’s not just GE debt that’s in question. Per a tweet by Scott Minerd, Global Chief Investment Officer at Guggenheim Partners:

The fact is, there’s now around $3 trillion of bonds rated BBB, the lowest rating bracket above junk. How much of this debt – like General Electric bonds – should be rated junk that isn’t? We suspect the next liquidity event will clarify the answer to this question. The real question, however, is how did $3 trillion of questionable debt pile up to such a perilous level to begin with? What follows is an attempt at an answer… |

GESpread, Mar 2017 - Nov 2018 Spread of 7-year GE bond over mid-swaps – this bond retains an investment grade rating for now. We have discussed the problem posed by the proliferation of bonds rated in the lowest investment grade category in detail previously – see: “Corporate Credit – A Chasm Between Risk Perceptions and Actual Risk” [PT] - Click to enlarge |

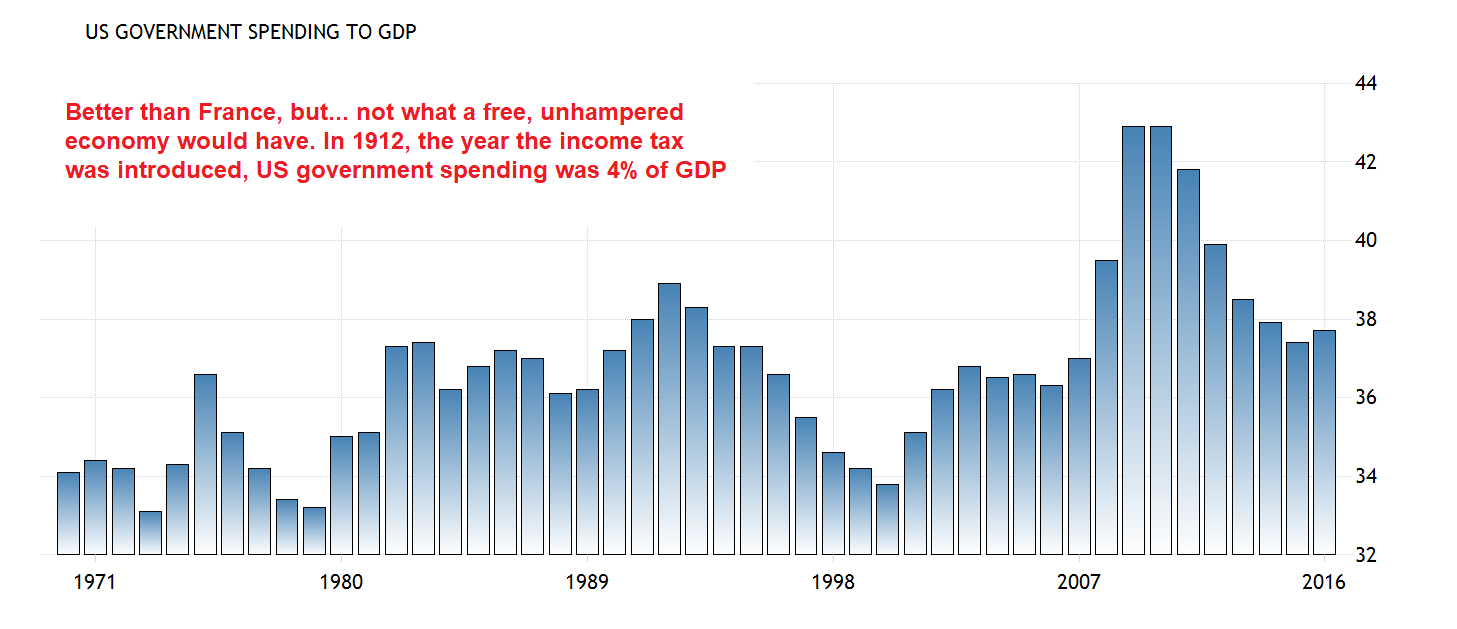

How Fake Capitalism WorksOne popular delusion is that America operates under an economic framework of capitalism. One where businesses, and their finances, are free to succeed and fail based on their economic merits. In reality, America hasn’t had a truly capitalist economy since the 19th century. Moreover, the encroachment of government into the economy has increased over the last several decades. The ratio of federal government spending to GDP increased from 33 percent in 1973 to about 40 percent today. How can an economy that is composed of 40 percent federal government spending and extreme central bank intervention into credit markets be an economy of private enterprise? Naturally, it can’t. The fake capitalism of the 21st century is, in essence, a destructive form of self-cannibalism. The economic model depends on three factors: big deficits, monetary policies of extreme intervention, and a central authority with a highly visible hand to direct the supply and demand of goods and services. Taken in concert, these factors consume tomorrow’s productivity with