Human error happens all of the time. It’s natural – sometimes, you’ll be typing up a document and later realize you made a grammatical error. Or, you might type a date in wrong. You might think you only make these types of mistakes now and again, but the numbers do add up if you think about how many humans each day must be making them. Why Does Human Error Happen? Human error happens for numerous reasons, but it’s important to remember that it’s normal. Nobody is a...

Read More »5 Hidden Secrets To Amp-Up Your Company’s Marketing Strategy

Copyright: PHOTOMORPHIC PTE. LTD You may be wondering why some companies seem leaps and bounds above others when it comes to creating comprehensive marketing strategies that guarantee positive results. Well, they are actually successful for one simple reason, and that is that they have knowledge that their competitors do not have. These secret objectives help them promote their businesses effectively, and, as such, draw in potential customers to consume their...

Read More »Ukraine and the Next Wave of Inflation, Part II, Can Russia Enact a Gold Standard?

Can Russia Enact a Gold Standard? In Part I we discussed how the fallout from the Russian invasion of Ukraine will lead to inflation, but not in the way most people think. In Part II we discuss the possibility of Russia repudiating the dollar and going on a gold standard. Can they do it? How would the world react? Why not enact a Bitcoin Standard instead? The Russian central bank reportedly has over 2,000 tonnes of gold. We have seen three arguments repeated many...

Read More »What’s In Your Loan?

Opposing Monetary Directions “Real estate is the future of the monetary system,” declares a real estate bug. Does this make any sense? We would ask him this. “OK how will houses be borrowed and lent?” “Look at this housing bond,” he says, pointing to a bond denominated in dollars, with principal and interest paid in dollars. “What do you mean ‘housing’ bond’,” we ask, “it’s a bond denominated in dollars!” “Yes, but housing is the collateral.” OK, so it’s not a...

Read More »A Look Back at Nixon’s Infamous Monetary Policy Decision

Putting the World on a Paper Standard Half a century ago one of the most disastrous monetary policy decisions in US history was committed by Richard Nixon. In a television address, the president declared that the nation would no longer redeem internationally dollars for gold. Since the dollar was the world’s reserve currency, Nixon’s closing of the “Gold Window” put the world on an irredeemable paper monetary standard. The ramifications of the act reverberate to...

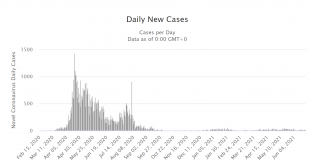

Read More »Post-Covid China

Lessons to be Learned from East Asia The world should take a lesson from how East Asia ran itself in 2020. Japan had no lockdown. None. With an aging population, its death rate has been creeping up for many years. In 2020, it fell by 0.7%, as if Covid-19 was a life-saver. The Prime Minister of Singapore repeatedly appeared on TV to advise people to live normally and not let fear dominate. Taiwan had a total of 623 Covid-19 related deaths [ed. note: there were only...

Read More »Did You Make Janet Yellen Rich?

The Stress of Losing Billions Up until the WallStreetBets crowd short squeezed Melvin Capital for a $7 billion loss, Robinhood had it made. But losing billions is stressful. And when your product blows up your customer the clucking that follows comes hot and heavy. A surprise revival of business at Game-Stop… [PT] One of the sweetest displays in the world, we’ve been told, is the bursts of digital confetti that shower down Robinhood’s investment app to celebrate the...

Read More »Grantham’s ‘Real McCoy’ Bubble in a World Gone Mad

The Lure of Easy Money Right now happens to be an attractive time to do something stupid. What’s more, everyone is doing it. Maybe you are too. Stock valuations and corporate earnings growth no longer appear to matter. Why not buy an S&P 500 index fund and let it ride? Or, better yet, why not buy shares of Nvidia? The stock of the semiconductor company is up more than 170 percent over the last 9-months. Perhaps it will double again from here. Of course,...

Read More »Game Over Spending

Coming and Going Like a Wildfire Second quarter 2020 came and went like a California wildfire. The economic devastation caused by the government lock-downs was swift, the destruction immense, and the damage lasting. But, nonetheless, in Q2, the major U.S. stock market indices rallied at a record pace. The Dow booked its best quarter in 33 years. The S&P 500 posted its best performance since 1998. And the NASDAQ had its biggest increase since 1999… jumping...

Read More »An Excellent Seasonal Buying Opportunity in Silver Lies Directly Ahead

Gold’s Little Brother Today I want to put a popular precious metal under the magnifying glass for you: silver. Silver, often referred to as the “little brother” of gold, has a particularly interesting seasonal pattern I would like to share with you. Shiny large good delivery door stops made of silver – about to enter interesting seasonal phase. PT Silver’s seasonality under the magnifying glass Take a look at the seasonal chart of silver. In contrast to a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org