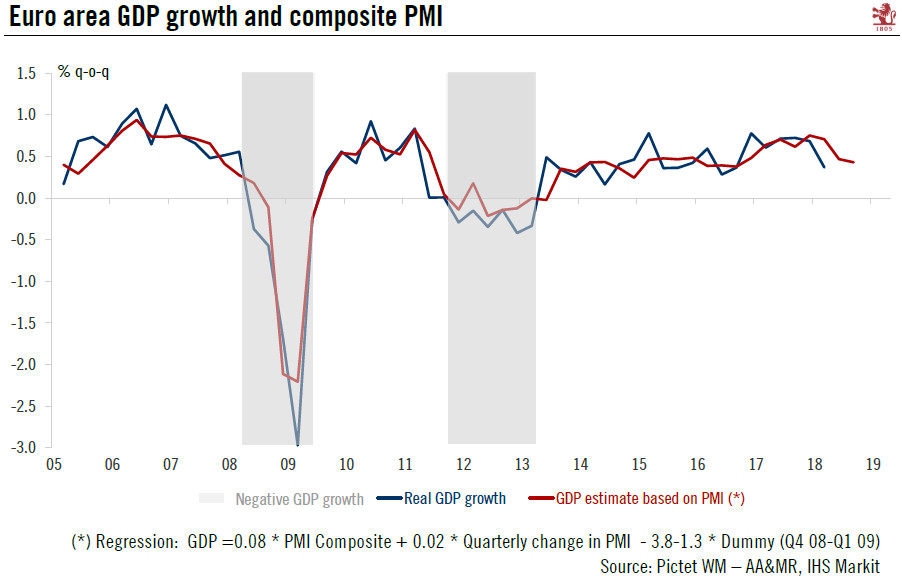

Fundamentals remain solid but the decline in some forward-looking indicators in July signal downside risk in the coming months.Markit’s euro area flash PMI surveys for July came in on the soft side. The composite PMI for the euro area fell to 54.3 in July from 54.9 in June, below consensus expectations. At the sector level, the manufacturing PMI index rose marginally, putting a halt to six consecutive months of decline.The services PMI declined to 54.4, but this followed a 1.4 points jump last month to 55.8. The details were somewhat mixed. The rise in manufacturing was mainly due to stronger output growth, while new orders and export orders growth slowed, with the latter reaching a 27-month low. Job creation remained strong by historical standards. Finally, input price inflation

Topics:

Nadia Gharbi considers the following as important: euro area composite PMI, Euro area GDP growth, euro area PMIs, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Fundamentals remain solid but the decline in some forward-looking indicators in July signal downside risk in the coming months.

Markit’s euro area flash PMI surveys for July came in on the soft side. The composite PMI for the euro area fell to 54.3 in July from 54.9 in June, below consensus expectations. At the sector level, the manufacturing PMI index rose marginally, putting a halt to six consecutive months of decline.

The services PMI declined to 54.4, but this followed a 1.4 points jump last month to 55.8. The details were somewhat mixed. The rise in manufacturing was mainly due to stronger output growth, while new orders and export orders growth slowed, with the latter reaching a 27-month low. Job creation remained strong by historical standards. Finally, input price inflation accelerated due to higher prices for raw materials and wages. Markit noted that “price hikes for raw materials were also again often linked to tariffs, trade wars, supply chain delays and shortages, with supplier delivery times widely reported to have lengthened again, notably from China”. Part of the rise was passed on in the form of higher sales prices.

Evidence of heightened global trade conflicts in the July data was mixed, with contrasts between the two largest euro area economies. While surveys showed some worries about trade wars in France, there was no mention of them in Germany, where new export orders grew at their fastest pace in three months.

Overall, July’s composite PMI is consistent with GDP growth of 0.4% q-o-q in Q3, down from the 0.5% expansion indicated by the PMI surveys for Q2 (first estimate to be published on July 31). Economic fundamentals remain solid and the euro area economy is expected to continue to grow at an above-trend pace over the coming quarters. That said, the decline in some forward-looking indicators such as new orders and new export orders signals downside risks for the coming months.