the gluttonous appetite of pigs devouring slop. The results are an endless collection of gross distortions, misallocations, debt pileups and vulnerabilities. Stocks, corporate bonds, residential real estate, General Electric, Washington lobbyists, student loan debt, defense contractors, digital gizmo producers, Ford Motor Company, per capita healthcare costs, Anheuser-Busch, Bryce Harper’s imminent $400 million contract, unfunded state pension liabilities, federal debt, and on and on… This is how fake capitalism works. And what you may not know is that under fake capitalism someone, most likely you, will be left holding the bag for these liabilities – and many more. You may not want to pay for them. You may not be prepared to pay for them. But you will pay for them, nonetheless. In fact, you already are… |

US Government Spending to GDP, 1971 - 2016 |

The Intolerable Scourge of Fake CapitalismYou see, if you own residential property in America today you really don’t own it. You are merely leasing it from your local governments. Try skipping your property tax payment, if you don’t believe us. One implication is that your city holds an option on your house. And when push comes to shove, they’ll exercise it. The city government will raise your property taxes to cover its pension obligations. Then it will raise it some more. Many cities already are. And if your kids are in public schools, it is likely their classrooms are more crowded than they were when you were a kid. Why? Is there a shortage of teachers? On the contrary, there is a glut of retired teachers – some of whom haven’t taught a class for over 20 years – who have a claim on today’s taxes. On top of that, your state wants to stick you with a progressive wealth exit tax if you try to sell your house and leave the state. After a lifetime of paying down your mortgage you can no longer flee to a tax friendlier state without being taken to the cleaners. Remember, you no longer own your property. Your local and state government owns your property. |

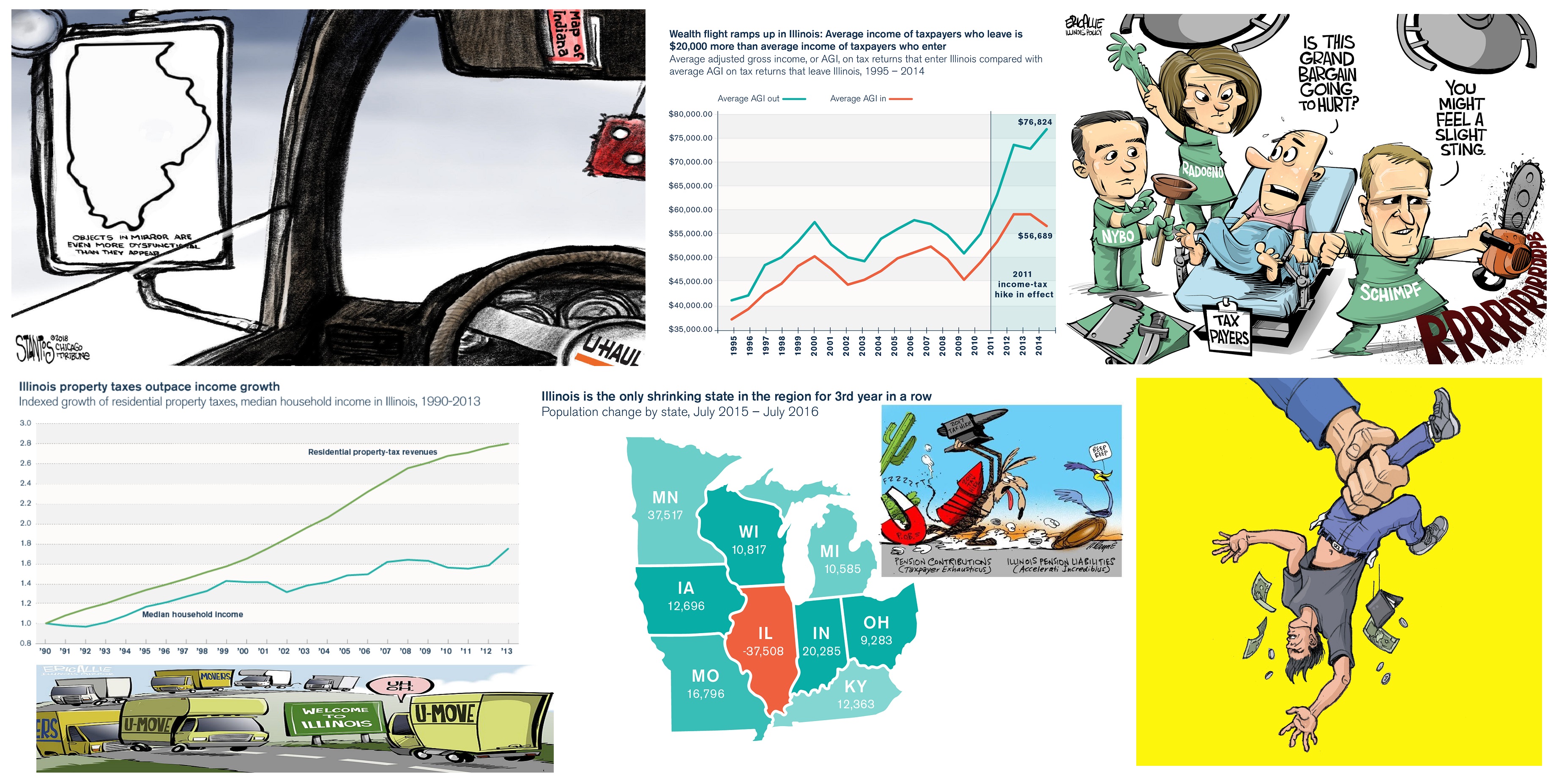

A little Illinois data and cartoon collage: this is the quasi-bankrupt state in which the political class now ponders restricting the basic human right of free movement by blackmail in the form of an “exit tax”. Your property does not belong to you. You and all you own belong to them. [PT] White For Desktop Wallpaper - www.walldes-download.com - Click to enlarge |

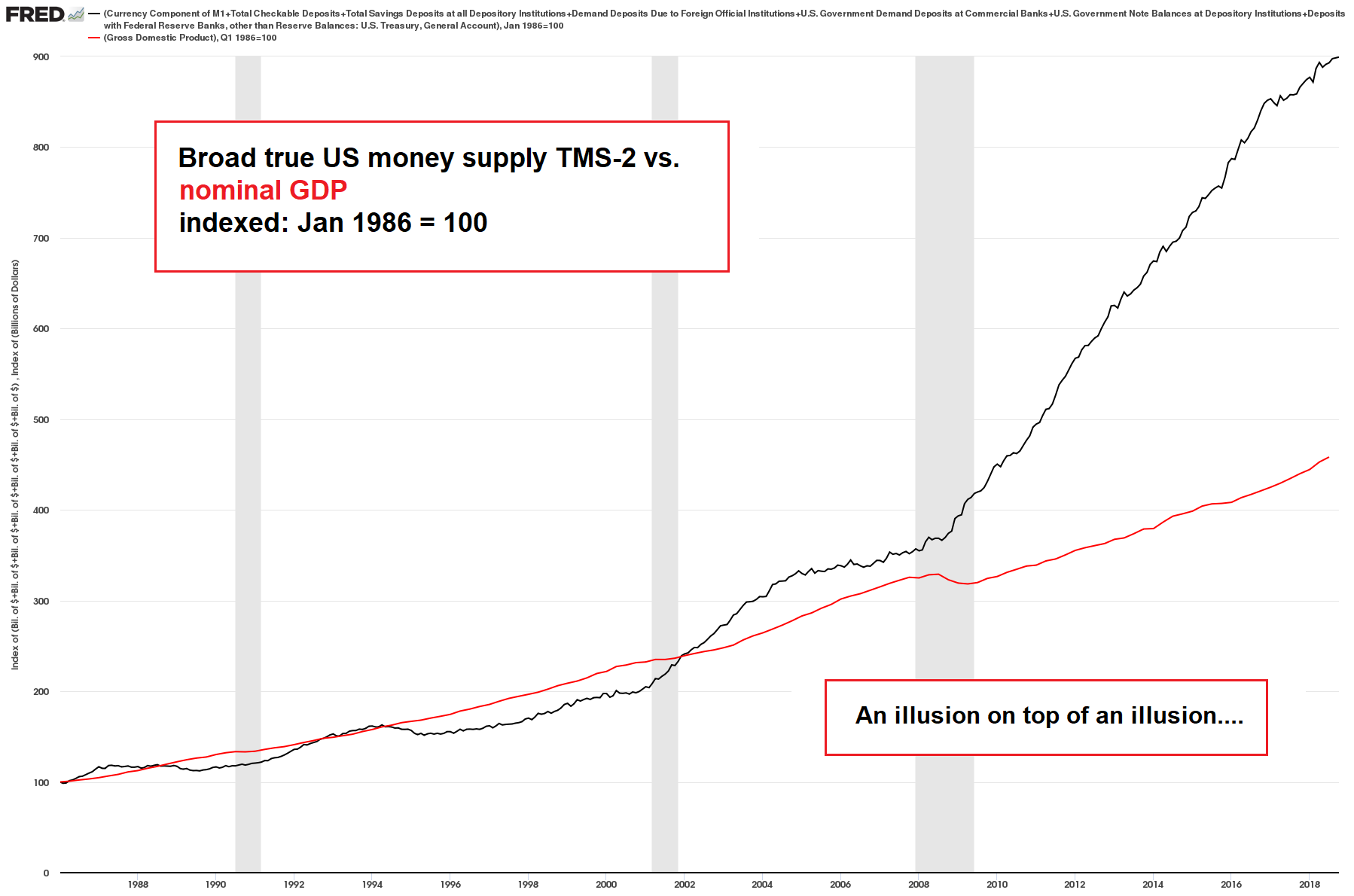

| So, too, under a fiat money system, you don’t own your own money. You may think you do. You can see the balance in your savings account. But at all hours of the day, including holidays, the value is being extracted from your savings through deficit spending and policies of mass money debasement. This is why working and saving money has become an unending run on a treadmill. You can never get ahead. But you can run faster and faster.

Of course, the taxpayer – that’s you – will also be responsible for picking up the tab on the next round of too big to fail corporate bailouts. You can count on it. The Treasury Secretary, through smiling teeth, will even tell you it’s for your own good… that they must destroy capitalism to save it. Yet capitalism was destroyed long ago. And we find the fake capitalism that remains to be an intolerable scourge to a just society. |

TMS-2 vs. Nominal GDP, 1988 - 2018 |

Charts by: StockCharts, Bloomberg, TradingEconomics, illinoispolicy.org, St. Louis Fed

Chart annotations/captions and image captions by PT

Tags: central banks,Featured,newsletter,The Stock Market